This column shows that the Maastricht convergence criteria are political instruments, not economically vital measures. They were ignored in 1998 so as to facilitate the Eurozone’s creation, and now they are stringently applied so as to slow its enlargement.

The stern judges of economic orthodoxy have ruled from Frankfurt. The entrance criteria for the new EU members that would like to join the Eurozone should not be relaxed. Strict adherence to the rules should be maintained, lest the Eurozone itself be endangered.

Entrance exam grades for the inaugural Eurozone members

Strange. Did these severe standards also apply to the current members of the Eurozone? The answer is an unequivocal no. The criteria were massively relaxed when the current member states faced their entrance exams in 1998. Without that relaxation, more than half of the present member states would have been denied Eurozone membership.

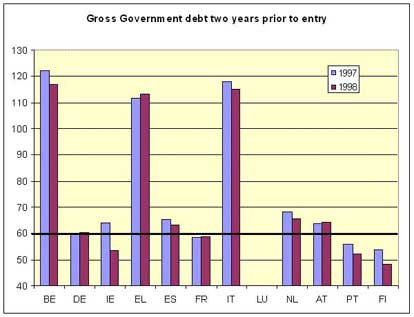

Figure 1

Here is the evidence. Take government debt. The Treaty says that government debt should not exceed 60% of GDP. We see from Figure 1 that seven out of the twelve original member countries had a debt level exceeding 60% the year before entry. The Treaty, however, adds a proviso that says that if the debt ratio exceeds 60%, it should “diminish sufficiently and approach the reference value (60%) at a satisfactory pace” (Art. 104c(b)). This should have ruled out Germany, Greece, and Austria, because their debt to GDP ratios exceeded 60% the year before entry and were increasing (from 59.7% to 60.3% in Germany, from 63.8% to 64.3% in Austria, and from 111.6% to 113.2% in Greece).

You may say this is quite a strict interpretation of the Treaty for countries like Germany and Austria. Indeed, it is, but it is the same strict attitude that was exhibited by the judges from Frankfurt who insist on applying the most literal interpretation of the Treaty. The same literal interpretation was used to bar Lithuania from entry into the Eurozone two years ago because its inflation rate was 0.2% above the maximum.

The other four countries with debt ratios exceeding 60% in 1998 (Belgium, Spain, Italy, the Netherlands) were experiencing a decline (see Figure 1). But was this decline occurring “at a satisfactory pace” as stipulated by the Treaty? For Spain and the Netherlands, one can make such a case. But with no stretch of the imagination could one interpret the decline observed in Belgium and Italy to occur at a “satisfactory pace”. Extrapolation of the declines observed in these countries prior to the start of EMU would have led to the conclusion that they needed 20 to 30 years to reach the 60% target. These extrapolations would not have been far off the mark; in 2008 Belgium’s debt ratio stood at 88% (halfway on its voyage to 60%) and Italy’s at 105% (way off course from its projected track to 60%). Thus, a strict Frankfurt-inspired interpretation of the Treaty should have led to the conclusion that Austria, Belgium, Germany, Italy, and Greece were unfit to be in a monetary union. Strangely enough, this was not the result.

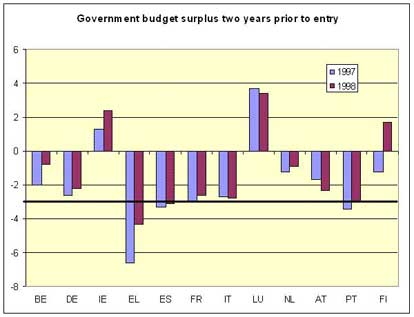

Let’s turn to budget deficits (see figure 2). Things look better. Only two countries exceeded the 3% reference value the year before entry (Greece and Spain). When the budget deficit exceeds the reference value, the Treaty says it should be declining continuously and substantially and come close to the reference value, or alternatively, the deviation from the reference value “should be exceptional and temporary and remain close to the reference value” (Art. 104c(a)). Well, one could make a case here that the Spanish budget deficit satisfied this proviso. It is much less clear that this was the case for Greece (which already flunked the debt ratio test).

Figure 2

Source: European Commission, Statistical Appendix to European Economy

Note: for Greece the two years prior to entry were 2000 and 2001.

The real problem with the budget deficit numbers is that they were manipulated. In the case of Greece, as it turned out later, there was fraud involved. In other cases (Belgium, France, Italy), “creative accounting” permitted these countries to hide the true level of the budget deficits. For example, these countries took over pension funds of state companies and booked the assets of these funds as current revenues while failing to book the future additional pension liabilities. As a result, the budget deficits were artificially and temporarily lowered. All this occurred while the European Commission gave its stamp of approval. It is no exaggeration to conclude that the budget deficit numbers were falsified, thereby allowing countries like Belgium, France, Italy and Greece to obtain free passage into the Eurozone.

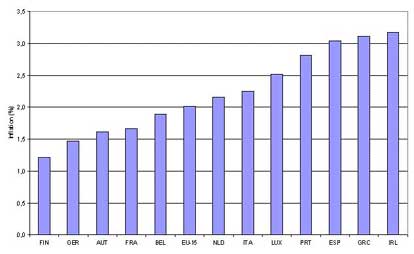

Two more comments about the entrance criteria. First, Italy did not satisfy another entry condition, i.e. that it should have been in the ERM for at least two years prior to entry. Second, the inflation convergence criteria were satisfied by the original member countries. However, this did not prevent inflation rates from systematically diverging after the start of the Eurozone (see Figure 3), leading to substantial changes in competitive positions within the Eurozone. Thus, convergence in inflation rates prior to entry is no guarantee of convergence afterwards.

Figure 3. Average yearly inflation in Eurozone countries, 1999-2007

Source: European Commission (Eurostat) and European Central Bank

Politics at play

What do we learn from the systematic transgressions of the entrance criteria applied to the original member countries and the refusal to be lenient with the new member states? The answer is that the entrance criteria have very little to do with economics, and very much with politics. During the 1990s, the governments of most EU-countries had made a strong political commitment to go ahead with monetary union. As the fatidic date of 1999 approached, it became increasingly obvious that a large number of countries committed to the monetary union would fail the entrance criteria. Only a few marginal countries would succeed, and the whole thing would have to be shelved. So politics prevailed and the annoying Maastricht numbers were set aside – which was the right decision and conclusively showed that the Maastricht convergence criteria are irrelevant).

Today, politics again prevails. This time, however, the numbers are used with a vengeance. There is now a large majority in the Eurozone against a hasty entry of the new member states. This is not based on any economic analysis showing that the new member states are less fit than the original member states to be part of the Eurozone. The motivation is political, and now the Maastricht numbers that were shelved for the original member countries are applied with meticulous care to prevent the new member states from entering too quickly.

Thus, the Maastricht convergence criteria are instruments that are used in arbitrary ways to pursue political objectives. In the past, they were set aside to achieve the political objective of monetary unification. Today, they are strictly applied to pursue a political objective of slowing down the enlargement of the Eurozone.

![]()

Leave a Reply