The British are leaving! The British are leaving!

Britain voted to leave the European Union by a narrow margin last night. World markets are spiraling out of control on the news. In a historic move, the pound dropped 8% to its lowest level against the dollar since 1985. Gold is soaring. European stocks are heading for their worst day since October 1987, according to FactSet.

Stateside, elation over yesterday’s rally toward 2016 highs has quickly turned to panic. Dow futures are down more than 500 points. The S&P 500 is off by nearly 4%. Fear is spreading throughout the market as investors rush to safe havens.

Just how freaked out are investors right now?

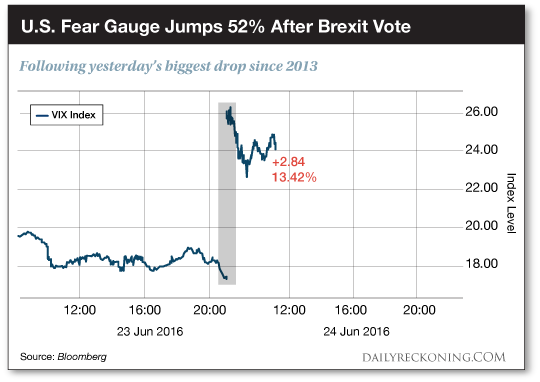

According to Bloomberg, the VIX suffered its biggest drop since 2013 during yesterday’s melt-up rally. After last night’s vote, it rocketed more than 50%…

So what the hell are you supposed to do now?

Yesterday, I told you we’d just have to do our best to tune out the insanity and hope that the market gives us some direction—whatever the outcome of this vote might hold. Now that we know the results, it’s time to once again ignore the political pundits and wait for the market to show us our next move.

Here’s what we need to keep in mind today when the opening bell rings:

Closing prices matter most

We’re going to see nothing but chaos when the clock strikes 9:30 a.m. Stocks are going to go crazy for the first hour of trading or more.

But we don’t have a crystal ball. We don’t know if last night’s panic lows are going to hold or if stocks will continue to sell off until the closing bell. Heck, we might even see a rally.

Anything can happen.

If you have trades you want to sell today, don’t just throw an order out to the market a few minutes after the opening bell. The market is like an emotional child right now. Let it blow off some steam with morning temper tantrum and then take the time to reassess your positions. If you have trades that have hit your stops, you can jettison them once things settle down.

Since it’s Friday, we’re going to get a nice new daily and weekly candle after today’s close. That should give us a better idea as to where the market’s important inflection points will be in the coming weeks…

The Market’s Big Themes Remain Intact

Today’s a great chance to go over our favorite market themes to determine what’s vulnerable—and what has the chance to rally in the face of panic.

Gold is obviously the big winner so far. But the yellow metal’s rise above $1,300 on the Brexit vote didn’t come out of nowhere. Gold and precious metals mining stocks have been some of the best places for your trading dollars this year. Last night’s move was just another in a series of bullish breakouts.

You already have two open trades that should benefit from the Market Vectors Gold Miner ETF (NYSE:GDX) and Silver Wheaton Corp. (NYSE:SLW). These should help soften the blow of a panicky market crash.

Brexit Ain’t Over Yet…

So far we have a “leave” vote and a resignation from Prime Minister David Cameron. And if you think that’s enough to get this Brexit nonsense out of the headlines, you are mistaken.

Next comes two years of negotiations between Britain and the European Union in order to hash out the terms of the exit. This story isn’t going anywhere. Nothing is priced in.

Buckle up. We could be in for one heck of a ride…

Leave a Reply