Danvers Bancorp, Inc (DNBK) is surging following the most recent earnings surprise. Analysts quickly raised estimates, driving growth rates even higher.

Company Description

Danvers is a holding company for banks in Massachusetts, with 25 branches. The company’s has $2.5 billion in assets and provides traditional banking services and non-deposit investment products and services.

Another Beat

On Jul 22 Danvers saw net income for the second quarter rise to $4.9 million, from $0.14 million a year ago. Deposits were up 15% on an annualized basis. Net interest income was up 62% as the loan portfolio grew along with margins.

Earnings per share came out to 24 cents, which was 5 cents higher that analysts were expecting. Danvers has now beaten the Zacks Consensus Estimate in each of the past 4 quarters.

While the company did say there could be challenges to keep the loan portfolio growing, they hope to be back to their “historic rates” this year.

Consensus is Rising

Analysts were quick to raise their full-year projections following the quarterly release. The Zacks Consensus Estimate for this year is up a nickel to 82 cents. Next year’s estimates are averaging 92 cents, up 4 cents.

Last year Danvers only made 31 cents, so the growth rates are now expected to be 166% and 12%, respectively.

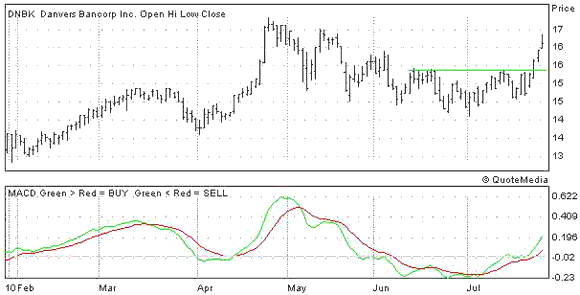

The Chart

Shares of DNBK broke through recent resistance on the earnings news and are now approaching the 52-week high.

Leave a Reply