Daffodils are in full bloom, the grass has started growing again, and Macro Man is awakened every morning by the dulcet tones of birdsong through his bedroom window.

Spring is also the time for Easter, and the Macro Boys are more than pleased to have a couple of weeks off school. Naturally, they also await the impending arrival of the Easter Bunny with bated breath.

And perhaps, just perhaps, in a small neighbourhood on the outskirts of Pittsburgh, a pink plastic flamingo is still being passed from house to house.

Macro Man introduced the investment concept of the pink flamingo nearly a year ago, during a previous period of treacherous trading conditions. A pink flamingo is, simply put, a widely-held position in the macro trading community that turns as ugly as one of those garish plastic birds. And like the pink flamingos of Macro Man’s distant youth, pink-flamingo status gets passed from market to market as more and more trades get sucked into the “fun.”

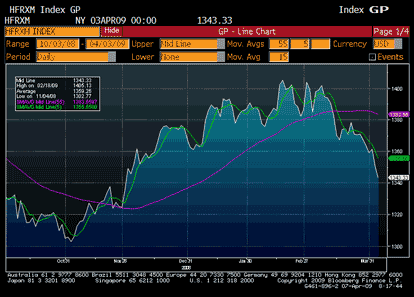

While Macro Man has found himself scuffling over the past few weeks, he’s clearly not alone. The HFR Macro hedge fund index has performed a bit of a swan dive since early March. While it’s scant comfort to know that Macro Man isn’t alone in his pain, it’s nevertheless useful information to know that pink flamingos are dotted around the investment landscape. On current form, financial markets are a virtual aviary.

Regular readers will recognize a few pink flamingo in Macro Man’s book from his recent grumbling, among them EUR/CHF and Schatz. But wait! There are oh so many more fundamentally sound trades that have gone wrong because of positioning.

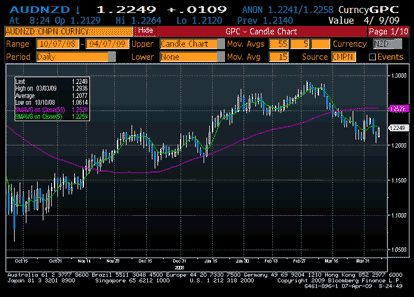

Consider AUD/NZD. This has been a darling of macro and currency punters for a number of years. New Zealand’s macroeconomic fundamentals would rate poorly for an emerging market; as a developed market, it’s bottom of the heap. And while Australia has clearly not been immune to the global economic downdraft, it’s long-term fundamentals (excluding housing) look very solid indeed.

And yet AUD/NZD has been on a one-way train south since mid-March, which looks to have been largely a position liquidation. Ironically, the cross bounced overnight despite a somewhat surprising rate cut from the RBA; perhaps a wretched business survey out of New Zealand has re-focused attention on the fundamentals?

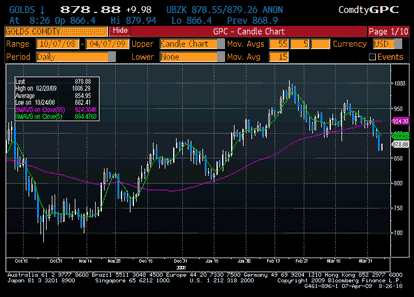

Gold is another consensus trade gone badly wrong. There seemed to be so many reasons to own it; it’s a safe haven if equities go down, and an inflation/fiat currency hedge if global central banks break out the printing prsses en masse. The yellow metal peaked a bit before AUD/NZD, and sicne then has proved to be mighty disappointing to longs. Macro Man’s inbox is stuffed to the rafters with analysis suggesting that IMF gold sales should not affect the price; be that as it may, the market still trades very long and very wrong.

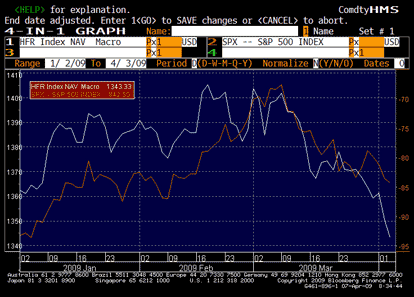

And of course, equities. The inverse correlation between the SPX and the HFR index isn’t quite as strong as it was a few weeks ago, but the market still appears to be leaning short equities…or at least short stuff that is correlated with equities (if, indeed, one can trust any correlations to hold.)

These pink flamingo episodes usually seem to last a month to six weeks, taking even the most sacred of cows to the abattoir. Given that we abear to be halfway to 2/3 of the way through the usual duration of a pink flamingo episode, the question then turns to where the remaining pink flamingos reside.

Readers are invited to submit their suggestions: enquiring minds want to know!

Leave a Reply