Jos. A. Bank Clothiers (JOSB) has been bucking the convention that retail, especially clothing, is dead in the water as the company has been aggressively growing during, and now after, the recession. JOSB has a return on equity (ROE) of 22.1%, well above the industry average of 13.1%.

JoS. A. Bank sells men’s suits, tuxedos, casual clothing, footwear and accessories through 484 stores in 42 states and the District of Columbia and through its web site, www.josbank.com. The company has a 100% money back guarantee on its products.

Growth Continues

On July 15, the company announced it was expanding into the factory concept with the opening of a new factory store at the Tanger Outlets in Riverhead, NY.

It plans on opening 5 factory concept stores in 2010 and projects an addition 50 to 75 factory stores in the U.S. by the time expansion is completed. JoS. A. Bank is also launching a website specifically for the stores at www.josbankfactorystores.com.

Stock Dividend

JoS. A. Bank is feeling bullish about the growth trajectory of the company. On June 21, it announced it would be issuing a stock dividend to shareholders of record as of July 30.

How it would work is that each shareholder will get one additional share of common stock for every two shares it owns. The shares will be distributed on Aug 18, 2010.

Yet Another Earnings Beat in the Fiscal First Quarter

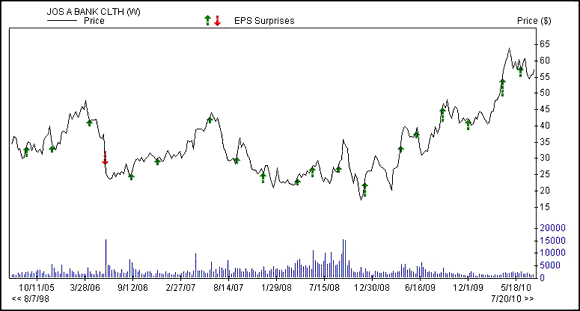

On June 2, JoS. A. Bank reported its fiscal first quarter results which easily beat the Zacks Consensus Estimate by 19.7%. Earnings per share were 85 cents which surpassed the last year’s number by 23 cents.

It has grown earnings in 34 out of the last 35 quarters, which is impressive given the severe retail recession that just occurred and that, for some retailers, is still occurring.

Sales rose 10% to $178.1 million from $161.9 million in the first quarter of 2009. Same store sales did even better, climbing 10.4% year over year.

The company has an amazing track record of beating the estimate, having done so every quarter except one over the last five years. You can see the amazing streak below:

Zacks Consensus Estimates Rise

Analysts are looking for 17% earnings growth in 2010. The fiscal 2010 Zacks Consensus is up 5 cents to $4.48 per share in the last month.

For the fiscal second quarter, the Zacks Consensus has moved up 2 cents to 80 cents in the prior 2 months.

JoS. A. Bank doesn’t report again until Sep 8.

Value Fundamentals

JoS. A. Bank is trading under its industry with a forward P/E of 12.9. The industry average is 14.

Its price-to-book ratio of 2.6 is a little pricier than the industry, which is at 1.8, but it is still well within the value parameters as it is under 3.0.

JoS. A. Bank is a Zacks #1 Rank (strong buy) stock.

JOS A BANK CLTH (JOSB): Free Stock Analysis Report

Zacks Investment Research

Leave a Reply