The New York Times dedicated a chunk of last Sunday’s paper to gold as a mainstream investment. In other words, gold is now legit — no longer can it be dismissed as the asset of choice for fringe types with a cellar full of canned goods and a stash of bullion buried in the backyard.

And to illustrate just how far gold has moved into the American mainstream, the paper goes bipartisan by holding up investor George Soros on the left and commentator Glenn Beck on the right as examples of the newly converted.

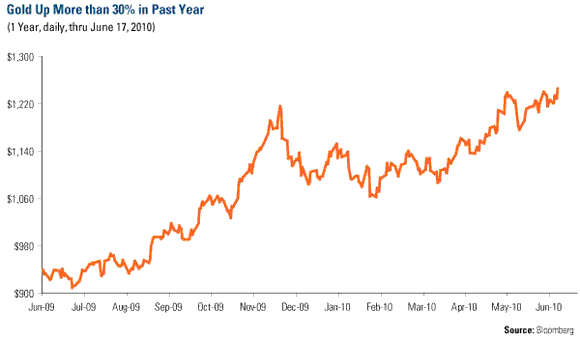

Now there’s an old saying that the time to sell an investment is when it’s finally “discovered” by the popular media, but that may not be good advice for gold in today’s environment. This week spot gold and gold futures hit all-time highs as the latest government reports cast doubts on the economic recovery.

In its story, the Times points out many of the same gold drivers that we have been citing for a while now – the tandem risks of near-term deflation and longer-term inflation, massive U.S. budget deficits and crushing sovereign debt burdens in Western Europe that threaten the euro’s viability.

Gold’s safe-haven qualities now make it attractive to worried investors. It’s true that this fear won’t last forever, but it’s not at all clear that investors will have a good reason to be less fearful any time soon.

From a recent research note by UBS: “The sense that some investors only trust a gold holding if they can see it and touch it is a clear indication that some investors are buying gold as a hedge against a full-scale financial crisis and currency debasement.”

From a recent research note by UBS: “The sense that some investors only trust a gold holding if they can see it and touch it is a clear indication that some investors are buying gold as a hedge against a full-scale financial crisis and currency debasement.”

There are other factors supportive of gold. One is the renewed interest of central banks in adding to their gold holdings to diversify their foreign reserves.

The chart above shows how little gold has been sold by the 18 European countries covered under the Central Bank Gold Agreement. The annual limit is 400 metric tons, but through the first eight months of its latest fiscal year (ends September 2010), only a tenth of that amount changed hands, nearly all of it being sold by the International Monetary Fund.

Russia’s central bank added more than 26 metric tons to its reserves in the first quarter of 2010, according to the World Gold Council. The Philippines has boosted its gold reserves by about 10 metric tons, and China is widely believed to be quietly adding large quantities of gold to its vaults. China is the world’s largest producer and is consuming all of its production, so this supply is not seen in the market.

Russia’s central bank added more than 26 metric tons to its reserves in the first quarter of 2010, according to the World Gold Council. The Philippines has boosted its gold reserves by about 10 metric tons, and China is widely believed to be quietly adding large quantities of gold to its vaults. China is the world’s largest producer and is consuming all of its production, so this supply is not seen in the market.

Gold mine supply also comes into play. After a nice bump up in 2009, gold mine output is on track to decline this year and in 2011 (chart) at the same time that investment demand is strong. The World Gold Council forecasts that overall gold consumption in China could double in the coming decade as income levels rise – it is very unlikely that China’s production will be able to keep the same pace.

Other appeal: gold’s historic non-correlation with other financial assets, household debt reduction and the uncertainties created by the efforts in Washington to raise tax rates and impose new regulatory schemes. And as we approach the important 2010 midterm elections, it would be no surprise to see government deficit spending climb even higher into the stratosphere to curry favor with the voting public.

Some extreme gold bulls are urging investors to move half or even more of their portfolio into gold – we are not in that camp. We consistently suggest that investors consider a maximum 10 percent allocation to gold-related assets – half in bullion or bullion ETFs and the other half in gold stocks or a good gold fund – and that they rebalance each year to capture the swings.

On the gold equities, our research via a basic regression analysis shows that gold equities appear undervalued by 8 percent to 9 percent relative to bullion. This may present a buying opportunity for long-time gold investors and those New York Times readers who are among the many new believers.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

You can’t do NOTHING with gold. When all hell breaks loose, I’ll be laughing at people trying to buy REAL STUFF (like food, for instance) with their little pieces of chopped-up gold biscuits,coins,bars,whatever… The Popes DooDoo is pretty rare stuff too, but that doesn’t make it valuable OR usefull !!!