Yesterday saw speeches from two of the most important people in the world, Ben Bernanke and Barack Obama. People seem to have given BB a modestly positive reception on his performance, though to Macro Man’s eye the headlines seemed underwhelming.

In fact, Macro Man has a confession to make: he is getting policy announcement fatigue. For more than a year and a half, we’ve never been more than a few days away from yet another “important announcement” or “key speech” or “vital press conference.” And sure, Macro Man has had fun tossing verbal (if not literal) darts at the likes of Trichet, et al….but it’s getting to the point where he is really struggling to see the utility in parsing every passage of key announcements for fresh developments. It would take several pages of 10-point printing to list everything that the Federales have done since August 1, 2007….and in the grand scheme of things, this panoply of programs, proposals, and procedures has accomplished…..peanuts.

Small wonder, then, that when Bernanke…or Geithner….or any of these guys open their mouths….Macro Man is starting to hear nothing but Charlie Brown’s teacher.

As for Obama, Macro Man hasn’t really seen any market-based critique of the speech, but c’mon! What can the guy say? The State of the Union is: Buggered!

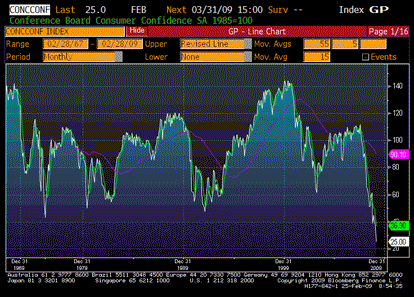

Such, at least, was the message from yesterday’s Conference Board consumer confidence data, which printed an all-time low yesterday (going back to 1967.)

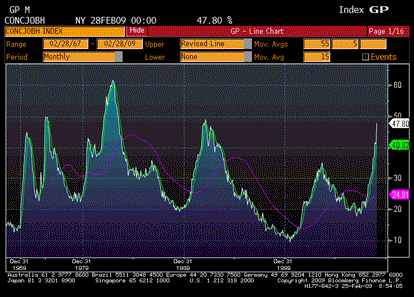

The “good” news is that at least the employment components were not at all time extremes- the chart below shows the “jobs hard to get” indicator. The bad news is that it still jumped a lot, is consistent with an unemployment rate at 8%, and shows no signs of slowing down.

So if you wanted to draw conclusions from the isolated datapoint of yesterday’s trading (warning: may be hazardous to your investment health), you might say that bear fatigue has set in and the market is set up for a bounce. Certainly a few notable bears (Prechter, for example) are suggesting a good chance of a technical squeeze.

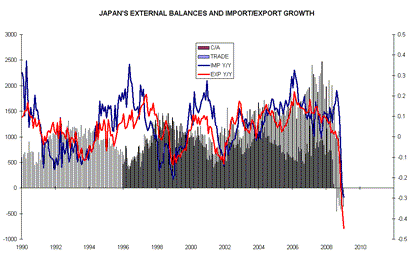

Speaking of squeezes, the rally in all yen crosses remains rampant and in force. A number of crosses broke through the upper barrier of “ichimoky clouds” yesterday, fueling more buying from locals. Also not helping the yen were Japan’s January trade figures; although the level of the deficit was moderately better than expected, the collapse in volumes was stunning: exports are now down 46% y/y. That’s comfortably the worst reading since 1970.

So given the stunning reversal in the yen, and what he wrote yesterday, Macro Man is now on the hunt for other good risk/reward bets on a reversal. “Equities higher” seems an obvious one, though from a fundamental perspective some of the dividend swap products discussed periodically in the comments section look like better value. Gold lower is another one that Macro Man has played with, but frankly he has struggled to construct a trade that offers a solid risk/reward profile. Ditto with “dollar lower against all but the yen” trades…..the cost of transacting options in the marketplace seems very, very high to him; small wonder many banks are reporting record trading volumes so far this year!

Perhaps Macro Man will have to trawl the Second Market website, which appears to be a sort of financial E-Bay for Turds…no doubt there is plenty of stuff on sale there cheap cheap! Then again, if you’re only willing to pay peanuts……

Leave a Reply