There was a big story in the WSJ about one of Nassim Taleb-affiliated fund Universa Investments LP (he’s merely an advisor, but he takes credit when it does well and it’s run based on his long-Black Swan theory). Supposedly, they made a big trade around 2 pm EST on Thursday, just before the market tanked. As the electronic exchanges were spotty a large order like this didn’t help, and wasn’t very savvy on a pure tactical level (ie, don’t make big trades when systems are down).

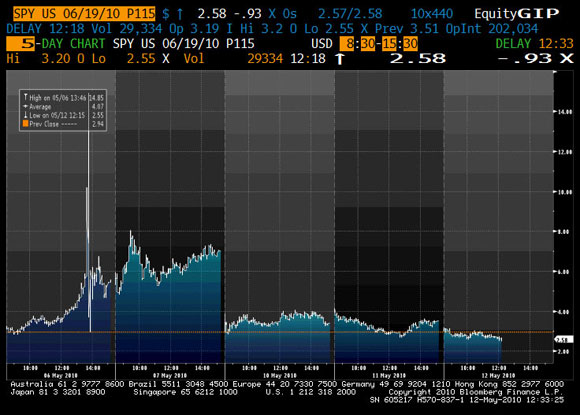

Anyway, lets look at the tape. Here’s an S&P 115 June Put option from Thursday. Around 2 PM EST, it was price about $4.30. It went to about $8 (one bizarre print at $14), and is now about $2.50. Whatever he bought is probably down 50%.

I would bet that his Universa Fund will go exactly like his Empirica fund: first year, up big in year 1, then slightly negative for the next five, when it is 5 times as large. Net net, it loses dollars, and like Emprical will have a Sharpe below the Hedge Fund Mendoza line of 0.5.

All the while, however, he makes huge fees, because 1% on $4B is a lot of money, and his wealth will serve as proof that he’s an investing genius. More importantly, he then selectively presents to a credulous press he makes billions off his market savvy.

Gee, someone should write a book about blow-hard traders who misrepresent their track records and take excessive risk with other-people’s money, all due to cognitive biases they are too shallow to notice in themselves. Oh yeah, Taleb has done that! I guess his insider status gives him better insight.

Leave a Reply