As we anticipate the pattern of a Monday Pump up at the open, consider that a lot of positive excitement last week came from a positive retail report on Friday. This led to gushing that consumer spending was now likely the fastest in three years, and upwards revisions in GDP forecasts for Q1 to 3.1% from 2.7%. The V is on! We’re saved!

This premature exaggeration could lead to a flurry of buy orders over the weekend. Yet consider:

- retail was up in Feb, but only because Jan was revised down

- higher oil prices were half the increase (oil has doubled in price YoY)

- a big slug of tax credits went out in Feb

- the Jan numbers were suspect when issued, and proven wrong

- Consumer sentiment is souring, not improving – indeed it was dismal

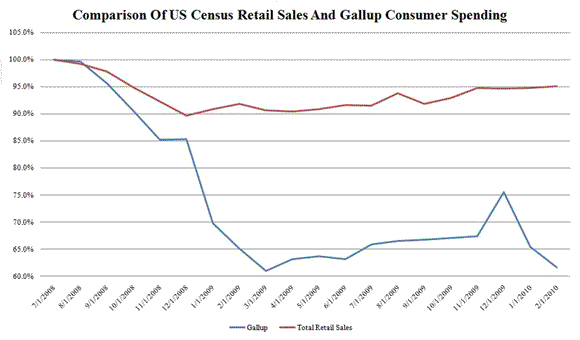

- Gallup Consumer Spending surveys do not support the surge (see chart)

You wonder how a month of blizzards and bad Toyota news could lead to a good report. Although I am not a conspiracy guy, and tend to blame purported manipulations on incompetence, this report looks an awful like we have a rolling manipulation of data, with positive reports and later revisions. Expect Feb to be revised down – to make March look better!

The trend over the last three months is a 1.2% annual rate of growth (0.7% ex gasoline). Weak. Hard to see how that supports a 3% or higher annual GDP increase, let alone the close-to-6% from Q4.

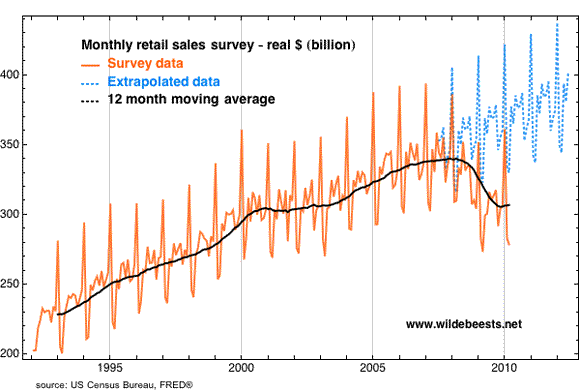

Worse, in inflation-adjusted real terms, retail is down although trending as if bottoming: “[W]e are in the recovery phase, i.e. declines have stopped [but] this phase is very anemic, kind of like a patient on life support.” This chart shows real retail (orange), a twelve-month moving average (black), and an extrapolation (blue) as if the Great Recession had not occurred:

A lot of retail experts gushed with excitement on Friday. Maybe the experts are out of touch with reality? Especially because Peak Stimulus is rolling over. if so, the downside surprise in a few months could be shocking. A “gap and crap”, on Monday, as Mish predicts, might presage a gap & crap quarter in markets.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply