After reading Paul Krugman’s anatomy of a Euromess, I thought I would look take a quick look at the Eurozone countries through the prism of the optimal currency area (OCA) framework. So what is the OCA framework? Here is my discussion of the OCA from a previous post modified to fit the Eurozone:

Is [Europe] best served by a single central bank conducting countercyclical monetary policy? According to the optimal currency area (OCA) criteria, the answer is yes if the various regions of the Europe (1) share similar business cycles or (2) have in place flexible wages and prices, factor mobility, fiscal transfers, and diversified economies. In the former case, similar business cycles among the regions mean that a [European] monetary policy, which targets the aggregate business cycle, will be stabilizing for all regions. In the latter case, dissimilar business cycles among the regions make a [European] monetary policy destabilizing—it will be either too stimulative or too tight—for some regions unless they have in place the above listed economic shock absorbers.

If a region’s economy is not in sync with the currency union’s business cycle and the above listed shock absorbers are absent then it does not makes sense for a country to be a part of the currency union. Instead, the country should keep its own currency which itself will act as a shock absorber.

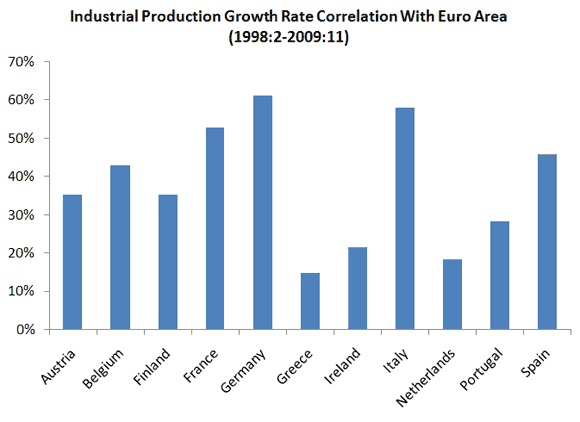

So where does the EU stand with regards to the OCA criteria? I went to the OECD database for some quick answers and here are some interesting data points I found. First, I looked at the correlation between the industrial production growth rate in the regional economies and the Eurozone. This reveals how similar the regional business cycles are with the broader European economy:

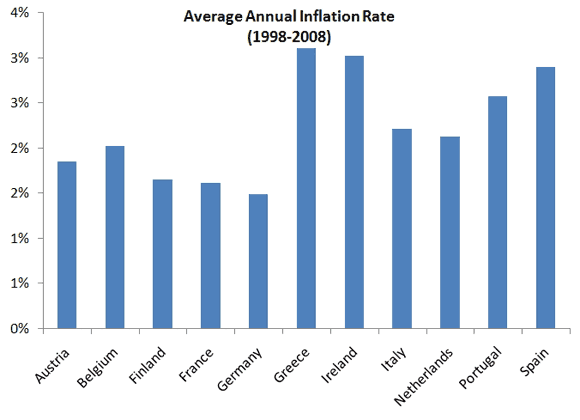

Greece, which is at the center of the current Euro crisis, is notably less in sync with the rest the of European economy. In terms of price flexibility I examined the average annual inflation rate over the 1998-2008 period. To the extent that higher inflation reflects the rigidity of downward price adjustment, it should provide some sense of price flexibility:

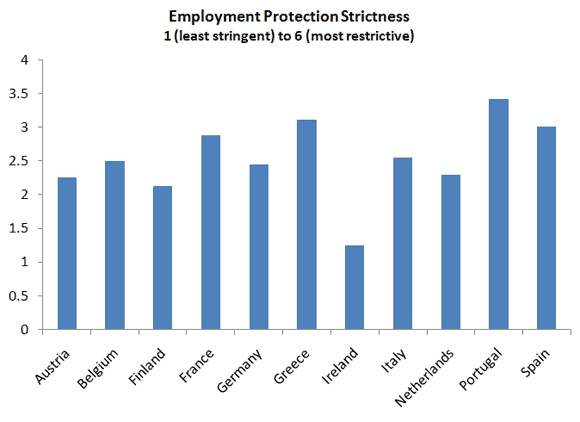

Here the periphery countries have the highest inflation rates. (This also means that they have also had a significant real exchange rate appreciation against the core Eurozone countries.) Next, I looked for some measure of labor market flexibility and the closet proxy I could find is the OECD’s employment protection strictness (EPS) measure. Presumably, the greater the EPS the more rigid is the labor market. Below is the measure for 1998-2008:

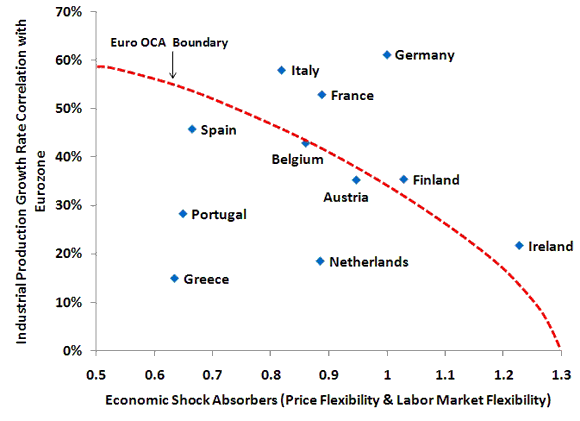

Here, Portugal, Spain, and Greece have the most stringent EPS over this time If we add to the above findings the fact that there is no EU treasury providing fiscal transfers and that labor mobility is not where it should be then it seems reasonable to conclude some of the Eurozone periphery should not be in the currency union. Taking this quick analysis one step further, I rescaled the inflation and EPS measures and then took the average of them to create a shock absorber index where increases in its value indicate a greater shock absorbing ability. I then plotted this shock absorber index for each country against its industrial production correlation with the Euro industrial production:

To make the graph complete, I added the red line which shows a hypothetical OCA boundary where countries on the outside of it have a sufficient mix of business cycle coordination and economic shock absorbing ability to be a part of the Euro OCA. This red line is purely a conjecture and used only to illustrate that somewhere there is a marker that separates those countries that are truly a part of the Euro OCA. Where it exactly falls is unclear. What does seem clear, though, is that some of the Eurozone periphery falls inside of it.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply