According to a recent report by Bloomberg, Warren Buffett’s Berkshire Hathaway Inc. (BRK-A), (BRK-B) is approaching a significant threshold in its ownership of Bank of America Corp. (BAC) stock, which could soon alter the frequency and urgency of its disclosure requirements for stock sales.

The investment conglomerate’s latest round of divestments, revealed late Friday, has reduced its stake in Bank of America to 11.4%. This brings Berkshire tantalizingly close to the 10% ownership mark, a crucial regulatory boundary.

Current U.S. regulations mandate that stakeholders holding more than 10% of a company must disclose transactions within days. However, once Berkshire’s ownership dips below this threshold, it would gain the flexibility to report its trading activities less frequently, typically on a quarterly basis.

This potential shift in reporting obligations could have significant implications for market dynamics surrounding Bank of America’s stock. Since mid-July, when Buffett initiated an unexpected selling spree without public explanation, the bank’s share price has been under pressure. The possibility of less frequent disclosures might help alleviate some of this market tension, as investors would have fewer immediate updates on Berkshire’s trading activities.

The latest transaction, as reported by Bloomberg, involved Berkshire offloading approximately 21 million shares for $848 million between August 28 and 30. This sale is part of a larger series of divestments that have netted Berkshire a total of $6.2 billion since the selling began.

Buffett’s relationship with Bank of America dates back to 2011 when he made a strategic $5 billion investment in preferred stock and warrants. Over time, Berkshire Hathaway grew to become the bank’s largest shareholder. Despite the recent sales, Berkshire’s remaining stake in Bank of America is still substantial, valued at approximately $36 billion based on Friday’s closing price of $40.75 p/sh.

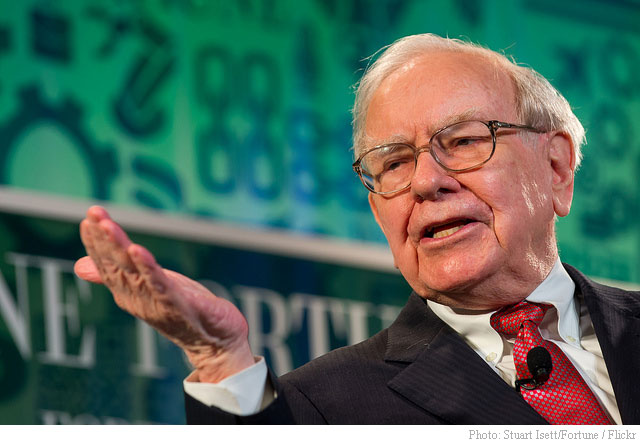

The 94-year-old investor’s decision to reduce Berkshire’s position in Bank of America has raised eyebrows in the financial community, particularly given Buffett’s long-standing support for CEO Brian Moynihan. The lack of explanation for this change in strategy has fueled speculation and contributed to the stock’s recent volatility.

As Berkshire inches closer to the 10% ownership threshold, market observers will be keenly watching for any further sales and their potential impact on Bank of America’s stock performance. The possibility of less frequent disclosures in the future adds an additional layer of intrigue to this unfolding financial narrative.

This situation underscores the significant influence that major investors like Buffett can have on market perceptions and stock valuations, even as they adjust their portfolios. It also highlights the delicate balance between regulatory requirements for transparency and the strategic considerations of large institutional investors.

As the financial world continues to monitor Berkshire’s moves, the coming weeks may prove crucial in determining whether Buffett will further reduce his stake in Bank of America and how such decisions might reshape the landscape of one of America’s largest banking institutions.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply