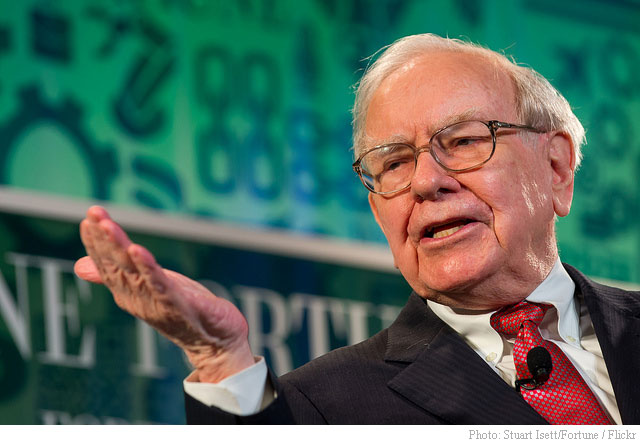

Warren Buffett on Saturday signaled his Berkshire Hathaway (BRKa.N) (BRKb.N) would gladly partner again with Brazilian private equity firm “3G Capital” on more transactions. Buffett and the New York-based 3G — a firm best known for its acquisition of Burger King (BKW) — teamed up to buy ketchup maker Heinz & Co. (HNZ) last year for $23.3 billion in the richest deal ever in the food industry.

“I think 3G does a magnificent job of running businesses,” Buffett said [via Reuters] at Berkshire’s annual meeting. “We’re very likely to partner with them, perhaps on some things that are very large.”

Berkshire contributed $12.12 billion toward the acquisition of Heinz, but gave Jorge Lemann’s 3G, whose record of aggressively cutting costs at businesses it acquires is well known, day-to-day control of operations and administration of the company.

Some industry observers who have criticized the Brazilian firm’s slashing of too many jobs at Heinz & Co, have said 3G’s cuts do not reflect Berkshire’s typical values toward people who work at companies it acquires.

“We have not enforced, or attempted to enforce, nor do we wish to enforce, a strong discipline in every subsidiary as to whether they have a few too many people or not,” Buffett said. “A great many don’t.”

Leave a Reply