In an Economix post today, titled “The Panic of ’08: Recession Cause or Effect?” Professor Mulligan writes:

…recent research questions the claim that the financial panics themselves contributed to their contemporaneous and severe employment downturns.

The post continues:

The timing was different in this recession — the largest employment drops seemed to come immediately after the financial panic — but a recent paper by Ravi Jagannathan, Mudit Kapoor and Ernst Schaumburg of Northwestern argues that the coincidence is just as misleading. They argue that the changing global economy — with more employment of residents in developing countries like China — created a glut of savings in those countries, and was destined to reduce employment in developed countries regardless of whether there had been a financial panic.

This paper was discussed earlier on this weblog, and Professor Jagannathan provided some clearly exposited counterarguments to my criticisms in his comments. Indeed, I think there’s a lot more subtlety to that paper, and the posited causal chain, than is related above, even if I disagree with the main thesis (see [1]).

But even if you believe the Jagannathan, Kapoor, Schaumberg thesis in full, this does not invalidate the idea that banks provide useful intermediation services, and that failing banks, insolvent banks, or banks that are retrenching in terms of their lending will exert a contractionary influence on the economy. (After all, if one reads Bernanke’s 1983 paper (AER 73(3)), you’ll see him focus on the declining ratio of loans to the sum of checking and savings deposits, shown in his Table 1) It’s just that you think that what caused the banks to overleverage is the “saving glut”. (Another way to put it is you think the financial system is the proximate cause, and Beijing the ultimate cause, a la “Blame it on Beijing“). This interpretation is suggested to me by this passage in the conclusion to Jagannathan et al.:

…History might have taken an entirely different path with better risk management controls in place in the US but then again, financial innovation might just have found a different way of getting highly leveraged deals done off-shore or through creative accounting. The root cause of the excess liquidity in the global financial system must be addressed, otherwise we are just squeezing the proverbial balloon only to see it bulge out somewhere else. However, this does not negate the need for the development of improved risk management in the broadest sense in order to ensure financial stability and prosperity going forward.

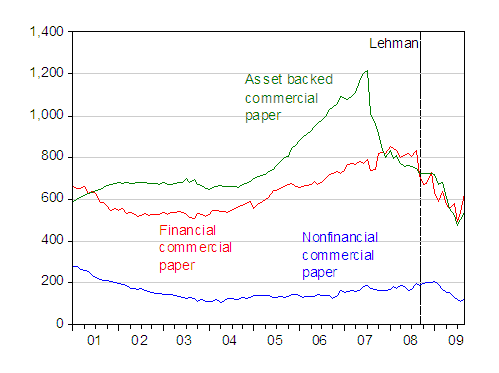

One truly odd aspect of Professor Mulligan’s discussion is the treatment of the banking system as the financial system. I’ve been hearing a lot about the “shadow financial system” for quite a while — and I have some inkling there was trouble brewing there somewhat before the plunge in employment and output in September 2008. Below, I graph one aspect of the broader financial system.

Figure 1: Commercial paper outstandings, in billions of dollars, seasonally adjusted. Source: Federal Reserve Board, data releases, commercial paper.

So in my view, the financial system problems preceded the initial decline in employment and output. That doesn’t preclude the possibility of the subsequent declines in employment and output causing further financial system problems. That I believe is what is called an adverse feedback loop.

More graphs from the real world in this post and the IMF’s GFSR.

Postscript: Brad Delong also appears to find this post befuddling.

One Interpretation of Recession Causes… with Really Long and Really Variable Lags

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply