Its stock is back on track after consolidating for just one month. Now it’s Bigger. Stronger. Faster… and more profitable than ever before.

Face facts – no retailer can top Amazon.com (NASDAQ:AMZN).

Amazon shares have roared back to life in July. They’re back above $1,000 and pushing to new all-time highs.

Investors are losing their minds over the company’s dominance over the retail sector. There’s nowhere left for the old-fashioned brick and mortar stores to hide. Even so-called “disruptors” like food delivery upstart Blue Apron (NYSE:APRN) are imploding under the pressure.

Amazon is accelerating Blue Apron’s record breaking fall from grace with the release of its own line of meal kits – which officially hit U.S. markets yesterday. Meanwhile, Blue Apron’s stock tumbled to new lows again (it’s already down nearly 40% from its June IPO price).

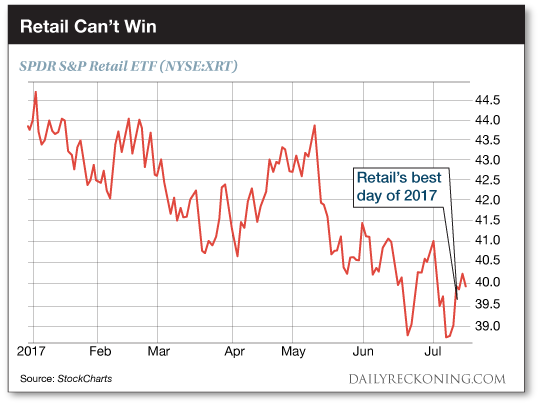

The list of Amazon’s victims grows longer by the day. Even “good days” for retail aren’t drumming up any excitement for the sector. Just last week, the SPDR S&P Retail ETF (NYSE:XRT) enjoyed its best day since November, bolstered by Target raising its earnings forecast.

“But even with the one day of euphoria in some of the worst performing retail names, many major brick-and-mortar chains are still extremely depressed, having seen their market cap dissolve this year as shoppers move online,” CNBC reluctantly notes.

Despite enjoying its best day of the year, the retail sector is just a small drop from posting new lows. Every single bounce in 2017 has ended in more pain. The selling has been nothing short of relentless…

But we have to ask: Has retail hit rock bottom?

I know what you’re thinking…

Picking “bottoms” is downright impossible.

Sure, it’s tempting to scoop up shares of an oversold name that’s endured a painful drop. But nine times out of ten, the market beats the knife catchers to a pulp.

But it’s time to start paying close attention to this year’s big retail losers. It’s not time to pull the trigger just yet. But we are beginning to see signs that negative retail sentiment is hitting unprecedented extremes.

Just this month, ProShares filed plans for ETFs that will allow traders to bet against the brick and mortar retail sector. Hating retail stocks has gone beyond even mainstream common sense. The fact that these stocks are dogs is imbedded in the brain of every fund manager and investor in the world. Everyone’s on the same side of the boat.

“Could this announced product signify a bottom for brick and mortar retail? Is this the thing that marks the low in sentiment toward the shopping mall?” Josh Brown mused on his blog, The Reformed Broker. “Nah, too easy. Though it does mark the mood around non-online retail pretty nicely. A sign of the times to be sure.”

The death of the shopping mall and the rise of Amazon and the online shopping revolution remains an ongoing cultural event. As it continues to shake out, we will see more poorly run, unfocused retail operations hit the skids.

But as much as we’ve dogged brick and mortar retail lately, it would be silly to assume every single store in the country will close their doors and declare bankruptcy. Like any industry that finds itself in turmoil, the best businesses will adapt and survive.

That also means we can profit from snapback plays while the rest of the world crowds the other side of the trade.

I’ve already shown you three businesses that have what it takes to survive in the age of Amazon. We’ll be able to add to this list with some more explosive, shorter-term bounce plays as they begin to form. A strategy like this requires a little patience on our part. But it could hand us some of our biggest gains of the second half of the year when all is said and done…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply