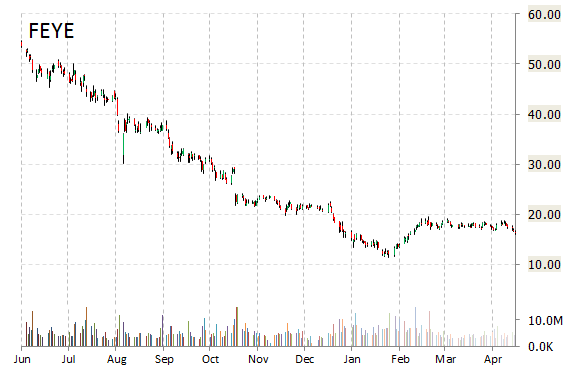

FireEye, Inc. (FEYE) was reiterated a ‘Neutral’ by UBS analysts on Friday. The broker also cut its price target on the stock to $16 from $18.

Shares have traded today between $12.86 and $14.49 with the price of the stock fluctuating between $11.35 to $55.33 over the last 52 weeks.

FireEye Inc. shares have a t-12 price/sales ratio of 4.26. EPS for the same period registers at ($3.5). The stock has lost $2.97 to $13.01 in midday trading on Friday, giving it a market cap of roughly $2.16 billion. FEYE traded as high as $55.33 in June 18, 2015.

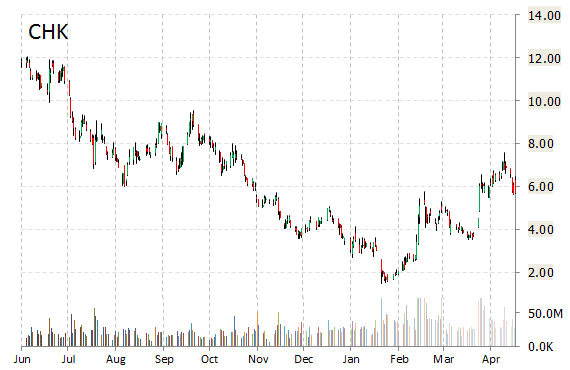

Chesapeake Energy Corporation (CHK) was reiterated as ‘Sell’ on Friday by UBS. The firm however, raised its price target on the name with a $4.00 from $0.50.

In the past 52 weeks, shares of Chesapeake Energy have traded between a low of $1.50 and a high of $15.76 and are now trading at $5.45. Shares are down 61.21% year-over-year ; up 26.89% year-to-date.

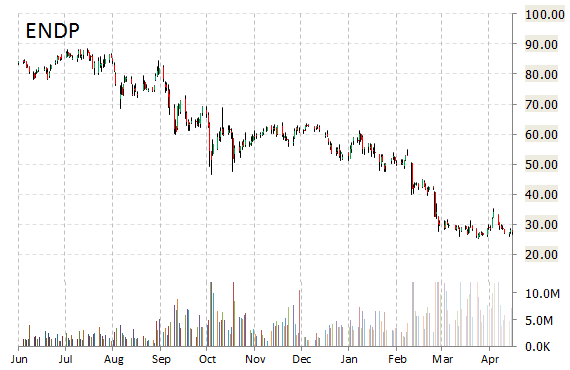

Endo International plc (ENDP) rating of ‘Equal Weight’ was reiterated today at Barclays with a price target decrease of $28 from $37 (versus a $26.59 previous close). The name was also downgraded to ‘Underperform’ from ‘Neutral’ with a $13 from $42 price target at Mizuho. The firm said it views ENDP as toxic based on the company’s weak longer term outlook, drastically lowered guidance, and pushed out de-levering targets.

ENDP shares have had a rough 2016, with shares down nearly 56% so far this year. The stock began trading this morning at $17.34 to currently trade 40.73% lower from the prior days close of $26.59.

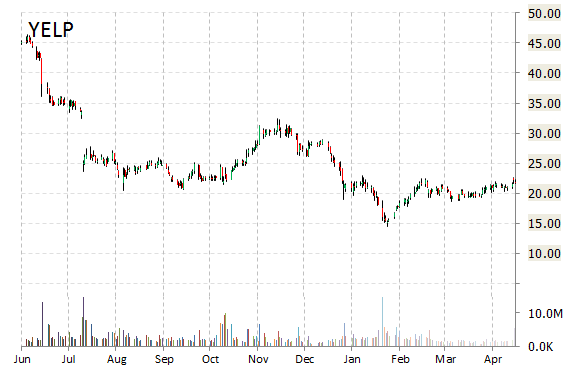

Shares of Yelp Inc. (YELP) are up $4.20 to $25.62 in midday trading following the company beating analysts’ estimates for Q116. RBC Capital Markets reiterated this morning its ‘Outperform’ rating and increased its 12-month base case estimate on the name by 3 points to $36 a share. Yelp’s price target was also raised to $24 from $20 at Mizuho.

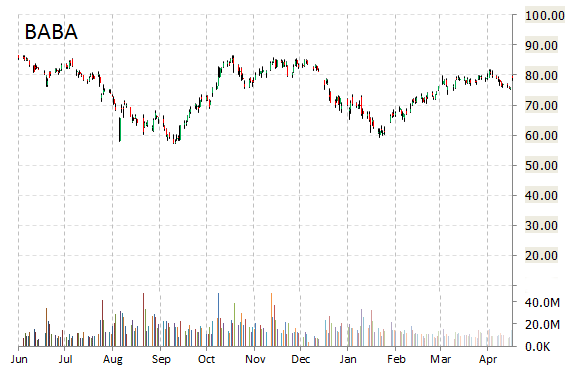

Alibaba Group Holding Limited (BABA) was reiterated an ‘Outperform’ by RBC Capital Markets analysts on Friday. The broker also raised its price target on the stock to $105 from $89.

On valuation measures, Alibaba Group Holding Ltd. ADR shares have a T-12 price/sales ratio of 13.23 and a price/book for the same period of 5.81. EPS is $4.12. The name has a market cap of $207.48 billion and a median Street price target of $93.16 with a high target of $120.

Currently there are 32 analysts that rate BABA a ‘Buy’, 5 rate it a ‘Hold’. No analyst rates it a ‘Sell’.

Shares of Alibaba are higher by 0.82% to $79.48 in midday trading on Friday.

Leave a Reply