Yahoo (YHOO) reported first-quarter 2016 results after the market close today that exceeded Wall Street’s expectations. Revenue came in at $859 million, well ahead of Wall Street’s consensus estimate of $846 million but down 17.6% from a year ago. Earnings per share came in at $0.08. That was up 14.28% above the Street’s expectations of $0.07.

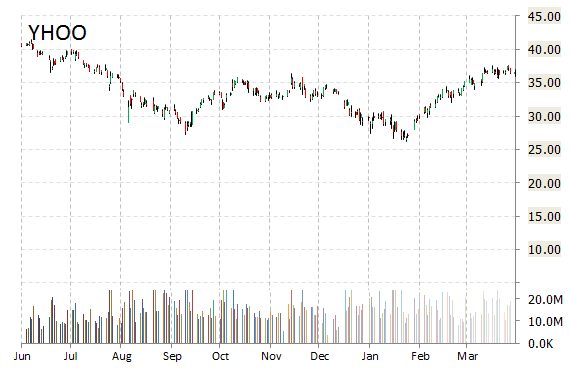

Share Performance

In the past 52 weeks, shares of the struggling web portal have traded between a low of $26.15 and a high of $45.18 with the 50-day MA and 200-day MA located at $35.04 and $32.77 levels, respectively. Additionally, shares of Yahoo trade at a P/E ratio of (14.85) and have a Relative Strength Index (RSI) and MACD indicator of 59.18 and -0.17, respectively.

YHOO currently prints a one year loss of about 18% and a year-to-date return of around 10%.

In after-hours trading, shares were up 1% to $36.68 following the earnings report.

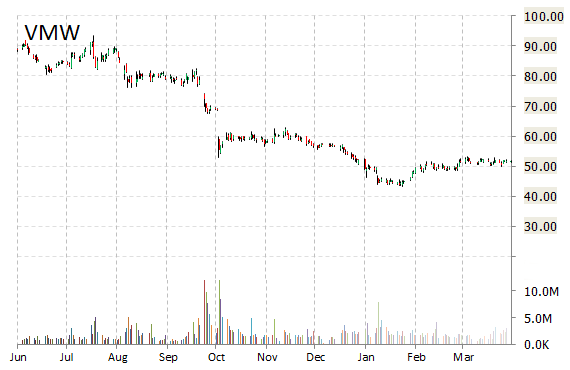

VMware, Inc. (VMW) reported first-quarter non-GAAP EPS of $0.86 after the closing bell Tuesday, compared to the consensus estimate of $0.84. Revenues increased 5.2% from last year to $1.59 billion. Analysts expected revenues of $1.58 billion.

VMware shares have fallen 9% since the beginning of the year. The stock is currently up $1.98 to $53.44 on 3.22 million shares.

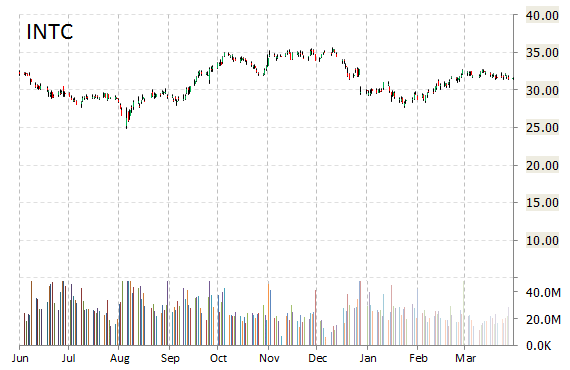

Intel Corporation (INTC) dropped $0.83 to $30.77 in after-hours trading after it reported fiscal results for the first quarter.

In its quarterly report, the chipmaker said it earned $0.54 per share, well above the $0.48 per share analysts were expecting. Revenue rose 8.0% YoY to $13.8 billion, below forecasts for $13.83 billion.

Intel today announced that it will lay off up to 12,000 employees, or 11% of its global workforce by mid-2017, as part of a restructuring initiative. The Santa Clara, Calif.-based company said restructuring efforts are intended to “accelerate its evolution from a PC company to one that powers the cloud and billions of smart, connected computing devices.”

Leave a Reply