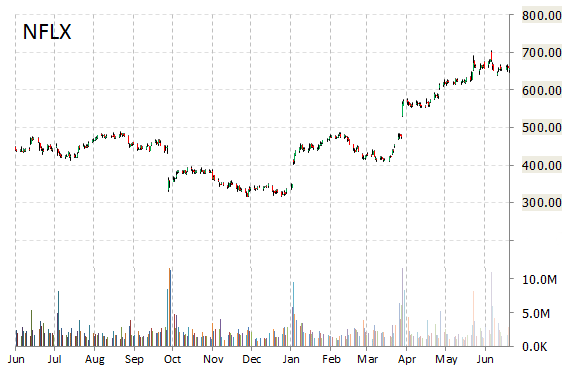

Netflix, Inc. (NFLX) reported second quarter EPS of $0.06 after the closing bell Wednesday, compared to the consensus estimate of $0.04. Earnings per share would have been $0.42 using pre-split share count. Revenues increased 22.8% from $1.34 billion last year to $1.64 billion, boosted by strong subscriber growth. Analysts expected revenues of $1.65 billion. Net income fell to $26.3 million, or $0.06 per share, from $71 million, or $0.16 cents per share a year earlier.

Netflix said its Internet TV service eclipsed 65.6 million subscribers in the second quarter. The strongest growth was in international markets, where subscribers jumped 2.37 million to 23.3 million. For the current quarter, Netflix expects to add 3.55 million new streaming subscribers, bringing its global total to 69.1 million. The company gave also guidance for the third quarter of 2015, saying it expects EPS of $0.07 compared to consensus estimates of $0.05.

The stock is currently up $10.23 to $108.36 on 26.38 million shares.

As a quick reminder, NFLX had a 7:1 split today which obviously has an impact on both PPS and EPS consensus.

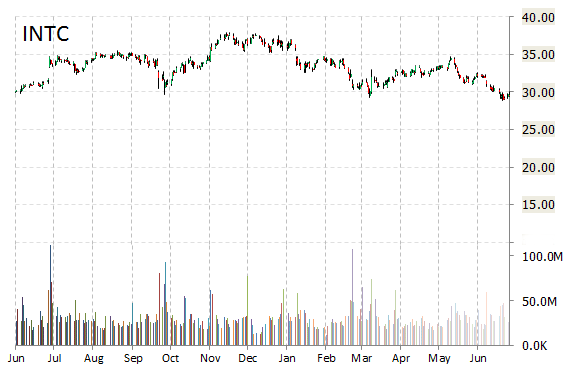

Intel Corporation (INTC) rallied $1.81 to $31.50 in after-hours Wednesday after it reported fiscal-second quarter earnings.

The chipmaker handed in EPS $0.55 on revenue of $13.20 billion, beating Street estimates of $0.50 per share on revenue of $13.05 billion, but down from $13.8 billion a year ago.

For Q3/15 the company guided revenues of $13.8 to $14.8 billion, as compared to analysts’ expectations of $14.1 billion. Intel said it expects revenue to fall about 1% for full year 2015 compared to 2014.

“Second-quarter results demonstrate the transformation of our business as growth in data center, memory and [Internet of Things] accounted for more than 70 percent of our operating profit and helped offset a challenging PC market,” Intel CEO Brian Krzanich said in a statement. “We continue to be confident in our growth strategy and are focused on innovation and execution. We expect the launches of Skylake, Microsoft’s (MSFT) Windows 10 and new OEM systems will bring excitement to client computing in the second half of 2015.”

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply