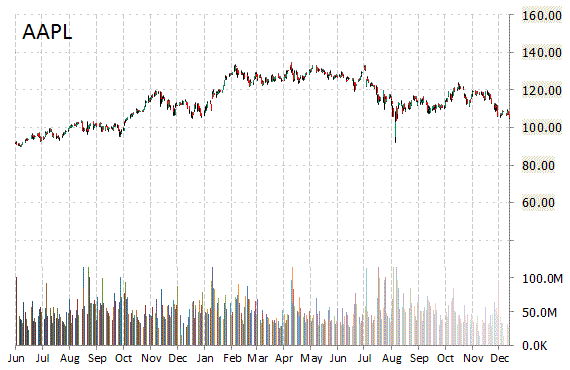

Analysts at BofA/Merrill (BAC) are out with a report this morning upgrading shares of Apple Inc. (AAPL) with a ‘Buy’ from ‘Neutral’ rating. The banking giant set its price target for the company at $130, noting worries regarding supply chain data points are now largely priced into the stock at theses levels following the pullback. BofA also said demand in China for iPhones remains strong.

Apple Inc. shares are currently priced at 10.77x this year’s forecasted earnings, compared to the industry’s 8.37x earnings multiple. Ticker has a forward P/E of 9.48 and a t-12 price-to-sales ratio of 2.35. EPS for the same period is $9.22.

In the past 52 weeks, shares of Cupertino, California-based company have traded between a low of $92.00 and a high of $134.54 and are now at $99.33.

Shares are down 10.54% year-over-year.

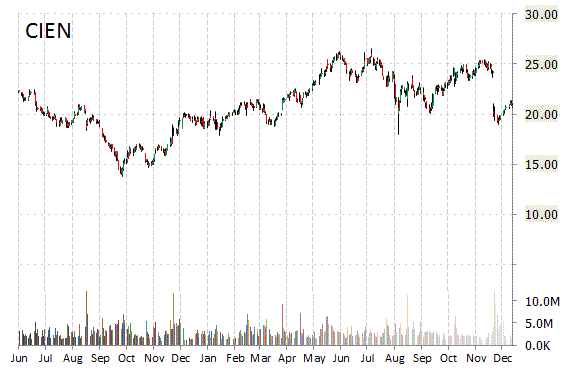

Analysts at Morgan Stanley (MS) upgraded their rating on the shares of Ciena Corporation (CIEN). In a research note published on Tuesday, the firm lifted the name with an ‘Overweight’ from ‘Equal-Weight’ rating and set a 12-month base case estimate of $23 per share.

On valuation measures, Ciena Corp. shares are currently priced at 185.45x this year’s forecasted earnings, compared to the industry’s 11.54x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.78 and 10.30, respectively. Price/Sales for the same period is 1.01 while EPS is $0.10.

Currently there are 18 analysts that rate CIEN a ‘Buy’, 3 rate it a ‘Hold’. No analyst rates it a ‘Sell’. CIEN has a median Wall Street price target of $26 with a high target of $32.

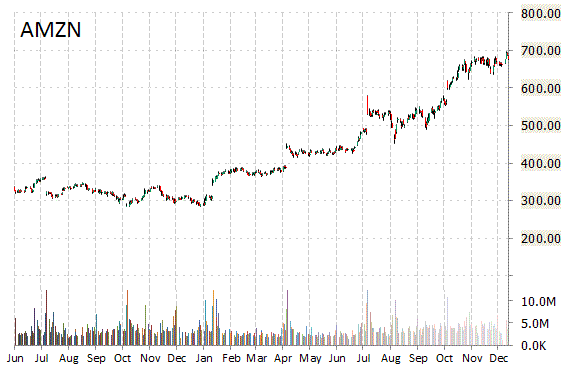

Amazon.com, Inc. (AMZN) was reiterated an ‘Outperform’ by Credit Suisse (CS) analysts on Tuesday. The broker also raised its price target on the stock to $800 from $777.

AMZN is up $1.39 at $619.13 on normal volume. Midway through trading Tuesday, 2.84 million shares of Amazon.com have exchanged hands as compared to its average daily volume of 4.53 million shares. The stock has ranged in a price between $618.03 to $625.99 after having opened the day at $625.10.

In the past 52 weeks, shares of Seattle, Washington-based e-commerce giant have traded between a low of $285.25 and a high of $696.44.

Shares are up 108.04% on a year-over-year basis.

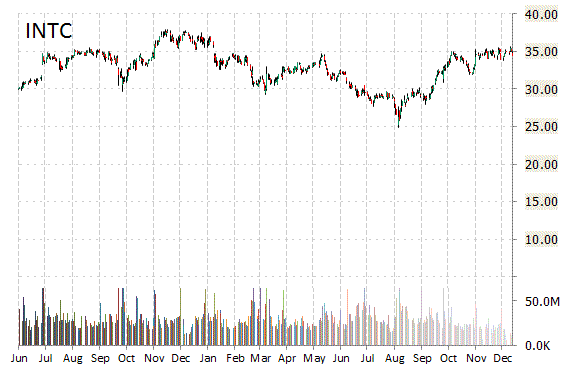

Intel Corporation (INTC) was raised to ‘Buy’ from ‘Neutral’ and it was given a $37 price target at Mizuho on Tuesday. The firm notes that declines in the PC market are moderating and that the company is a dominant force in cloud and other new markets.

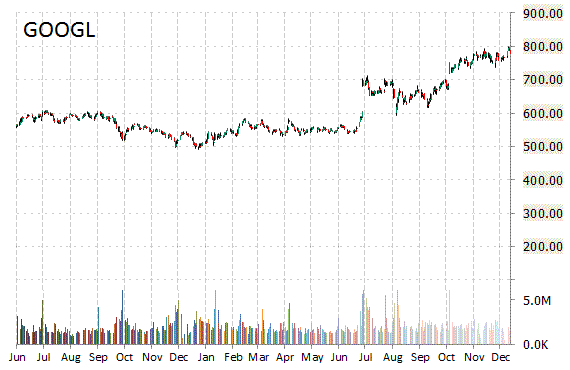

Alphabet Inc. (GOOGL) was reiterated as ‘Outperform’ with a $900 from $850 price target on Tuesday by Credit Suisse.

The stock began trading this morning at $740.44 to currently trade 1.39% higher from the prior days close of $733.07. On an intraday basis it has gotten as low as $738.36 and as high as $748.20.

On valuation measures, Alphabet Inc. Cl A shares are priced at 31.33x this year’s forecasted earnings, compared to the industry’s 13.42x earnings multiple. The company’s current year and next year EPS growth estimates stand at 15.30% and 17.80%, compared to the industry growth rates of 12.00% and 19.90%, respectively. GOOGL has a t-12 price-to-sales ratio of 7.03. EPS for the same period registers at $23.72.

Alphabet shares have declined 3.87% in the last 4 weeks while advancing 9.21% in the past three months. Over the past 5 trading sessions the stock has lost 3.47%. The Mountain View, California-based company, which is currently valued at $511.15 billion, has a median Wall Street price target of $850.00 with a high target of $1,000.00.

Alphabet is up 46.40% year-over-year, compared with a 4.91% loss in the S&P 500.

Leave a Reply