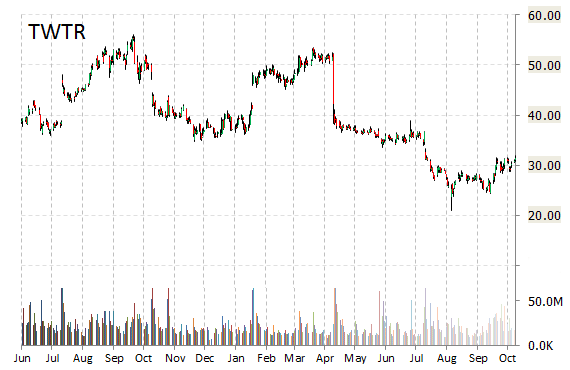

Analysts at Stifel upgraded their rating on the shares of Twitter, Inc. (TWTR). In a research note published on Wednesday, the firm lifted the name with a ‘Buy’ from ‘Hold’ rating and set a 12-month base case estimate of $34 per share. Firm believes the hiring of Jack Dorsey was the first step toward an improved product and repaired franchise.

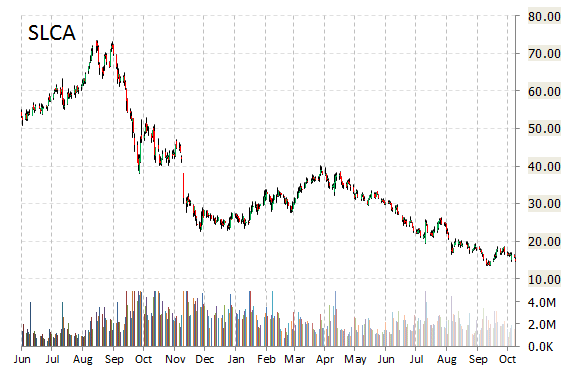

U.S. Silica Holdings, Inc. (SLCA) was raised to ‘Buy’ from ‘Neutral’ at Guggenheim on Wednesday.

SLCA is up $3.37 at $18.01 on heavy volume. Midway through trading Wednesday, 5.04 million shares of U.S. Silica Holdings Inc. have exchanged hands, compared to its average daily volume of 1.99 million shares. The stock has ranged in a price between $15.98 – $18.66 after having opened the day at $15.92.

Over the past year, shares of Frederick, Maryland-based producer of commercial silica in the United States have traded between a low of $13.48 and a high of $50.95.

Shares are down 42.19% since the beginning of the year.

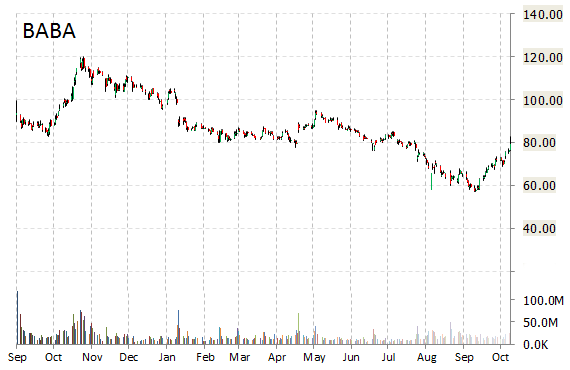

Alibaba Group Holding Limited (BABA) was reiterated as ‘Buy’ with a $89 from $85 price target on Wednesday by Deutsche Bank (DB). The Chinese e-commerce giant was also raised to $95 from $80 at BC Capital Markets, and to $92 from $85 at Axiom Capital.

Alibaba is currently valued at $202.62 billion. The name has a median Wall Street price target of $88 with a high target of $120. Alibaba Group Holding Ltd. is down 18.76% year-over-year, compared with a 4.22% gain in the S&P 500.

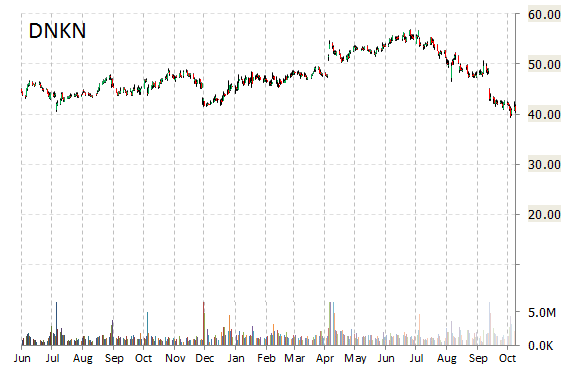

Dunkin’ Brands Group, Inc. (DNKN) was raised to ‘Buy’ from ‘Outperform’ at Credit Agricole on Wednesday.

DNKN shares recently gained $1.08 to $41.62. The stock is down more than 9% year-over-year and has lost 3.41% year-to-date. In the past 52 weeks, shares of Canton, Massachusetts-based company have traded between a low of $39.29 and a high of $56.79.

Dunkin’ Brands Group, Inc. closed Tuesday at $40.54. The name has a current market cap of $3.96 billion.

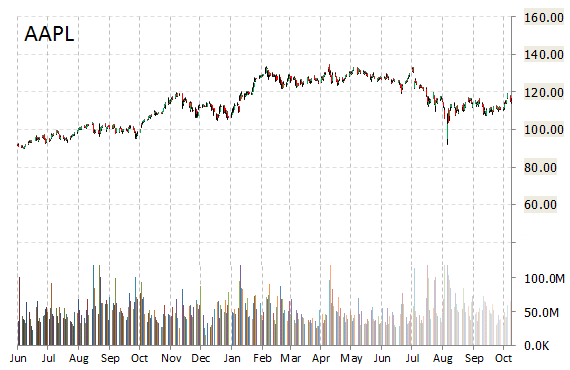

Apple Inc. (AAPL) was reiterated an ‘Overweight’ by Barclays analysts on Wednesday. The broker raised its price target on the stock to $155 from $150. Apple was also raised to $140 from $145 at Credit Suisse (CS), and to $179 from $172 at Piper Jaffray.

Apple Inc. shares are currently priced at 13.61x this year’s forecasted earnings, compared to the industry’s 14.24x earnings multiple. Ticker has a forward P/E of 10.88 and t-12 price-to-sales ratio of 2.91. EPS for the same period is $8.65.

In the past 52 weeks, shares of Cupertino, California-based company have traded between a low of $92 and a high of $134.54 and are now at $117.64.

Shares are up 10.84% year-over-year and 5.10% year-to-date.

Leave a Reply