All eyes will be on Apple Inc. (AAPL) after today’s close. Wall Street analysts are on average expecting the iPhone maker to post $51.02 billion in sales during the quarter. This would show a 2.86% increase from the Q315 revenue of $49.6 billion, and an increase of 21.13% from the same period in Q414. EPS in Q415, typically Apple’s second-weakest of the year, are expected to come in at $1.87, a growth rate of 31.69% from $1.42 per share a year earlier. In terms of some of the name’s quick metrics, the Street is anticipating Q4 iPhone sales of 48.8 million vs. 39.3 million last year. Q4 iPads and Macs are projected to come in at 10.1 million vs. 12.3 million, and 5.6 million vs. 5.5 million last year, respectively. Meanwhile, for the current quarter EarningsWhisper.com reports a whisper number of $1.99 per share.

As a quick reminder, Cupertino reported Q315 EPS of $1.85, $0.04 better than the Street’s consensus estimate. Revs increased 32.62% year-over-year to $49.6 billion versus the $49.31 billion consensus.

In advance of Apple’s Q4 earnings today, we have some key data points that we would like to share, courtesy of Verto Analytics:

- In Q3 of 2015, the installed base for Apple’s devices was 85M for iPhones (41% share), 63M for iPads (40% share) and 47M for Mac computers (12% share).

- In August 2015, Apple’s web sites and mobile apps reached a total of 140M users, which is 57% of the online population.*

The average daily reach was 82M users, resulting in Verto Stickiness Index** of 59% for August 2015. - Most of Apple’s monthly users accessed via smartphones (86M), while 72M accessed the content via PCs and 56M via tablets.

- Content is any app, site, system app, software, or services, operated or owned by Apple.

68M (49%) of Apple’s monthly users accessed the content via mobile devices only. Out of the daily users, the average number of mobile-only users was 74M (90%). - On average, Apple users spent 22 hours per month engaged with the company’s content.

“Apple is a very mobile driven company today – 90% of Apple daily users are accessing Apple apps and services solely from their mobile devices. Apple also has an extremely loyal customer base, and they keep inventing services to turn your mobile device into a digital hub – not just for communications, but entertainment and commerce, too,” commented Dr. Hannu Verkasalo, Ph.D., CEO of Verto Analytics.

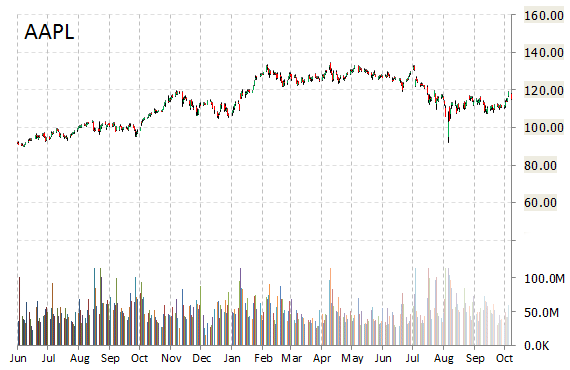

Stock reaction: AAPL was up $0.43 at $115.71 in morning trading, moving within a 52-week range of $92 to $134.54. The name, valued at $657.41 billion, has a median Street price target of $150 with a high target of $200. Currently, ticker boasts 38 ‘Buy’ endorsements, compared to 7 ‘Holds’ and 2 ‘Sell’.

On valuation measures, Apple shares are priced at 13.33x this year’s forecasted earnings, compared to the industry’s 13.52x earnings multiple. The name has a t-12 price/sales ratio of 3.03. EPS for the same period registers at $8.65.

As for passive income investors, the tech giant pays shareholders $2.08 per share annually in dividends, yielding 1.75%.

If Apple delivers an upbeat report, it could drive the Nasdaq 100 (NDX) to surpass its 52-wk highs.

AAPL dominates the S&P 500 as no other company has in 30 years.

Leave a Reply