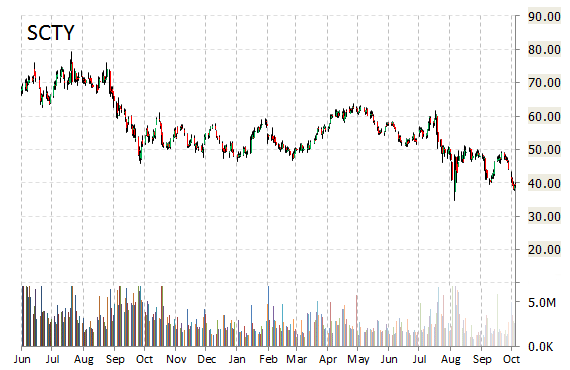

SolarCity Corporation (SCTY) was reiterated a ‘Buy’ by ROTH Capital analysts on Monday. The broker however, cut its price target on the stock to $70 from $98, noting ticker is primed for a short squeeze.

Shares of the $3.78 billion market cap company are down 27.47% year-over-year and 26.63% year-to-date.

SolarCity Corp., currently with a median Wall Street price target of $75 and a high target of $105, dropped $0.38 to $38.86 in recent trading.

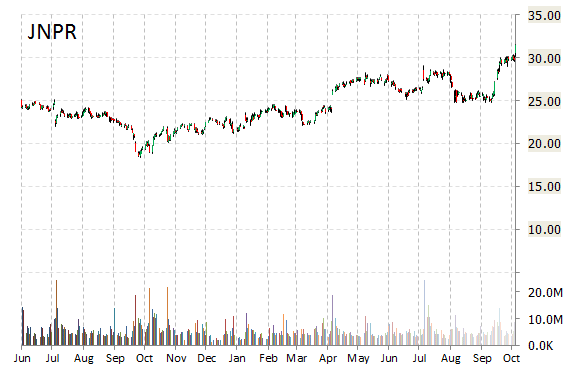

Juniper Networks, Inc. (JNPR) was downgraded to ‘Hold’ at Stifel.

Shares have traded today between $30.90 and $31.56 with the price of the stock fluctuating between $18.81 to $31.56 over the last 52 weeks.

Juniper Networks Inc. shares have a t-12 price/sales ratio of 2.68. EPS for the same period registers at ($0.83).

Shares of Juniper Networks have lost $0.58 to $30.91 in midday trading on Monday, giving it a market cap of $11.88 billion. The stock traded as high as $31.56 in Oct. 23, 2015.

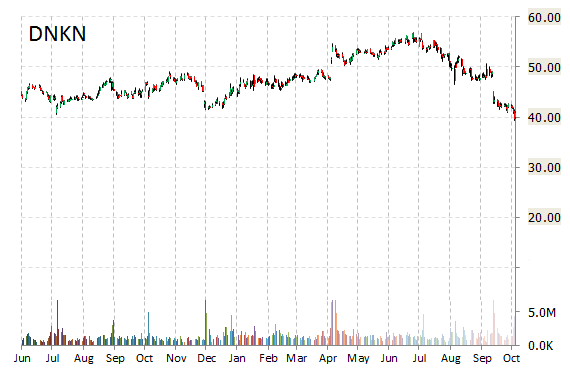

Dunkin’ Brands Group, Inc. (DNKN) was reiterated as ‘Neutral’ with $43 from $45 price target on Monday by UBS.

Dunkin’ Brands Group Inc. recently traded at $41.56, a gain of $0.70 over Friday’s closing price. The name has a current market capitalization of $3.96 billion.

As for passive income investors, the company pays shareholders $1.06 per share annually in dividends, yielding 2.59%.

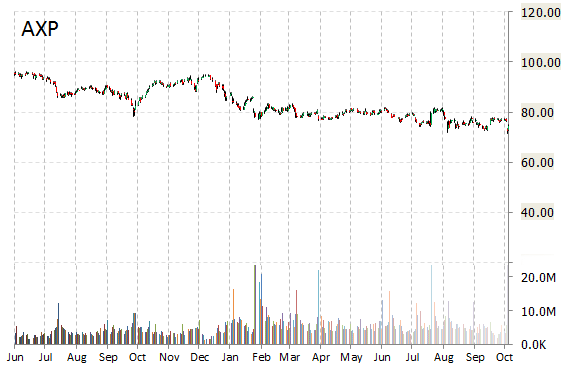

American Express Company (AXP) had its rating lowered from ‘Neutral’ to ‘Sell’ by analysts at UBS on Monday. The firm sees shares as fairly valued at $67 from $81, versus $74.59 close. Currently there are 14 analysts that rate AXP a ‘Buy’, 4 analysts rate it a ‘Sell’, and 13 rate it a ‘Hold’.

AXP was down $0.51 at $74.08 in midday trade, moving within a 52-week range of $71.39 to $94.89. The name, valued at $72.97 billion, opened at $73.13.

On valuation measures, American Express Co. shares are currently priced at 13.37x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 2.32. EPS for the same period registers at $5.54.

As for passive income investors, the New York-based credit card company pays stockholders $1.16 per share annually in dividends, yielding 1.56%.

Leave a Reply