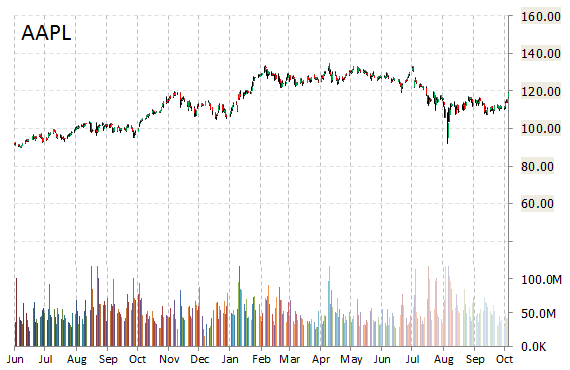

Apple Inc. (AAPL) was reiterated a ‘Market Perform’ by Cowen analysts on Monday. The broker however, cut its price target on the stock to $130 from $135, noting they believe stock has broadly entered a holding pattern, albeit with upward bias.

Apple Inc. shares are currently priced at 13.34x this year’s forecasted earnings, compared to the industry’s 13.52x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.76 and 11.74, respectively. Price/Sales for the same period is 3.03 while EPS is 8.65. Currently there are 37 analysts that rate AAPL a ‘Buy’, 8 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. AAPL has a median Wall Street price target of $150 with a high target of $200.

In the past 52 weeks, shares of the tech giant have traded between a low of $92.00 and a high of $134.54 and are now at $115.31.

Shares are up 9.25% since the beginning of the year.

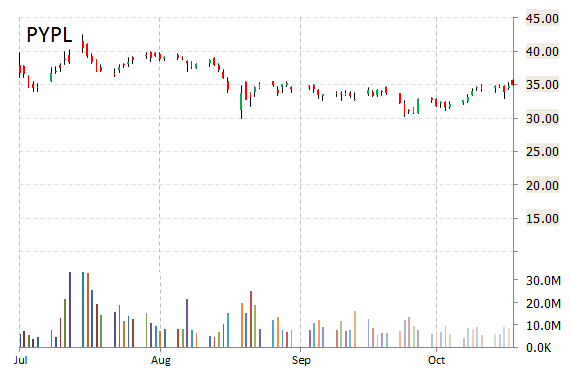

PayPal Holdings, Inc. (PYPL) was added to ‘Conviction Buy List’ at Goldman Sachs (GS).

PYPL shares recently gained $1.28 to $36.27. Since its IPO the name has traded between a low of $30 and a high of $42.55.

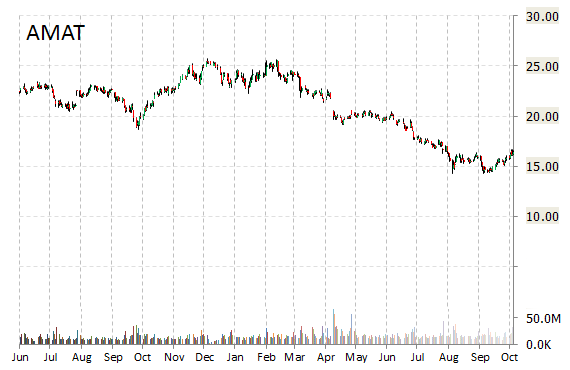

Analysts at Nomura upgraded their rating on the shares of Applied Materials, Inc. (AMAT). In a research note published on Monday, the firm lifted the name with a ‘Buy’ from ‘Neutral’ rating.

AMAT shares recently lost $0.17 to $16.27. The stock is down more than 19% year-over-year and has lost roughly 33% year-to-date. In the past 52 weeks, shares of Santa Clara, California-based company have traded between a low of $14.25 and a high of $25.71.

Applied Materials closed Friday at $16.44. The name has a current market cap of $19.54 billion.

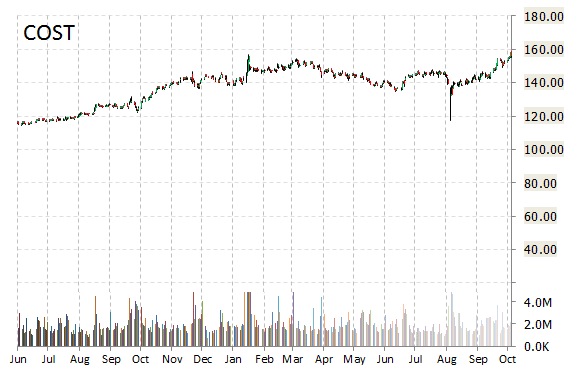

Analysts at UBS upgraded this morning their rating on the shares of Costco Wholesale Corporation (COST) to ‘Buy’ from ‘Neutral’ and raised their target to $180 from $153.

Costco shares recently gained $1.16 to $156.90. UBS’ target price suggests a potential upside of about 15% from the company’s current stock price.

In the past 52 weeks, shares of Issaquah, Washington-based operator of membership warehouses have traded between a low of $117.03 and a high of $158.80.

Shares are up 24.51% year-over-year and 14.41% year-to-date.

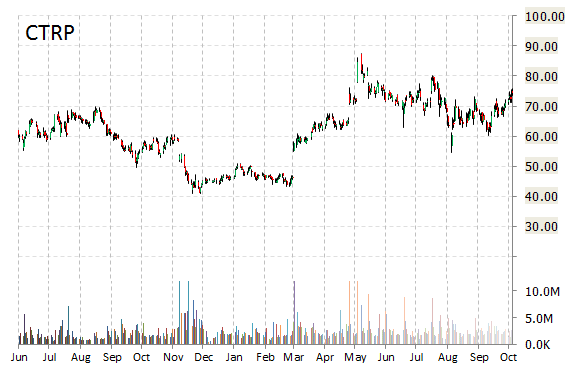

Analysts at Goldman Sachs (GS) are out with a report this morning upgrading shares of Ctrip.com International Ltd. (CTRP) with a ‘Buy’ from ‘Neutral’ rating.

Ctrip.com International Ltd. ADR shares are currently priced at 18,353x this year’s forecasted earnings, which makes them expensive compared to the industry’s 27.52x earnings multiple. Ticker has a forward P/E of 82.13 and t-12 price-to-sales ratio of 7.59. EPS for the same period is $0.01.

Shares are up 30.40% year-over-year and 63.38% year-to-date.

Leave a Reply