Right now, we’re suffering through the largest market meltdown since 2008.

It’s true. But I’m not talking about stocks…

No, this year’s big market meltdown comes courtesy of commodities. And it’s not just crude or gold or even copper right now, the usual suspects we talk about around here. This disease has metastasized across the “real stuff” board to just about every other commodity out there. And it ain’t over yet…

But first, we need to get to the bottom of this whole commodity bust that’s dragging down everything in its path.

Citigroup’s commodity “naughty list” is getting longer by the second. Citi’s bearish on aluminum, platinum, iron ore, wheat and crude—just to name a few…

“Excess supplies and a sluggish world economy mean that it’s ‘hard to argue that most commodity prices have reached their trough for the year,” Citigroup analysts told Bloomberg this week.

So what gives?

Let’s let Bloomberg handle this one:

Prices for raw materials are languishing near a 16-year low as inventories climb just as demand growth slows in China, the world’s biggest consumer of everything from cotton to zinc. Money has been flowing out of funds linked to metals, crops and energy, while investors have punished shares of miners and oil drillers.

There you have it. Nothing like a China slowdown and an investor exodus to pull the bottom out of a market that was already breaking down…

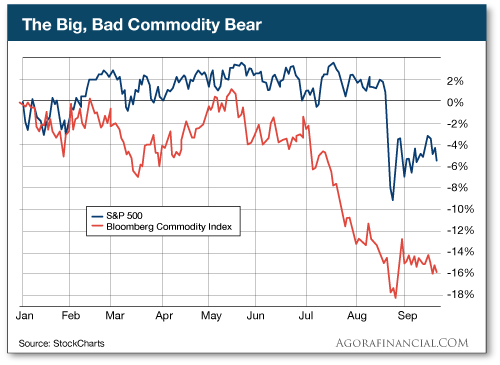

But hey, a picture’s worth a thousand words. So let’s take a look at how commodities have fared versus stocks this year:

Here’s the answer: miserably. The recent market swoon has taken the shine right out of stocks. The S&P 500 is down nearly 6% on the year. But the Bloomberg Commodity Index has been an unfolding disaster since May, making the S&P look like a raging bull market. It’s down about 16% year-to-date. And I’m not counting on a fast rebound, my friend.

So if you’ve been looking to hide out in a mainstream commodity to avoid the choppy stock market action, forget it. That dog won’t hunt. Commodities haven’t been the answer.

Leave a Reply