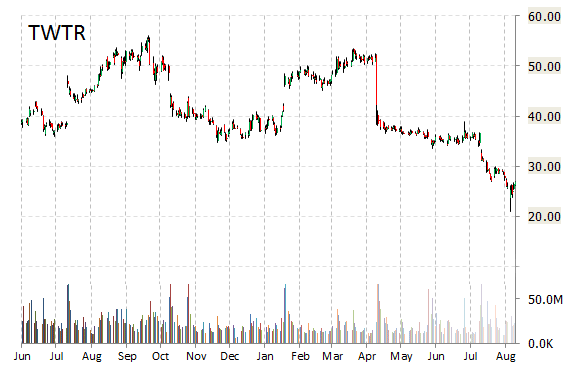

Analysts at Sun Trust Rbsn Humphrey are out with a report this morning upgrading shares of Twitter, Inc. (TWTR) with a ‘Buy’ from ‘Neutral’ rating. The firm set its price target for the microblogging service at $38/shr.

Twitter Inc. shares have a forward P/E of 44.83 and t-12 price-to-sales ratio of 10.08. EPS for the same period is ($0.95).

In the past 52 weeks, shares of San Francisco, California-based company have traded between a low of $21.01 and a high of $55.99 and are now at $28.36.

Shares are down 45.72% year-over-year and 25.20% year-to-date.

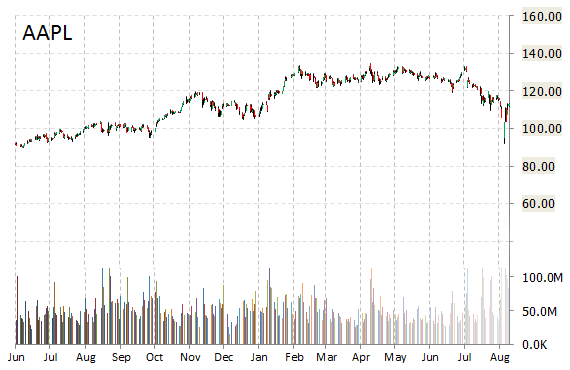

Shares of Apple Inc. (AAPL) are up slightly this morning after the iPhone maker’s stock was added to Citigroup’s (C) ‘Buy List’.

AAPL is currently printing a normal average trading volume with the issue trading 26.23 million shares, compared to the average volume of 69.56 million. The stock began trading this morning at $112.13 to currently trade 0.87% higher from the prior days close of $113.29. On an intraday basis it has gotten as low as $112.00 and as high as $114.53.

On valuation measures, Apple Inc. shares are priced at 13.21x this year’s forecasted earnings, compared to the industry’s 12.34x earnings multiple. The tech giant’s current year and next year EPS growth estimates stand at 41.60% and 7.10% compared to the industry growth rates of (7.1%) and 14.60%, respectively. AAPL has a t-12 price-to-sales ratio of 2.88. EPS for the same period registers at $8.65.

Apple shares have declined 7.00% in the last 4 weeks and 12.82% in the past three months. Over the past 5 trading sessions the stock has gained 7.12%. The Cupertino California-based company, which is currently valued at $651.38 billion, has a median Wall Street price target of $150.00 with a high target of $195.00.

Apple Inc. is up 12.69% year-over-year, compared with a 0.67% loss in the S&P 500.

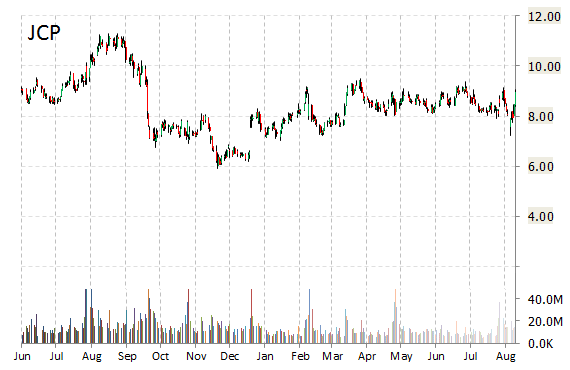

Analysts at Deutsche Bank (DB) upgraded their rating on the shares of J. C. Penney Company, Inc. (JCP). In a research note published on Monday, the firm lifted the name with a ‘Buy’ from ‘Hold’ rating and set a 12-month base case estimate of $12 from $10 per share.

On valuation measures, J.C. Penney Co. Inc. shares have a PEG and price/sales ratio of 0.25 and 0.22, respectively. EPS is ($1.81).

Currently, there are 4 analysts that rate JCP a ‘Buy’, 11 rate it a ‘Hold’. Seven analysts rate it a ‘Sell’.

JCP has a median Wall Street price target of $9.50 with a high target of $17.00.

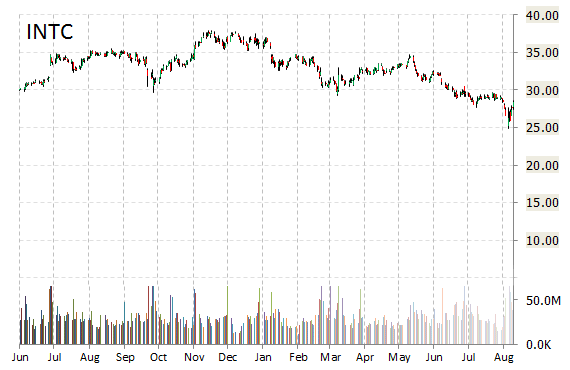

Intel Corporation (INTC) was raised to ‘Outperform’ from ‘Market Perform’ and it was given a $32 price target at Northland Capital on Monday.

Intel shares are up $0.67 at $29.09 on normal volume. Midway through trading Monday, 17.14 million shares of Intel Corp. have exchanged hands as compared to its average daily volume of 33.35 million shares. The stock has ranged in a price between $28.16 to $29.09 after having opened the day at $28.40 as compared to the previous trading day’s close of $28.42.

Over the past year, shares of Santa Clara, California-based chipmaker have traded between a low of $24.87 and a high of $37.90.

Shares are down 15.55% year-over-year and 19.89% year-to-date.

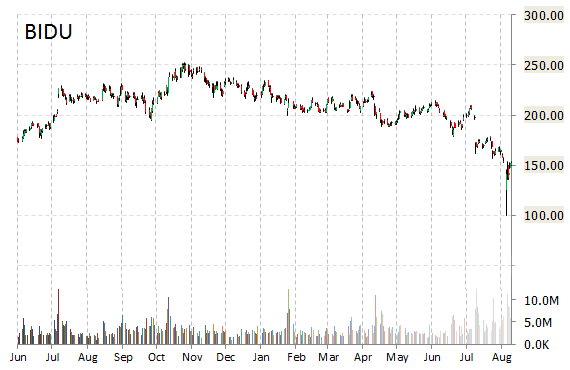

Baidu, Inc. (BIDU) had its rating hiked to ‘Buy’ from ‘Hold’ with $210 price target at Jefferies.

BIDU shares recently lost $2.72 to $149.41. The stock is down 28.85% year-over-year and has lost roughly 33% year-to-date. In the past 52 weeks, shares of Beijing, China-based company have traded between a low of $100 and a high of $251.99.

Baidu Inc. ADR closed Friday at $152.13. The name has a current market cap of $52.52 billion.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply