Don’tcha just love payroll day? The number was an unmitigated shocker, which duly produced the expected gap lower in equities, risky currencies, and yields….only to be followed by a slow grind higher in all of them throughout the rest of the day. Indeed some of them, especially in currency space, ended comfortably higher on the day.

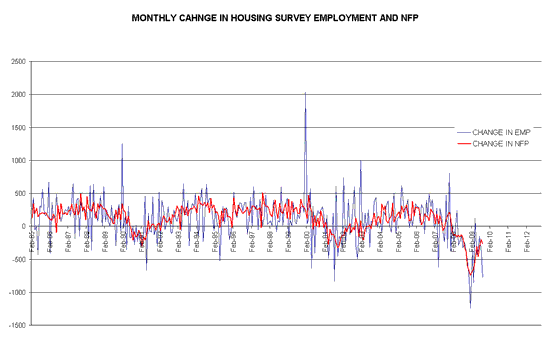

While the headline figures in the report were bad enough, beneath the surface the details were, if anything, even worse. The household figure, for example, was nearly the worst in a quarter century, other than the uber-weakness observed around the turn of the year. The chart below, incidentally, illustrates why it is the NFP is generally followed, rather than the household data. For all its flaws, the payroll figure is substantially less noisy than the HH data; if markets were to discard the former as fatally flawed, the end result which almost certainly be an uptick in market volatility given the substantially higher vol in the monthly household figure.

In any event, the week has started relatively slowly…though somehow, Macro Man has managed to lose a little bit on most of his positions, which sums to an irritatingly large portfolio-level result. As if that’s not bad enough, he will be paying another visit to the dentist this morning, where the cavities discovered a month ago will be drilled and filled. Irritating, indeed.

In any event, the G7’s pleas for China to allow its currency to move are now bordering on the pathetic; the impotence of this “organization” leaves Macro Man shaking his head. One hint as to why the RMB has remained stable may be found elsewhere in Asia; Korea, for example.

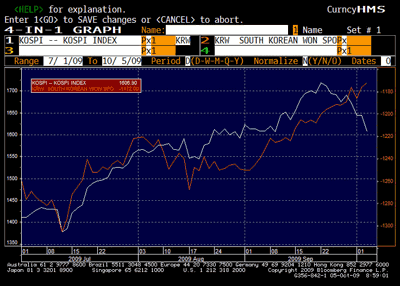

The currencies and equity markets of Asian economies are usually pretty highly correlated; they either price in happy days or risk aversion in tandem. What’s interesting is that recently, as foreigners have been orgiastically piling into all things Asia, the market performance has been rather poor, led by weakness in the exporters.

Observe in the chart below how the KOSPI peaked a couple of weeks ago and has since fallen steadily, despite the ongoing strength of the KRW.

Now perhaps this can continue, but Macro Man wouldn’t bet on it. These things have a funny way of snapping back when you least expect it. And if Q3 earnings season, which kicks off with Alcoa Wednesday night, turns out to be a disappointment? Let’s just say that Macro Man’s teeth might not be the only things to get drilled.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply