Lowe’s Companies Inc. (LOW) shares are down $4.03 to $67.80 in premarket trading Wednesday after the company reported its first quarter earnings results.

The home improvement retailer posted earnings of $0.70 per share on revenues of $14.13 billion, up 5.4% from a year ago. Analysts were expecting EPS of $0.74 on revenues of $14.26 billion. Q1/15 gross margin was 35.47%, marginally lower from 35.50% a year earlier. The company’s net income for the period came in at $673 million, or $0.70 per diluted share, from $624 million, or $0.61 per diluted share, a year earlier. Comparable sales for the quarter increased 5.2%. Comparable sales for the U.S. home improvement business increased 5.3%.

“I am pleased that we executed well and delivered another strong quarter,” commented Robert A. Niblock, Lowe’s chairman, president and CEO. “We generated comparable sales growth in all regions of the country and across all product categories, driving strong earnings per share growth.”

For the fiscal year ending January 29, 2016, the company guided revenues of $58.75 – $59.0 billion, as compared to analysts’ expectations of $58.97 billion. The management also gave its bottom line EPS of $3.29 per share, against projections of $3.31 per share.

Cash Position: As of May 1, 2015, Lowe’s cash and cash equivalents totaled $1.43 billion, compared to $658 million at May. 2, 2014.

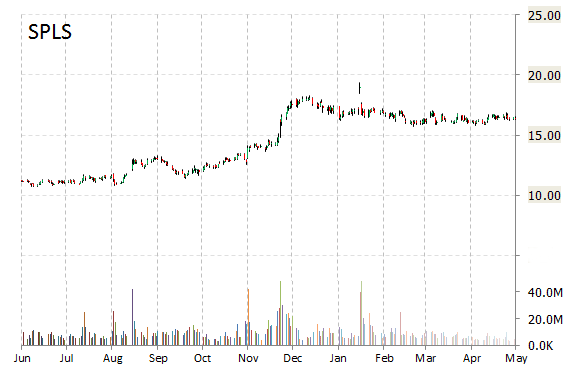

Staples, Inc. (SPLS) reported first quarter non-GAAP EPS of $0.17 before the opening bell Wednesday, compared to the consensus estimate of $0.17. Revenues declined 7% from last year to $5.26 billion. Analysts expected revenues of $5.46 billion. On a GAAP basis, the company reported net income of $59 million, or $0.09 per share (diluted), compared to net income of $96 million, or $0.15 per share, achieved in the first quarter of 2014.

“Our first quarter results were in line with our expectations,” said in a press release Ron Sargent, Staples’ chairman and CEO of Staples. “We grew sales in our North American delivery businesses and stabilized profitability across the company, which reflects continued progress on our strategic reinvention.”

For Q2/15 ending in July, the office supply chain provided EPS guidance of $0.11 – $0.13 versus consensus of $0.11 per share.

Liquidity: The company ended the quarter with $1.9 billion in liquidity, including $795 million in cash and cash equivalents.

The stock is currently down 3.11% to $15.90 on 10K shares.

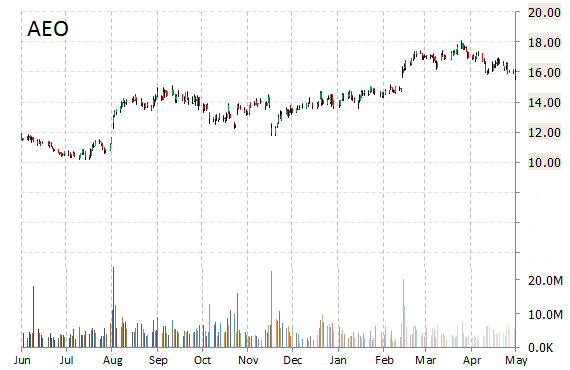

Shares of American Eagle Outfitters, Inc. (AEO) rallied $1.38, or 8.32%, to $17.12 after the company released its earnings results on Wednesday. The teen clothing retailer reported Q1’15 EPS of $0.15 per share vs. $0.12 consensus on $700 million in revenue, up 8.3% from a year ago. The company’s net income for the period came in at $29 million, or $0.15 per diluted share versus $3.9 million, or $0.02 per diluted share a year earlier.

Jay Schottenstein, Interim CEO commented, “Our strong first quarter results reflected outstanding merchandise and customer-focused execution. Both AE and aerie performed well, achieving higher sales and earnings, proving successful in a price promotional retail climate.”

On valuation measures, American Eagle Outfitters Inc. shares, which currently have an average 3-month trading volume of 4.41 million shares, trade at a trailing-12 P/E of 38.11, a forward P/E of 15.90 and a P/E to growth ratio of 1.69. The median Wall Street price target on the name is $19.00 with a high target of $24.00. Currently ticker boasts 15 ‘Buy’ endorsements, compared to 11 ‘Holds’ and 2 ‘Sell’.

Profitability-wise, AEO has a t-12 profit and operating margin of 2.45% and 6.50%, respectively. The $3.07 billion market cap company reported $327 million in cash vs. $429 million in total liabilities in its most recent quarter.

AEO currently prints a one year return of about 36% and a year-to-date return of around 14%.

The chart below shows where the equity has traded over the last 52 weeks.

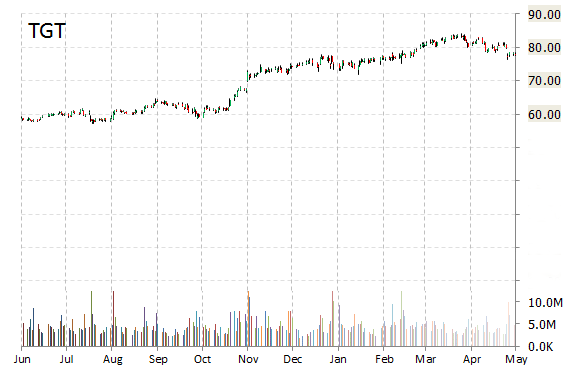

Target Corp. (TGT) gained $0.33 to $78.25 in premarket trading after it reported fiscal results for the first quarter.

In its quarterly report, the company said it earned $1.10 per share, well above the $1.03 per share analysts were expecting. Revenue rose 2.8% to $17.12 billion, above views for $17.09 billion. The company’s net earnings for the period came in at $635 million, up about 52% from $418 million a year earlier. Target said comparable sales at stores open at least a year rose 2.3%, matching the market consensus. Digital channel sales grew 37.8% and contributed 0.8 percentage points to comparable sales growth.

“We’re pleased with our first quarter traffic and sales, particularly in our signature categories, which drove better-than-expected profitability through improved gross margin and continued expense management,” stated Brian Cornell, chairman and CEO of Target. “We’re encouraged to see early progress on our strategic priorities, including strong sales growth in Apparel, Home and Beauty, nearly 40 percent growth in digital sales, and positive traffic in both our stores and digital channels.”

For Q2/15, Target provided EPS guidance of $1.04 – $1.14 versus consensus of $1.12 per share. The company said it expects full-year 2015 adjusted EPS of $4.50 – $4.65, compared with prior guidance of $4.45 – $4.65.

Cash Position: As of May 2, 2015, Target’s cash and cash equivalents totaled $2.76 billion, compared to $677 million at May 3, 2014.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply