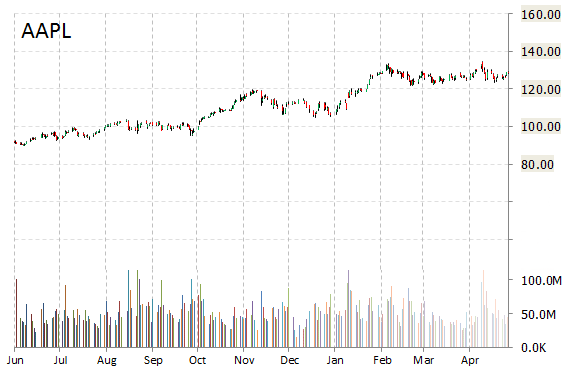

Piper Jaffray’s Gene Munster today weighed in on Apple Inc (AAPL)’s shelving of its plans to make a television. After the Wall Street Journal reported that Cupertino has dropped its plans to introduce a TV set, Munster said the news is unlikely to have a sustained impact on the stock. The analyst still believes Apple will continue to develop the Apple TV as a set top box. He sees AAPL as ‘Overweight’ with $162/shr 12-month base case estimate.

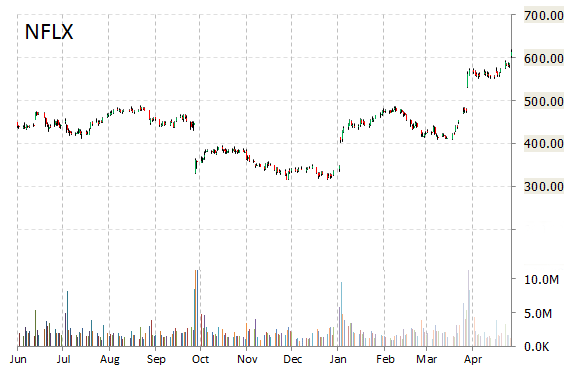

In a report published Tuesday, Pivotal Research analysts raised their price target on Netflix (NFLX) to $850 from $650, implying 31% expected upside.

On other NFLX news today, Carl Icahn was on CNBC this afternoon with his son Brett discussing a number of his trades, including Apple (AAPL) and Netflix. When Brett was asked by host Scott Wapner about his investment in Netflix, he said he has maintained an over 10% NFLX position in his portfolio.

On valuation measures, Netflix Inc. shares are currently priced at 161.64x this year’s forecasted earnings, which makes them quite expensive compared to the industry’s 29.04x earnings multiple. Ticker has a forward P/E of 176.14 and t-12 price-to-sales ratio of 6.45. EPS for the same period is $3.84.

In the past 52 weeks, shares of Los Gatos, California-based video streaming company have traded between a low of $315.54 and a high of $628.50 and are now at $620.22. Shares are up 76.59% year-over-year and 81% year-to-date.

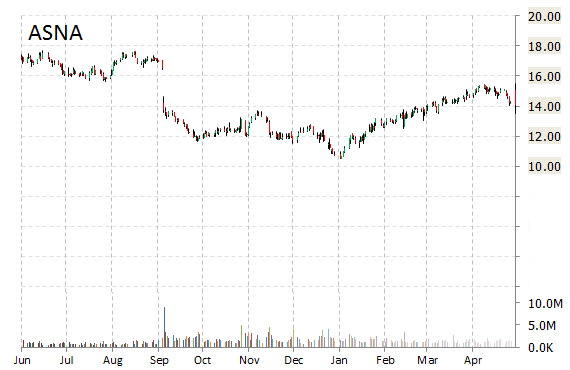

Analysts at FBR Capital upgraded their rating on the shares of Ascena Retail Group Inc. (ASNA). In a research note published on Tuesday, the firm lifted the name with a ‘Outperform‘ from ‘Market Perform‘ rating and set a 12-month base case estimate of $20 from $12 per share.

Ascena Retail Group Inc. shares are currently priced at 21.70x this year’s forecasted earnings compared to the industry’s 34.36x earnings multiple. Ticker has a price/book and forward P/E ratio of 1.26 and 16.31, respectively. Traliling-12 price/sales is 0.47 while EPS is $0.68. Currently there are 6 analysts that rate ASNA a ‘Buy‘, 5 rate it a ‘Hold‘. No analyst rates it a ‘Sell‘. ASNA has a median Wall Street price target of $16.00 with a high target of $19.00.

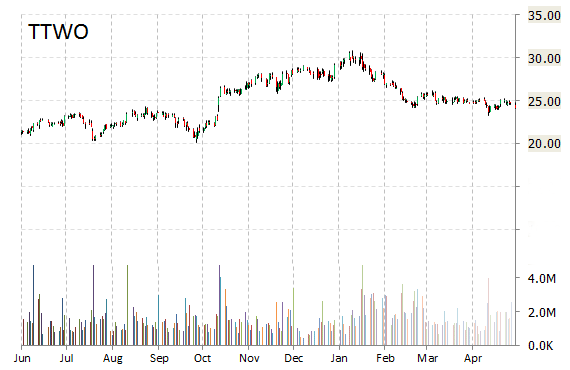

Take-Two Interactive Software Inc. (TTWO) was raised to ‘Buy‘ from ‘Neutral‘ at Sterne Agee CRT on Tuesday.

TTWO is up $4.14 at $28.34 on heavy volume. Midway through trading Tuesday, 11.50 million shares of Take-Two have exchanged hands as compared to its average daily volume of 1.67 million shares. The stock ranged in a price between $26.70-$28.34 after having opened the day at $26.74 as compared to the previous trading day’s close of $24.20.

In the past 52 weeks, shares of New York-based company have traded between a low of $18.79 and a high of $30.80. Shares are up 26.77% year-over-year.

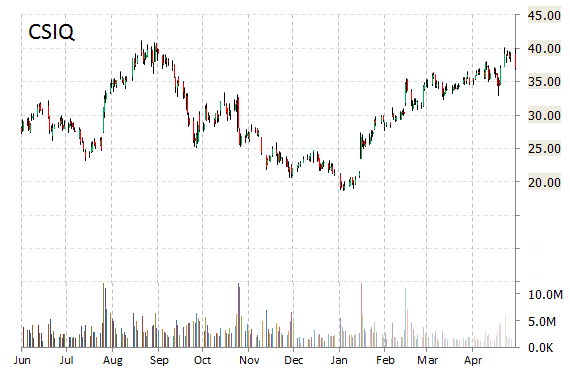

Canadian Solar Inc. (CSIQ) was reiterated a ‘Buy’ by ROTH Capital analysts on Tuesday. The broker also raised its price target on the stock to $46 from $40.

CSIQ shares recently lost $1.83 to $35.22. The stock is up 68% year-over-year and has gained roughly 53% year-to-date. In the past 52 weeks, shares of West Guelph, Ontario-based company have traded between a low of $18.68 and a high of $41.12.

Canadian Solar Inc. closed Monday at $37.06. The name has a current market cap of $1.96 billion.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply