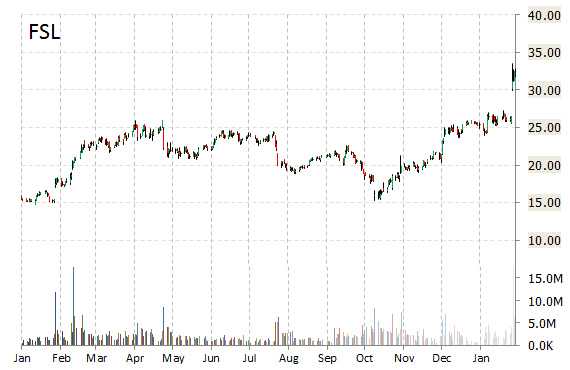

Freescale Semiconductor, Ltd. (FSL) is higher by nearly 11% this morning after sources told the New York Post that the tech company has hired investment bankers to explore a possible sale. The publication noted that while the name of the potential buyer could not be learned, “CM Research Analyst Cyrus Memawalla recently told Bloomberg that Samsung Electronics should spend some of its $63 billion in cash on acquisitions, and one of the companies it might consider buying is Freescale.”

Freescale Semiconductor, currently valued at $10.63B, has a median Wall Street price target of $34.50 with a high target of $45.00. In the past 52 weeks, shares of Austin, TX-based company have traded between a low of $15.29 and a high of $34.89 with the 50-day MA and 200-day MA located at $28.37 and $22.39 levels, respectively. Additionally, shares of FSL trade at a P/E ratio of 1.08 and have a Relative Strength Index (RSI) and MACD indicator of 78.90 and +2.36, respectively.

FSL currently prints a one year return of about 70%, and a year-to-date return of 37.53%.

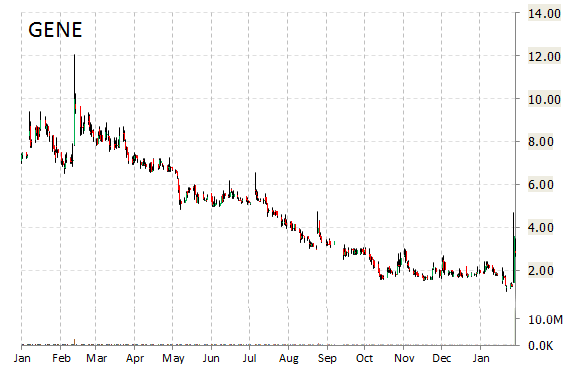

Shares of Genetic Technologies Limited (GENE) are up 13.20% to $6.95 in pre-market trade. Not seeing any news or rumors to account for the move.

Genetic Technologies is a Fitzroy, Australia-based provider of genetic testing services primarily in Australia and the United States. Its stock has a median consensus analyst price target of $12.50, and a 52-week trading range of $1.04 to $10.25. The T-12 profit margin at Genetic Technologies is (221.84%). GENE‘s revenue for the same period is $3.55 million.

Genetic Technologies Ltd has market cap of $27.35M.

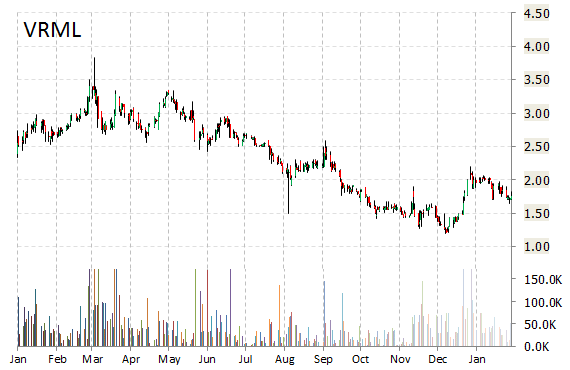

Vermillion, Inc. (VRML) soared 11% in pre-market trading on Friday after the bio-analytical solutions company announced that it has been awarded ISO 13485:2003 from the British Standards Institution, one of the world’s leading certification bodies, for Vermillion’s quality management system. ISO 13485:2003 certification is the internationally recognized quality standard for medical devices and diagnostics.

“The receipt of this certification is an important achievement for Vermillion, and is a reflection of our commitment to our quality and customer experience. This is one of our building blocks for our planned International expansion,” said in a statement Valerie Palmieri, Vermillion’s President & CEO.

VRML shares recently gained $0.22 to $2.18. In the past 12 months, shares of Austin, Texas-based firm have traded between a low of $1.20 and a high of $3.83. Shares are down 30.25% year-over-year, and 1.51% year-to-date.

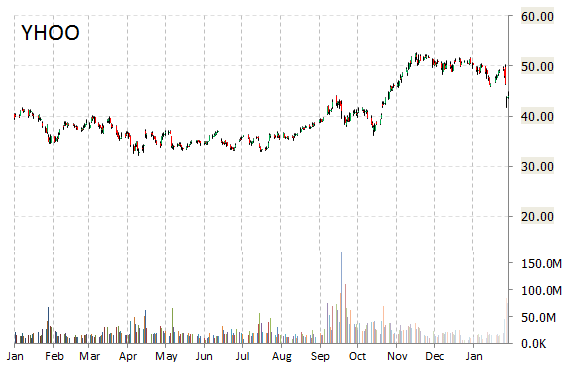

Yahoo! Inc. (YHOO) – The web portal is cutting between 100-200 jobs in Canada, according to a source quoted by the Wall Street Journal. Layoffs come as CEO Marissa Mayer aims to cut costs amid pressure from activist shareholders.

On valuation measures, Yahoo Inc. shares are currently priced at 5.90x this year’s forecasted earnings compared to the industry’s 2.40x earnings multiple. Ticker has a PEG and forward P/E ratio of -4.63 and 46.73, respectively. Price/Sales for the same period is 9.16 while EPS is $7.45. Currently there are 21 analysts that rate YHOO a ‘Buy’, 13 rate it a ‘Hold’. No analyst rates it a ‘Sell’. YHOO has a median Wall Street price target of $59.00 with a high target of $69.00.

In the past 52 weeks, shares of the Sunnyvale, California-based internet giant have traded between a low of $32.15 and a high of $52.62 and are now up 0.63% at $44.20. Shares are up 15.27% year-over-year ; down 13.03% year-to-date.

Leave a Reply