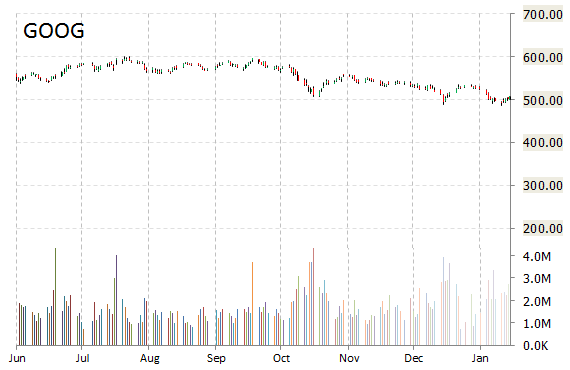

Google Inc. (GOOG) shares edged up 0.52% to $510.74 in pre-market trade Tuesday after a report from technology site TechCrunch suggested the company is in talks to buy Softcards, a company specializing in mobile payments. The deal, which according to the publication may be valued below $100 million, could help pair the search giant with the largest U.S. wireless carriers to battle Apple (AAPL) and its new Apple Pay service. Separately, Google is close to investing about $1 billion in Elon Musk’s SpaceX, according to The WSJ.

On valuation measures, Google Inc., currently valued at $344.66B, has a median Wall Street price target of $631.00 with a high target of $750.00. In the past 52 weeks, shares of Mountain View, Calif.-based maker of Android have traded between a low of $487.56 and a high of $604.83 with the 50-day MA and 200-day MA located at $518.34 and $554.63 levels, respectively. Additionally, shares of GOOG trade at a P/E ratio of 1.34 and have a Relative Strength Index (RSI) and MACD indicator of 45.49 and -5.51, respectively.

GOOG currently prints a one year loss of 11.60%, and a year-to-date loss of around 3.50%.

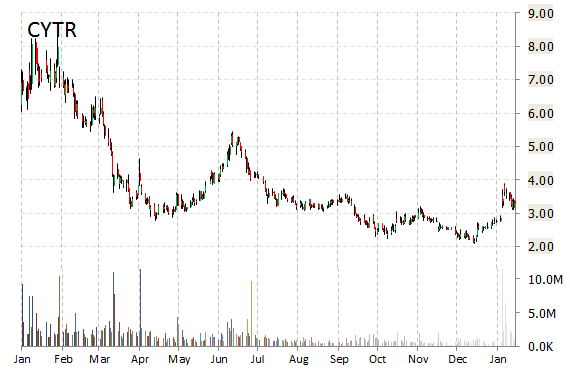

Shares of CytRx Corporation (CYTR) are higher by 11% in early trade on Tuesday, as the stock continues to see gains following the company’s announcement that the FDA has removed the partial clinical hold on the company’s aldoxorubicin clinical trials. CytRx said enrollment and dosing of new patients is now permitted after study sites’ Institutional Review Boards approve the revised trial protocols.

CYTR shares recently gained $0.37 to $3.70. In the past 52 weeks, shares of Los Angeles, CA-based biopharmaceutical company have traded between a low of $2.08 and a high of $8.35. Shares are down 53% year-over-year.

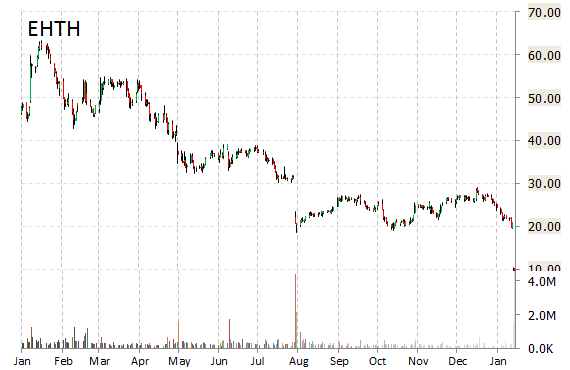

Shares of eHealth, Inc. (EHTH) are rising 5.37% to $10.20 in early trade after the stock was upgraded to ‘Hold’ from ‘Sell’ at Stifel.

On valuation measures, eHealth, Inc. shares are currently priced at 172.86x this year’s forecasted earnings compared to the industry’s 15.76x earnings multiple. Ticker has a PEG and forward P/E ratio of (8.80) and 138.29, respectively. Price/Sales for the same period is 0.91 while EPS is $0.06. Currently there is one analyst that rates EHTH a ‘Buy’, 7 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. EHTH has a median Wall Street price target of $11.00 with a high target of $25.00.

In the past 52 weeks, shares of Mountain View, Calif.-based online health insurance provider have traded between a low of $8.88 and a high of $62.63. Shares are down 84.47% year-over-year, and 61.16% year-to-date.

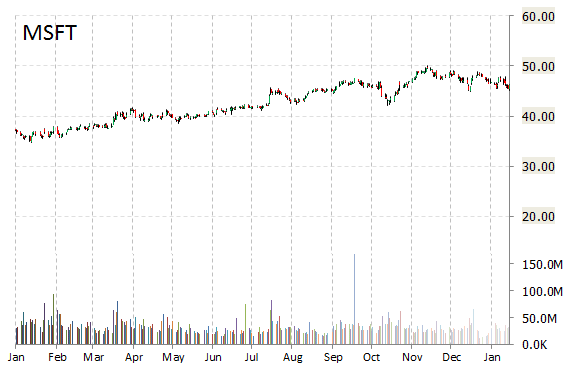

Microsoft Corporation (MSFT) – CNBC reports that the software giant’s email service in China was hacked by the country’s censorship authority, as the government continues its crackdown on U.S. technology giants. The publication said that according to Greatfire.org, which monitors censorship in China, Microsoft’s servers were subject to a so-called man-in-the-middle attack, enabling hackers to intercept private emails between users.

Shares of Microsoft were fractionally higher to $46.39 in early trading Tuesday.

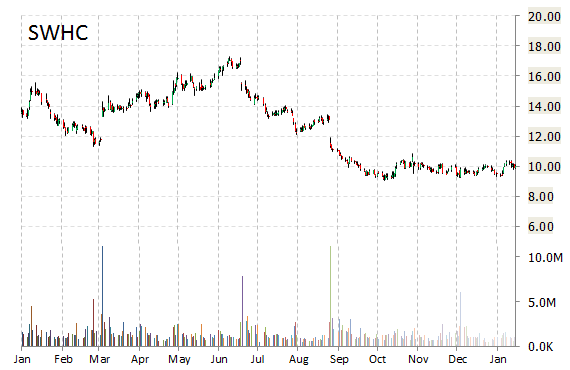

Smith & Wesson Holding Corporation (SWHC) shares rallied 13.17% to $11.72 in early trade Tuesday after the firearm maker issued upside guidance for its third quarter and full fiscal 2015. The company said it now expects revenue for the quarter ending January in the range of $124 million to $126 million versus previous outlook of $113 million to $118 million. Adjusted earnings per share, which excludes non-recurring items, is expected to be between $0.15 and $0.16, above the FactSet consensus analyst estimate of $0.08.

For full 2015 fiscal year, the company expects net sales of between $526 million and $530 million and adjusted earnings per share of between $0.74 and $0.78 versus $0.65 Capital IQ consensus estimate. Smith & Wesson indicated that it has seen recent, positive trends in the primary indicators it uses to assess its business and the consumer firearm market. In addition, on December 11, 2014, the company successfully completed the acquisition of Battenfeld Technologies, and this revised guidance includes estimated BTI results.

While SWHC is now up nearly 26% year-to-date, it’s still trading well below its June 11, 2014/$17.28 high.

Leave a Reply