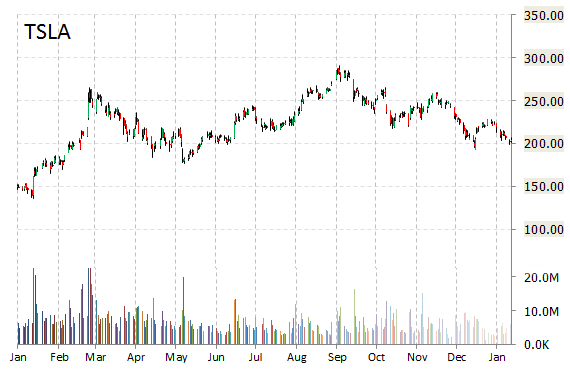

Tesla Motors, Inc. (TSLA) shares tumbled 10% in pre-market trade Wednesday after CEO Elon Musk said China sales fell significantly during Q4 due to misperceptions among Chinese consumers about the difficulty of recharging electric vehicles. Musk said however, his luxury electric-car company is working to correct that misperception and that slow sales are a short-term issue.

Tesla Motors lost $15.12 to $189.13 in morning trading today. Approximately 5.7 million shares have already changed hands, compared to the stock’s average daily volume of 5.58 million.

On valuation-measures, shares of Tesla Motors have a forward P/E of 73.47. P/E to growth ratio is 4.14, while t-12 profit margin is (7.09%). EPS registers at ($1.64). The company has a market cap of $23.71B and a median Wall Street price target of $299.00 with a high target of $400.00.

On trading-measure, TSLA has a beta of 1.46 and a short float of 26.02%. In the past 52 weeks, shares of Palo Alto, Calif.-based electric car maker have traded between a low of $162.10 and a high of $291.42 with its 50-day MA and 200-day MA located at $219.00 and $239.12 levels, respectively.

TSLA currently prints a one year return of about 46.58% and a year-to-date loss of around 8.17%.

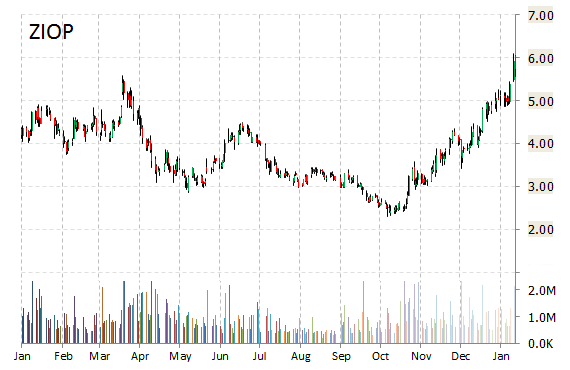

Ziopharm Oncology, Inc. (ZIOP) shares spiked 57% to $9.05 in early trading after the company announced a broad exclusive licensing agreement with The University of Texas MD Anderson Cancer Center.

Under the terms of the agreement, MD Anderson shall receive consideration of $100 million; $50 million from each Intrexon and ZIOPHARM, payable in shares of their respective common stock, as well as a commitment of $15 to $20 million annually over three years for researching and developing the technologies. The parties will enter into additional collaboration and technology transfer agreements to accelerate technology and clinical development. Further details on the terms of the transaction will be available within the current reports on Form 8-K filed today by Intrexon and Ziopharm.

In other Ziopharm news this morning, analysts at BMO Capital upgraded the name to ‘Outperform’ from ‘Market Perform’, saying they believe that the company’s licensing deal with MD Anderson for CAR-T cancer treatments will be “transformational” for Ziopharm. Target price raised to $15, implying 66% expected return.

ZIOP shares recently gained $3.29 to $9.03. The move comes on a big volume too with the issue currently trading more than 18 million shares, well above the average of 1.08 million for a full session over the past 3 months.

In the past 52 weeks, shares of Boston-based biopharmaceutical company have traded between a low of $2.31 and a high of $9.39. Shares are up 25.88% year-over-year and 13.21% year-to-date.

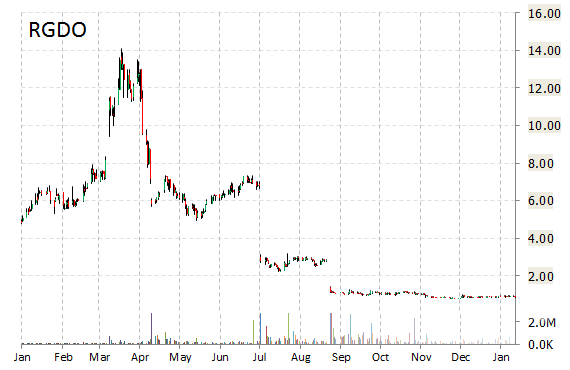

Shares of Regado Biosciences, Inc. (RGDO) have moved 69% higher intraday after the company today announced that it has entered into a definitive agreement with Tobira Therapeutics under which privately-held Tobira will merge with a wholly-owned subsidiary of Regado in an all-stock transaction. Regado said the total cash balance of the combined company following the closing of the merger and the financing is expected to be approximately $60 million.

RGDO shares recently gained $0.46 to $1.32. The stock is down more than 85% year-over-year and has lost roughly 5.5% year-to-date. In the past 52 weeks, shares of Basking Ridge, New Jersey-based company have traded between a low of $0.80 and a high of $14.10.

Regado Biosciences, Inc. closed Tuesday at $0.86. The name has currently a total market cap of $44.36M.

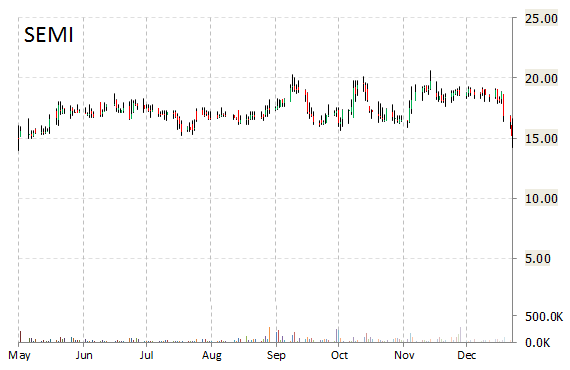

SunEdison Semiconductor Limited (SEMI) – The company announced today the pricing of its secondary underwritten public offering of 15 million ordinary shares on behalf of selling shareholders at a price to the public of $15.19 per share. Deutsche Bank (DB) is serving as lead book-running manager for the offering.

Shares of SunEdison rose 7.70% to $16.36 in recent trading.

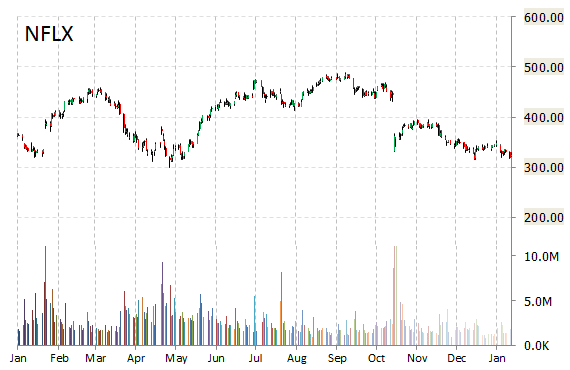

Netflix, Inc. (NFLX) – Analysts at Stifel Nicolaus upgraded shares of Netflix to ‘Buy’ from ‘Hold’ in a research report issued to clients on Wednesday, saying current valuation provide a compelling risk/reward ratio because of strong content cycle, and that the company will be able to grow overseas.

The equity research firm has set a $380 price target on NFLX.

Shares of Netflix recently traded at $327.17, up $3.38.

Leave a Reply