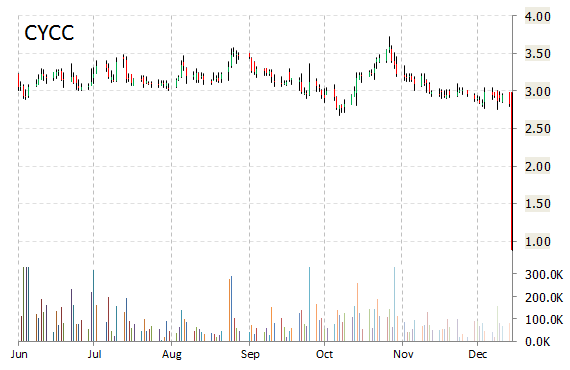

Cyclacel Pharmaceuticals, Inc. (CYCC) is one of Tuesday’s notable stocks in decline, down 64% to $1.03. The plunge comes after the company announced enrollment of 486 patients, continuation to final analysis and recommendations of the independent Data and Safety Monitoring Board [DSMB] of the company’s Phase 3 SEAMLESS study. However, DSMB said the planned futility boundary has been crossed and determined that based on available interim data, it would be unlikely for the study to reach statistically significant improvement in survival. The DSMB also said that it saw no reasons why patients should discontinue treatment on their assigned arm and recommended that recruited patients stay on treatment.

Cyclacel’s shares have declined 5.35% in the last 4 weeks and 8.71% in the past three months. Over the past 5 trading sessions the stock has lost 3.74%. Shares of Cyclacel Pharmaceuticals, Inc. are down 29.60% year-over-year and 29.60% year-to-date.

The Berkeley Heights, New Jersey-based development-stage biopharmaceutical company is currently valued at $65.02M.

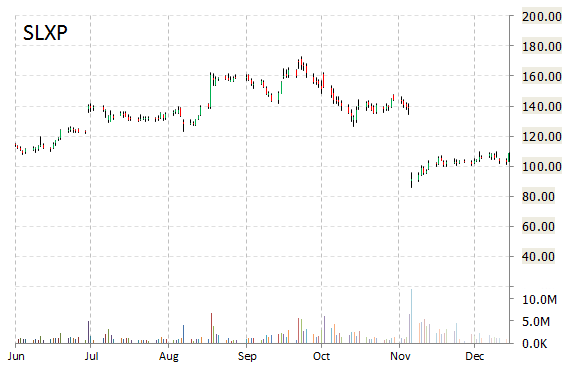

Salix Pharmaceuticals Ltd. (SLXP) shares ticking higher following news that the company is working cooperatively with its principal pharmaceutical wholesalers to clear out its wholesaler inventory, just months after a potential acquisition stalled because of concerns over the company’s high inventory levels. Salix also withdrew its FY14 outlook, guiding FY15 below consensus.

Salix Pharmaceuticals Ltd. shares currently have a PEG and forward P/E ratio of 1.39 and 22.95, respectively. Price/Sales for the same period is 4.76 while EPS is ($1.22). Currently there are 9 analysts that rate SLXP a ‘Buy’, 9 rate it a ‘Hold’. No analyst rates it a ‘Sell’. SLXP has a median Wall Street price target of $109.50 with a high target of $190.00.

In the past 52 weeks, shares of Raleigh, North Carolina-based firm have traded between a low of $83.26 and a high of $172.98 and are now up 6.40%/$109.51. Shares are up 22.58% year-over-year and 14.55% year-to-date.

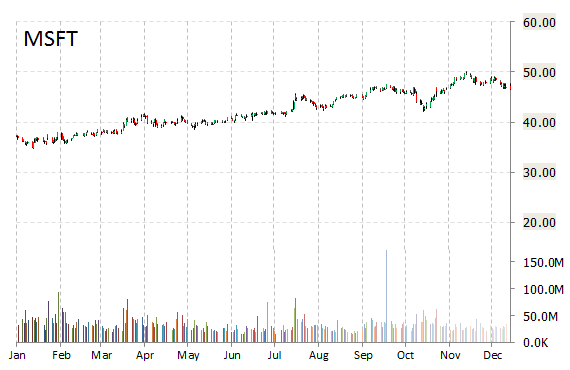

Microsoft Corp. (MSFT) shares are down 1.46% to $45.99 on Tuesday, after analysts at BofA (BAC) downgraded the stock to ‘Underperform’ from ‘Neutral’.

The target price for Microsoft is set to $47.

Microsoft Corp shares have surged 27.20% over the past 52 weeks, while the S&P 500 has gained 11.71% in the same period.

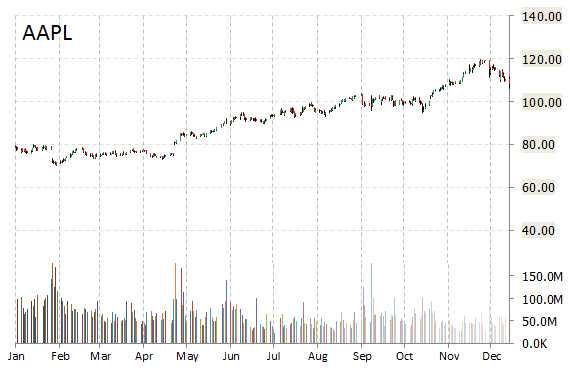

Apple Inc. (AAPL) – DigiTimes reports that Apple and Samsung Electronics have been offering price cuts for their tablet products for the year-end holidays. Cupertino will have a chance to sell around 20 million iPads in Q4, while Samsung’s tablet sales may reach 12 million units, according to DT sources.

AAPL shares recently lost $1.79 to $106.43. In the past 52 weeks, shares of the tech giant have traded between a low of $70.51 and a high of $119.75. Shares are up 39.53% year-over-year and 37.89% year-to-date.

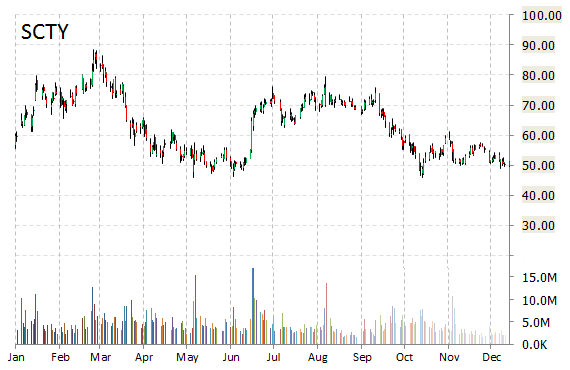

In a report published Tuesday, Goldman Sachs (GS) analysts reiterated SolarCity Corporation (SCTY) as a ‘Conviction Buy’ and a top pick with an $88 price target. In the report, Goldman said SolarCity’s near-term improving cash flow visibility is underappreciated and sees significant upside to shares.

SolarCity Corporation, currently valued at $4.79B, has a median Wall Street price target of $89.00 with a high target of $98.00. In the past 52 weeks, shares of San Mateo, California-based solar company have traded between a low of $45.79 and a high of $88.35 with the 50-day MA and 200-day MA located at $53.43 and $61.46 levels, respectively. Additionally, shares of SCTY trade at a P/E ratio of 0.33 and have a Relative Strength Index (RSI) and MACD indicator of 41.50 and -2.10, respectively.

SCTY currently prints a one year loss of about 2.97% and a year-to-date loss of around 12.64%.

SolarCity was up 19 cents to $46.83 at 9:39 a.m. est.

Leave a Reply