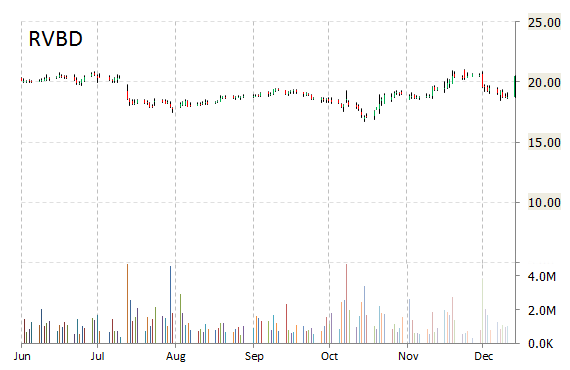

Shares of Riverbed Technology, Inc. (RVBD) are up almost 9% to $20.34 in mid-day trading Monday after the company announced it will be acquired by leading private equity investment firm Thoma Bravo and Teachers’ Private Capital, the private investor department of Ontario Teachers’ Pension Plan.

The San Francisco-based company said that its stockholders will receive $21.00 per share in cash, or a total of approximately $3.6 billion. That represents a 12% premium to the RVBD’s closing price Friday of $18.74. The deal was unanimously approved by Riverbed’s board following a comprehensive review of strategic and financial alternatives that the company announced in October, 2014.

“We are extremely pleased with this transaction, which we believe will be a winning proposition for all of our stakeholders,” Jerry M. Kennelly, chairman and CEO of Riverbed said in a statement.

Riverbed Technology, Inc., currently valued at $3.15B, has a median Wall Street price target of $20.00 with a high target of $22.00. Approximately 16 million shares changed hands by 1:17 p.m. in New York, compared to the average of 1.27 million shares.

In the past 52 weeks, shares of the the network-equipment maker have traded between a low of $16.70 and a high of $22.76 with the 50-day MA and 200-day MA located at $19.41 and $19.11 levels, respectively. Additionally, shares of RVBD trade at a P/E ratio of 1.13 and have a Relative Strength Index (RSI) and MACD indicator of 62.58 and -0.36, respectively.

RVBD currently prints a one year return of about 11.88% and a year-to-date return of around 3.65%.

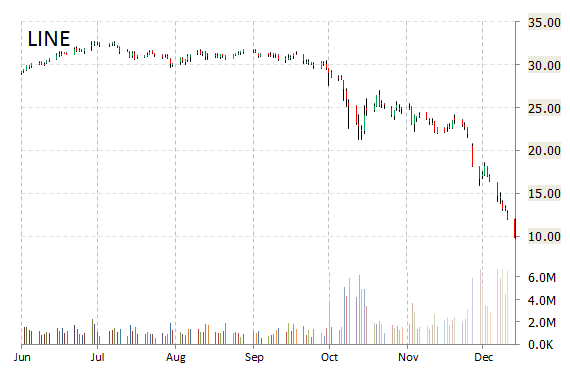

Shares of Linn Energy, LLC (LINE) plunged more than 14% to a 52-wk low of $9.78 in early trade Monday as oil prices continue making lower lows. Brent crude for January delivery hit $60.28 a barrel in Asian trade, printing the lowest price since July 2009 after OPEC restated its determination not to cut output despite a global fuel glut.

In the past 52 weeks, shares of Houston, Texas-based oil and natural gas company have traded between a low of $9.78 and a high of $34.08 with the 50-day MA and 200-day MA located at $21.11 and $27.91 levels, respectively. Additionally, shares of LINE trade at a P/E ratio of -0.56 and have a Relative Strength Index (RSI) and MACD indicator of 18.31 and -4.27, respectively.

LINE currently prints a one year loss of about 55.49% and a year-to-date loss of around 56.64%.

Linn Energy’s current market cap stands at about $4.10 billion.

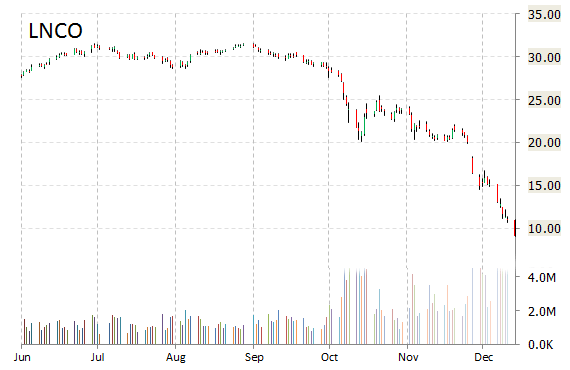

Linn Co, LLC (LNCO) shares are down 15% to about $9.35 in mid-day trading Monday. Not seeing any specific news to account for the move, but the nosedive looks supported by falling oil prices which keep fueling the recent investor sell off. Approximately 6.5 million shares have already changed hands, compared to the stock’s average daily volume of 2.8 million shares.

LNCO shares have declined 45.98% in the last 4 weeks and 61.67% in the past three months. Over the past 5 trading sessions the stock has lost 26.27%. Shares of Linn Co, LLC are down 58.78% year-over-year and 59.96% year-to-date.

The chart below shows where the equity has traded over the last 52 weeks.

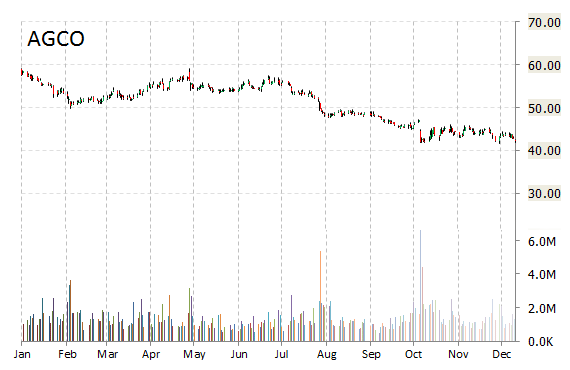

AGCO Corporation (AGCO) – The name is up more than 4% to $44 in midday trading after the company announced that its Board of Directors has authorized a share repurchase program of up to $500 million of the company’s common stock. The latest authorization is in addition to any previously authorized share repurchases and is effective through December 31, 2016.

“The new share repurchase authorization is indicative of AGCO’s strong cash generation capabilities,” Martin Richenhagen, Chairman, President and CEO of AGCO said in a statement.

In other AGCO news today, the company gives fiscal 2015 market outlook in analyst meeting.

Leave a Reply