Recent short interest data for the 11/28/2014 settlement date shows a significant decrease in short interest for shares of Yahoo! Inc. (YHOO). As of November 28, the short interest for the internet giant totaled 38,683,635 shares, as compared to 50,780,414 shares since November 14, a decline of 23.82%. Average daily volume [AVM] for the same period fell by 5,543,918 to 21,873,035 shares from 27,416,953 shares. It is worth mentioning that ticker’s short interest has dropped by more than 22M shares, or 36.50%, from the 9/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.77 days. Days-to-cover for YHOO decreased to 1.77 for the October 31 settlement date, as compared to 1.85 days at the October 15 report.

Recently, a number of Wall Street firms have assigned a rating to the stock. Analysts at Bank of America (BAC) upgraded the name with a ‘Buy’ rating and a $62 price target in a research note on December 5th. Bernstein analysts maintained their ‘Market Perform’ rating and $60 price target on the stock in a research note to clients on November 18th. Finally, analysts at UBS initiated coverage on Yahoo with a ‘Buy’ in a research note on November 12th. Overall, there are 17 analysts that rate YHOO a ‘Buy’, while 14 rate it a ‘Hold’. No analyst rates it a ‘Sell’. Yahoo has a median Wall Street price target of $50.00 with a high target of $63.00.

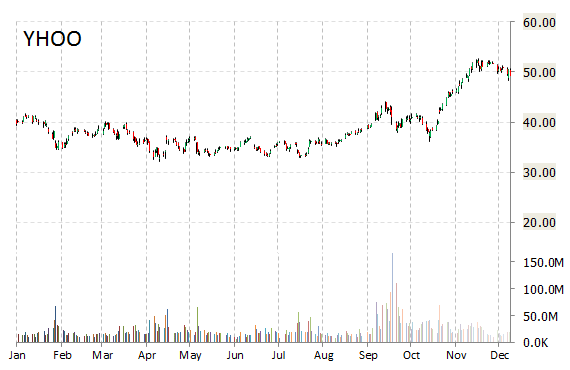

Yahoo! Inc. has a beta of 0.90 and a short float of 4.43%. In the past 52 weeks, shares of Sunnyvale, California-based web portal have traded between a low of $32.15 and a high of $52.62 and are now at $50.35. Shares are up 22.35% year-over-year and 21.69% year-to-date.

Leave a Reply