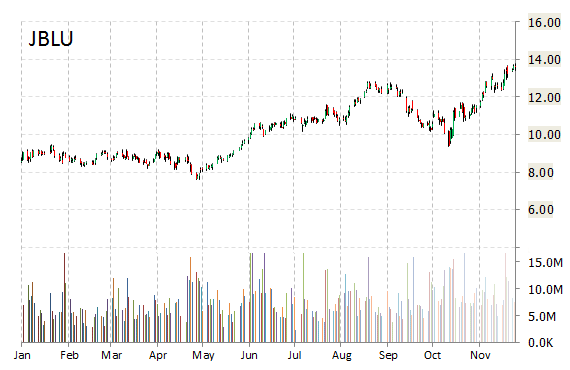

JetBlue Airways Corporation (JBLU) shares are up 5.09% to $14.32 in pre-market trading. Not seeing any news or rumors to account for the move.

JetBlue is a Long Island City, New York-based airliner providing transportation services in the United States, the Caribbean, and Latin America. Its stock has a median consensus analyst price target of $15 with a high target of $18, and a 52-week trading range of $7.61 to $13.77.

The T-12 profit margin at JetBlue Airways is 6.28%. JBLU‘s revenue for the same period is $5.74 billion.

JetBlue Airways Corporation has market cap of $3.97 billion.

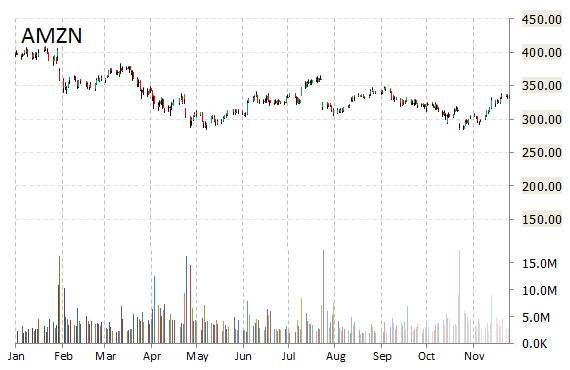

Analysts at Piper Jaffray raised their Amazon.com Inc. (AMZN) price target to $400 from $350 in a research report issued to clients on Friday. Amazon shares closed at $335.04 on Wednesday. Piper’s target price suggests a potential upside of about 20% from the company’s current price.

AMZN, valued at $154.44B, recently gained $1.93 to $335.50 with its 52-week range being $284.00 to $408.06.

The e-commerce giant’s shares are currently priced at 374.80x next year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 1.82. EPS for the same period registers at ($0.47).

Currently there are 24 analysts that rate AMZN a ‘Buy’, 19 rate it a ‘Hold’. No analyst rates it a ‘Sell’. AMZN has a median Wall Street price target of $350.00 with a high target of $450.00.

Shares of Seattle, Washington-based firm are down 12.53% year-over-year and 16.35% year-to-date.

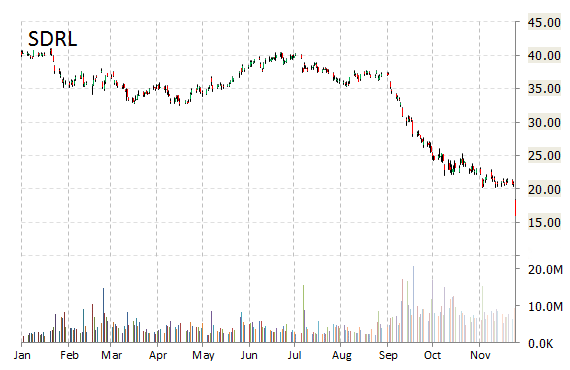

Seadrill Ltd (SDRL) shares tumbled 6% to $15.00 in early trade Friday. The plunge comes despite the fact the name was upgraded this morning to ‘Neutral’ from ‘Sell’ by analysts at Goldman Sachs (GS). SDRL was a big decliner last session with the shares nosediving 11% on the day, the most in six years, after the offshore driller controlled by billionaire John Fredriksen announced it is suspending dividend distributions citing significant deterioration in the broader markets.

In the past 12 months, the Bermuda-based company has traded between a low of $15.93 and a high of $43.52, which is almost 174% above that low price. The stock, currently with a total market cap of $7.50B, is down 58.80% year-over-year and 57.84% year-to-date.

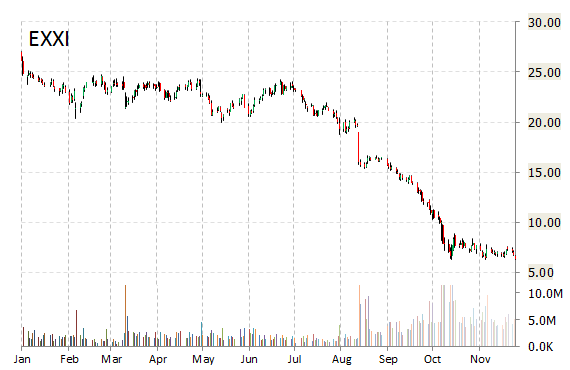

Energy XXI Ltd. (EXXI) shares are falling sharply, down 13% to $25.84 on Friday, after analysts at Iberia downgraded the stock to ‘Sector Perform’ from ‘Outperform’.

In the past 52 weeks, shares of Houston, Texas-based oil and natural gas explorer have traded between a low of $6.23 and a high of $27.69 with the 50-day MA and 200-day MA located at $7.25 and $15.94 levels, respectively. Additionally, shares of EXXI trade at a P/E ratio of -15.83 and have a Relative Strength Index (RSI) and MACD indicator of 36.51 and -0.22, respectively.

EXXI currently prints a one year loss of about 76.96% and a year-to-date loss of around 76.19%.

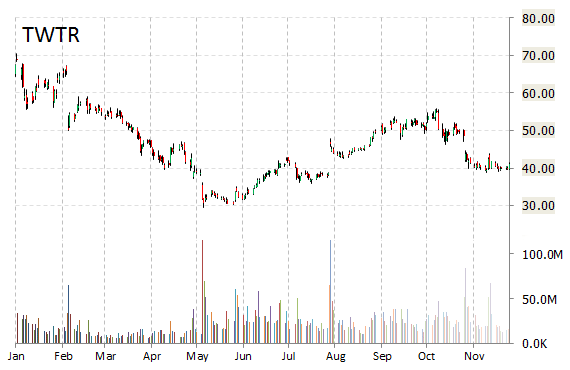

Twitter, Inc. (TWTR) — Co-founder/director Evan Clark Williams sold 14,040 shares earlier this week. The stock was sold at an average price of $39.99, for a total value of $561,459.60.

Twitter shares are up $0.08 to $41.21 in pre-market trading today. On valuation-measures, the social networking giant has a revenue and t-12 profit margin of $1.17B and (82.63%), respectively. EPS registers at ($1.79]. The company has a market cap of $25.71B and a median Wall Street price target of $54.00 with a high target of $64.00.

On trading-measure, TWTR has a short float of 5.11%. In the past 52 weeks, shares of the San Francisco, California-based company have traded between a low of $29.51 and a high of $74.73 with the 50-day MA and 200-day MA located at $44.47 and $42.77 levels, respectively.

TWTR currently prints a year-to-date loss of around 35%, compared with an 14.79% gain in the S&P 500.

Leave a Reply