Recent short interest data for the 9/15/2014 settlement date shows a significant increase in short interest for shares of Apple Inc. (AAPL). As of September 15, the iphone maker’s short interest totaled 138,266,760 shares, as compared to 96,046,863 shares since August 29, a jump of 43.96%. Average daily volume [AVM] for the same period rose by 36,193,967 to 84,842,699 shares from 48,648,732 shares. It is worth mentioning that ticker’s short interest has spiked by more than 123M shares, or 807.79%, from the 1/15/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.63 days. Days-to-cover for AAPL decreased to 1.63 for the September 15 settlement date, as compared to 1.97 days at the August 29 report.

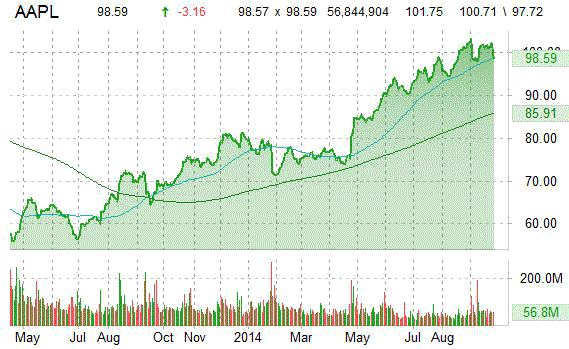

Apple Inc. has a beta of 0.83 and a short float of 2.31%. In the past 52 weeks, shares of Cupertino, California-based company have traded between a low of $67.77 and a high of $103.74 and are now at $98.21. Shares are up 42.93% year-over-year and 22.67% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Recent short interest data for the 9/15/2014 settlement date shows an increase in short interest for shares of Facebook, Inc. (FB). As of September 15, the short interest for the social networking company totaled 37,118,685 shares, as compared to 36,071,346 shares since August 29, a rise of 2.90%. Average daily volume [AVM] for the same period rose by 7,636,755 to 31,917,855 shares from 24,281,100 shares. It is worth mentioning that ticker’s short interest has declined by more than 9.44M shares, or 20.27%, from the 4/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.16 days. Days-to-cover for FB decreased to 1.16 for the September 15 settlement date, as compared to 1.49 days at the August 29 report.

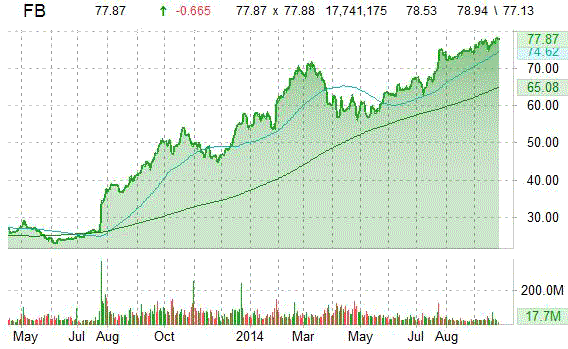

Facebook, Inc. has a beta of 0.94 and a short float of 1.93%. In the past 52 weeks, shares of Menlo Park, California-based company have traded between a low of $43.55 and a high of $78.94 and are now at $77.60. Shares are up 56.81% year-over-year and 41.92% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Recent short interest data for the 9/15/2014 settlement date shows a decrease in short interest for shares of Amazon.com Inc. (AMZN). As of September 15, the online retailer’s short interest totaled 7,782,645 shares, as compared to 8,055,719 shares since August 29, a decline of -3.39%. Average daily volume [AVM] for the same period rose by 899,803 to 3,197,267 shares from 2,297,464 shares.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 2.43 days. Days-to-cover for AMZN decreased to 2.43 for the September 15 settlement date, as compared to 3.51 days at the August 29 report.

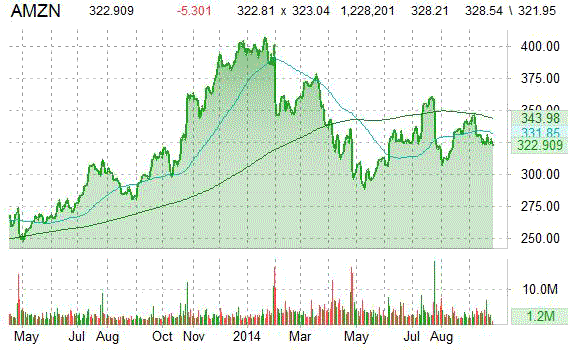

Amazon.com Inc. has a beta of 0.90 and a short float of 2.06%. In the past 52 weeks, shares of Seattle, Washington-based company have traded between a low of $284.38 and a high of $408.06 and are now at $323.05. Shares are up 3.30% year-over-year ; down 19% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Recent short interest data for the 9/15/2014 settlement date shows an increase in short interest for shares of Tesla Motors, Inc. (TSLA). As of September 15, the short interest for the electric car maker totaled 22,191,708 shares, as compared to 21,660,743 shares since August 29, a rise of 2.45%. Average daily volume [AVM] for the same period rose by 3,315,786 to 7,356,904 shares from 4,041,118 shares. It is worth mentioning that ticker’s short interest has declined by more than 9.10M shares, or 29%, from the 2/28/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 3.02 days. Days-to-cover for TSLA decreased to 3.02 for the September 15 settlement date, as compared to 5.36 days at the August 29 report.

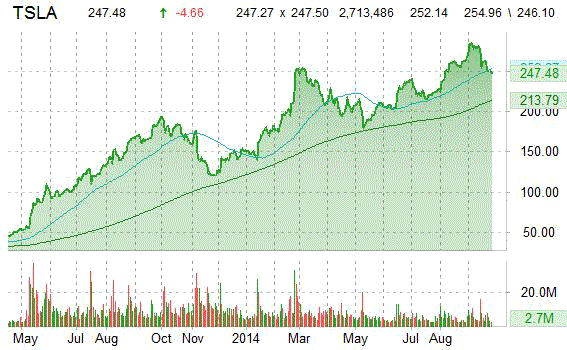

Tesla Motors, Inc. has a beta of 1.36 and a short float of 24.42%. In the past 52 weeks, shares of Palo Alto, California-based company have traded between a low of $116.10 and a high of $291.42 and are now at $246.84. Shares are up 33.25% year-over-year and 64.08% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

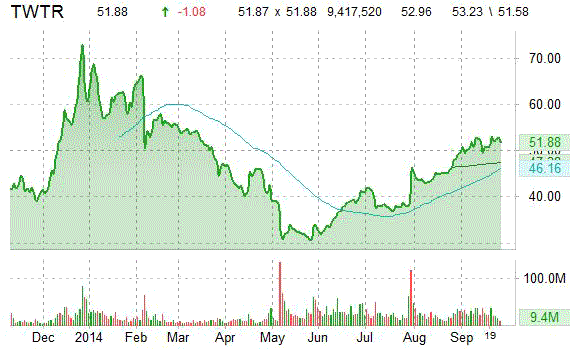

Recent short interest data for the 9/15/2014 settlement date shows a relatively significant increase in short interest for shares of Twitter, Inc. (TWTR). As of September 15, the blogging platform’s short interest totaled 24,570,198 shares, as compared to 21,579,104 shares since August 29, a jump of 13.86%. Average daily volume [AVM] for the same period rose by 9,512,948 to 30,073,126 shares from 20,560,178 shares. It is worth mentioning that ticker’s short interest has declined by more than 25.5M shares, or 50.95%, from the 4/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.00 days. Days-to-cover for TWTR decreased to 1.00 for the September 15 settlement date, as compared to 1.05 days at the August 29 report.

Twitter, Inc. has a short float of 4.79%. In the past 52 weeks, shares of San Francisco, California-based company have traded between a low of $29.51 and a high of $74.73 and are now at $52.03. Shares are up 15.95% year-over-year ; down 18.21% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply