Tesla Motors Inc. (TSLA) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank (DB) in a research report issued to clients on Monday. Price target raised to $310 from $220. The stock’s previous close was $252.39. TSLA is up in premarket hours, trading up almost 4% at $258/share.

Tesla stock, which currently has an average 3-month trading volume of 5,63 million shares, trades at a forward P/E of 76.82 and a price to growth ratio of 4.63. Price/Sales for the last 4 quarters registers at 12.87 while EPS is at (-$1.11). Currently there are 3 analysts that rate Tesla Motors Inc. a ‘Strong Buy’, compared to 3 ‘Buys’, 7 ‘Holds’ and one ‘Underperform’. No analysts rate it a ‘Sell’. The median Wall Street price target on ticker is $230.00 with a high target of $325.00.

Profitability-wise, Teslas’ trailing-12 profit margin currently stands at (-6.83%) while operating ones are at (-4.79%). The $30.83 Billion market cap company reported $2.67 Billion in cash vs. $2.45 Billion in debt in its most recent quarter.

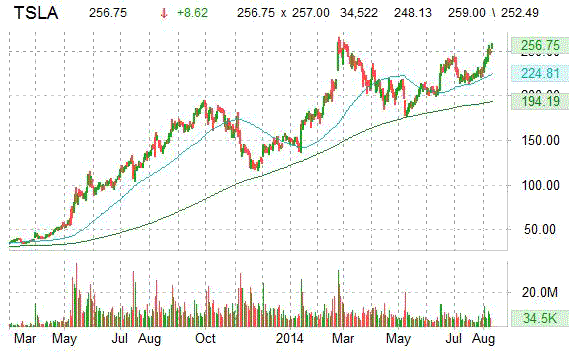

Over the last 52 weeks, TSLA has been trading between $116.10 and $265.00.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Tesla Motors, Inc. designs, develops, manufactures, and sells electric vehicles and electric vehicle powertrain components. The company was founded in 2003 and is headquartered in Palo Alto, California.

Leave a Reply