Theme d’anne ou theme du jour? The jury remains out. Yesterday’s “everything goes up” strategy worked swimmingly until the London market marked its sheets, after which there was a rather rude interruption. First, gold interrupted its Buzz Lightyear-esque trajectory by correcting back below 1000, and then a piece of really quite fugly data was released.

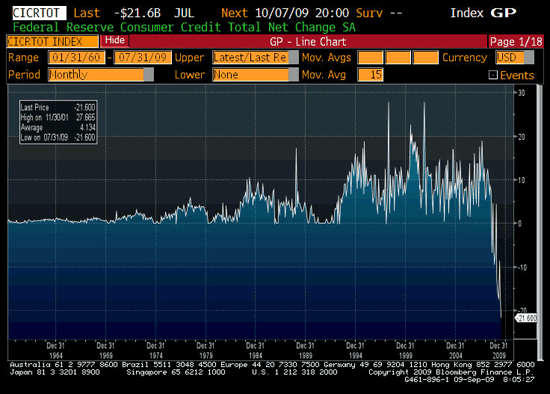

fell by $21.6 billion in July, by far the worst reading on record. While the apogee of “cash for clunkers” stimulus will have occurred in August, it nevertheless underscore the belief, widely held in macro circles, that the consumer will continue to rebuild balance sheets for the foreseeable future.

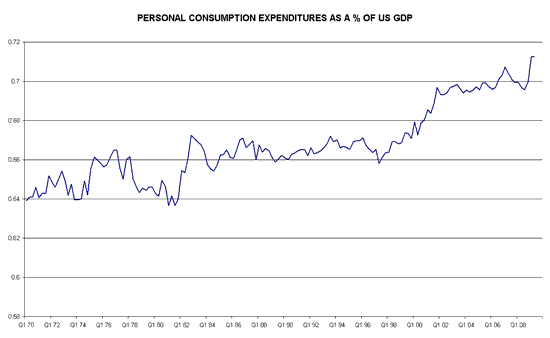

And small wonder, too! Even as household spending has fallen modestly over the past couple of years, it has reached a new high as a percentage of GDP. Not good. So if and as stimulus income is saved rather than spent, and spending growth remains sub-par by the standards of the past quarter-century, it will be mathematically very difficult for GDP growth to be anything but pretty blah over the next couple of years.

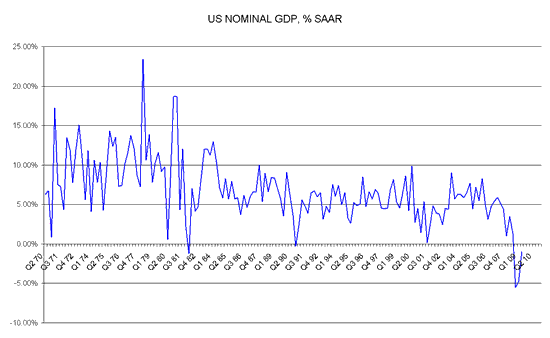

So while H2 might see a bounce in GDP growth (though in a period of price or debt deflation, as we are currently observing, nominal GDP growth trumps real growth), it remains difficult to get excited about the permanence of the rebound. Plus ca change, indeed.

What it means for equity prices, or indeed any other prices, is of course anyone’s guess. But it provided a timely reminder to Macro Man that while it’s OK to swim in the sea of “everything goes up”, when the tide goes out it’s best not to drink the Kool-Aid on the beach.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply