While the whole world of “economic experts” are talking about and bracing for inflation, consumer credit (credit being the largest part of the money supply) is CONTRACTING at a RECORD PACE.

That’s what exponential curves do when they have peaked. The math does not allow anything to grow unabated year after year into infinity, that only occurs in the minds of idiot politicians and poorly trained economists who received their education in the land of fiat – America.

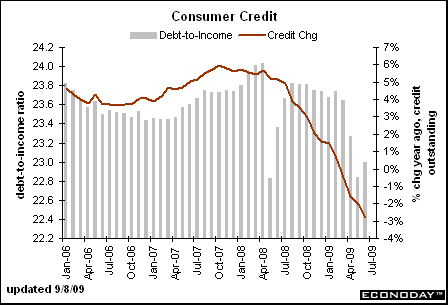

Here’s the data according to Econoday… the experts consensus was for a contraction of $4.1 billion, actual contraction was $21.6 billion for July:

Highlights

Contraction in consumer credit reflects rising consumer caution as well as banking efforts to limit lending exposure. Consumer credit contracted $21.6 billion in July, a very severe reading and the largest on record. At $15.5 billion, June’s contraction was also severe ($10.3 billion initially reported). July’s contraction is the sixth in a row for the longest streak since the credit squeeze of 1991. Nonrevolving credit led the decline, at minus $15.4 billion in a surprise given cash-for-clunkers which kicked off late that month. It would be a big surprise if there was another deep contraction in non-revolving during August. Revolving credit in July fell $6.1 billion. The markets may ignore this report but policy makers won’t as it works directly against their efforts to stimulate spending. (emphasis added)

So, even with Cash for Clunkers the contraction was the largest on record! What will it be without?

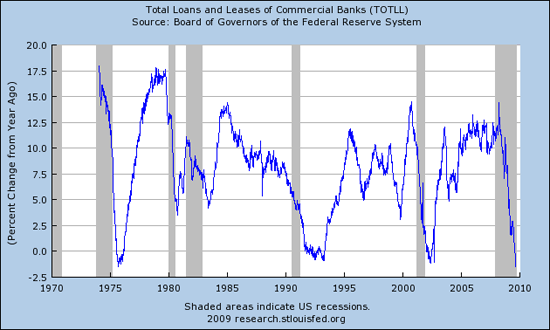

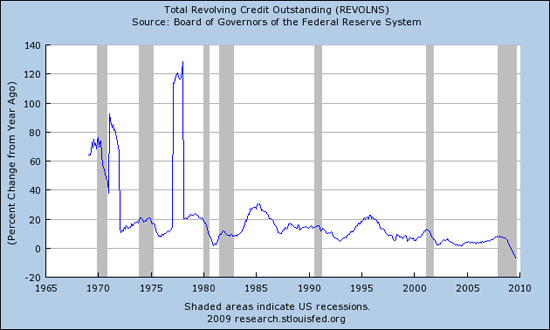

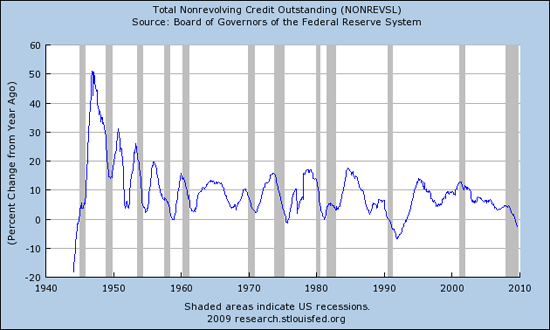

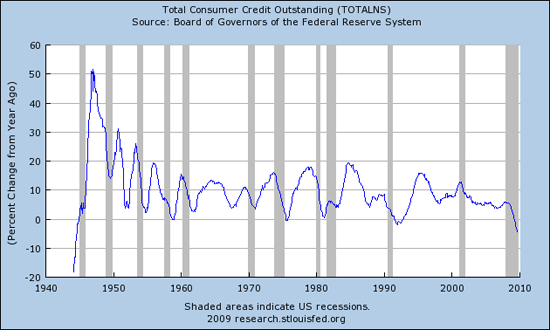

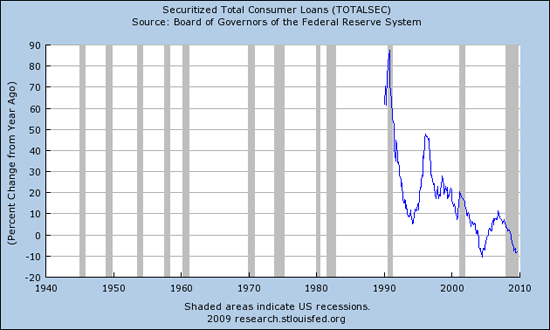

I’ve been warning that we are on the verge of a deflationary spiral, the data keeps coming in to support that view. Below are the latest graphs from the St. Louis Fed. Year over Year numbers below zero mean the supply of credit is shrinking:

Total loans and leases at commercial banks – negative yoy, the most since 1976:

Total Revolving credit outstanding – negative yoy, the most ever recorded by the modern Fed:

Total Nonrevolving credit outstanding – negative yoy, the most since the early 90’s, I’m sure it would far surpass that if not for government loan programs provided by the likes of Fannie (FNM), Freddie (FRE), and the FHA:

Total consumer credit is contracting, and the rate of contraction is accelerating:

As far as derivatives of consumer debt… Securitized total consumer loans are falling at nearly a 10% pace year over year:

Sure the government is going to create inflation, right up to the point that all confidence in our currency is lost. Yesterday they auctioned off tens of billions more in public debt. The supposed bid to covers were high, but they were FAKE BIDS made by the Primary Dealers who are buying up the debt and then selling it right back to Uncle Sugar. The game is not enough, the money they create cannot go into the economy because the economy is saturated with debt and all new money simply goes to pay it down. It’s a game that is going to end in tears, and already has for millions of unemployed and their families.

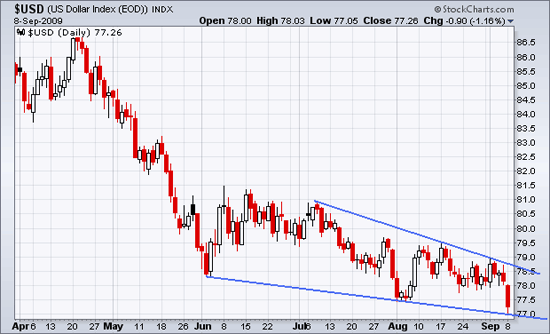

Yesterday’s action took the dollar’s daily chart right to the bottom of a descending wedge formation:

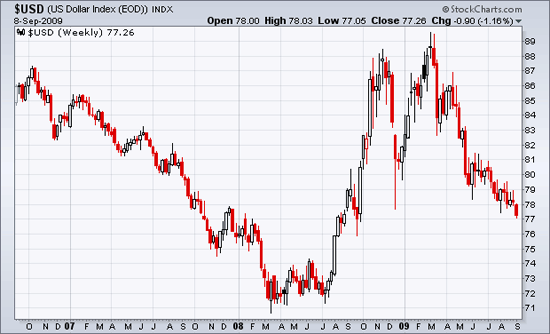

If that normally bullish formation breaks down, it’s likely to be violent and you can see that the next support can be found all the way back down in the 71 area on the weekly chart:

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

People’s memories of this time are not going to fade easily. Those free spending, free caring days I think are gone, at least for the foreseeable future. What I hope will emerge from this recession is a more financial responsible public. People are going to be weary, and that’s not necessarily a bad thing. I think when we do finally emerge from this downturn, that we’re going to see people saving a lot more money than they did in the past. That to me is a good thing. The borrow, borrow, borrow, spend, spend, spend, lifestyle is not one made for long term success. Eventually the bottom is going to fall out of anything like built like that. My dream is that a more secure, financial responsible America will emerge and that will be a country that is built on a solid foundation. It’s only going to take time.

Check out my blog on the record cut in consumer debt at… http://www.thedebtgazette.com/2009/09/set-record-for-cutting-debt-july/