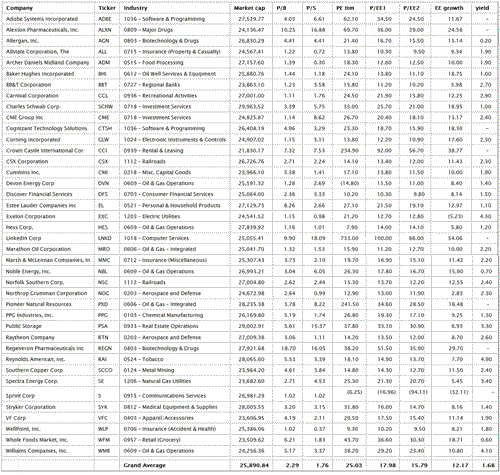

I don’t have a strong sense on the valuation of Twitter, but I want to share with you forty companies with valuations similar to that of Twitter (TWTR) as of the close on November 7th.

(click to enlarge)

Twitter’s valuation was around $25.9 Billion at the close of regular trading on 11/7. The private equity sponsors must be jumping for joy, as they got more than they expected on the IPO, and even more, if the price of Twitter holds up past the time of their lockup, when they can sell their remaining shares.

Twitter has no profits, and trades at 10 times book value, versus 2.3x on their competitors here. Price-to-Sales is around 50, versus 1.8 for competitors here.

There is one thing certain here, there is a lot of profits growth expected out of Twitter. It has to go from negative profits to positive, and then soar thereafter. That would justify the valuation.

But how likely is that? There are few companies that ever do that. So be wary and avoid Twitter stock, realizing there is a small chance that it might be worth its present valuation, much less more.

Disclosure: no positions in any companies mentioned here.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply