As summer draws to an end, the final countdown to the September 17-18 FOMC meeting begins. Odds still favor that the Fed begins tapering asset purchases at the conclusion of that meeting. But make no mistake, whether the Fed begins the tapering process this meeting or next is essentially irrelevant at this point. What is relevant is that the conversation fundamentally changed with Federal Reserve Chairman Ben Bernanke’s post-FOMC press conference back in June. Expanding accommodation is no longer really on the table; now the story is about how and when accommodation with be reduced.

Bill McBride at Calculated Risk surveys the latest data in light of the Fed’s forecast and concludes:

With the upward revision to Q2 GDP, and the low expectations for inflation (significantly below target), it now looks the year-end data might be “broadly consistent” with the June FOMC projections.

I think that is correct; the Fed could easily read the data as if it was “broadly consistent” with the June projections, and thus conclude that they can begin tapering. In addition, arguably the cost is low given that market participants already expect a reduction in the scale of asset purchases. There shouldn’t be anyone surprised if the Fed cuts asset purchases this month.

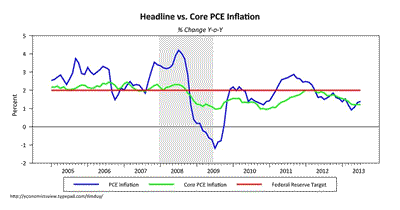

To be sure, one could argue that the inflation data still sticks out like a sore thumb and should preclude any notion that the Fed would dare taper purchases:

(click to enlarge)

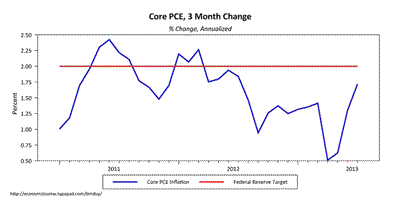

But I think looking at the year-over-year rates may be misleading. Looking at the three-month change suggests the tide is turning:

(click to enlarge)

Monetary policymakers will likely view the recent uptick in near-term inflation as consistent with their expectation that earlier softness was indeed temporary, giving them confidence that their baseline inflation forecast is correct. And confidence in that forecast means tapering in the near future.

Some may be holding out for this week’s employment report before committing to a September taper. Honestly, I think it would be ludicrous if at this point policy still hinged on one number – a number that is known to be heavily revised at that. I could see that a particularly good employment report would cement the case for tapering, but I sense that a weak number would only affect the pace of future reductions in the pace of asset purchases if corroborated in future reports. As for the report itself, I take no hard position – given the variability in month-to-month changes, I tend to think forecasting the change in nonfarm payrolls to be something of a fool’s game (a game, however, that I admit to playing in the past).

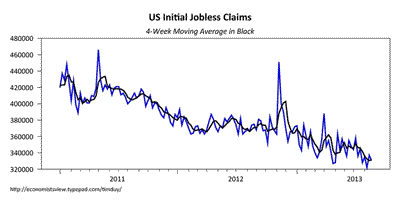

That said, I would be surprised if the report was significantly below expectations given the recent drop in initial unemployment claims:

(click to enlarge)

Of course, there are still some wild cards in the policymaking process. There is the Syria question, although I think the Fed will not change policy on the basis of a Tomahawk strike alone. And there is the looming budget showdown. That I suspect is weighing more heavily on monetary policymakers, but, again, it may be more of a factor in future policy actions rather than the September meeting. Then Fed will be hesitant to act (or, in this case, not act) without evidence that the budget process is bleeding over into the economy. Remember, as Josh Barro notes, we have gone down this road before, only to see the Republicans cave in the face of certain political doom.

Finally, the improving situation in Europe, and so far the lack of a hard landing China, take a downside risk off the table. And a downside risk off the table is kind of like an upside risk realized!

As I indicated earlier, the actual timing of the taper is not all that important at this point. What is important is that the conversation has changed. There is no serious consideration of expanding the pace of asset purchases, or even maintaining the current pace for an extended period. The clock on quantitative easing is ticking. The conversation has shifted, or perhaps more simply the Fed’s assessment of the costs/benefits have shifted. Pedro da Costa at Reuters wonders at the change in tone among policymakers:

Yet for some reason, at the highest levels of the U.S. central bank and in its most dovish nooks, the notion that asset purchases might not be having as great an impact as previously thought has become pervasive.

The reason might not be so elusive. Mark Thoma notes:

It’s just that some members of the Fed do not believe the Fed has much influence over the economy beyond stabilizing the financial system. Once that is done, the Fed’s powers are very limited (when at the zero bound) and — in the eyes of some members of the Fed — the risks of further aggressive action, e.g. QE, outweigh the potential benefits.

I think Mark is correct; monetary policymakers likely view quantitative easing as most effective in addressing financial crisis. They see it as less effective when financial markets are calm, and find high costs in terms of potential (and actual) subsequent financial instabilities and dislocations. Hence they have a bias against continuing asset purchases in the current environment. They very much seek to normalize policy by shifting back to a focus on interest rates. The conversation has shifted in this direction, making clear that there is no such thing as QEinfinity. As such, what we should now be watching for is signaling regarding the timing of the first rates hike. Expect monetary policymakers to continue to sooth any worries over the end of quantitative easing with assurances that rates will remain near zero well into the future.

Bottom Line: One would be hard-pressed to describe incoming data as anything better than lackluster. But lackluster is likely sufficient to allow the Federal Reserve to begin winding down asset purchases this month. What is not on the table is expanding asset purchases. Even if the Fed delays tapering for another meeting or two, monetary policy is clearly at an inflection point.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply