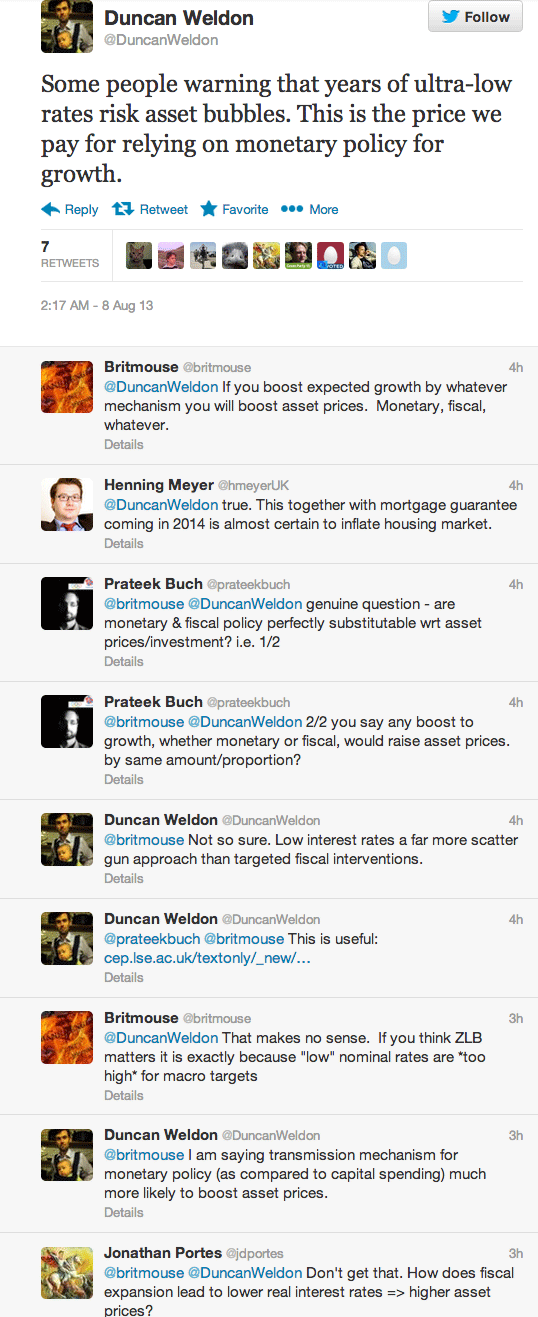

Ben Southwood sent me an interesting debate on Twitter:

Perhaps a good place to start is “never reason from a price change.” Asset prices collapsed in 2008-09, during a period of very low, and falling, interest rates.

The response might be that, holding business cycle conditions constant, low rates tend to trigger bubbles. In 2009 the recession overwhelmed the effects of low rates. OK, but asset prices should reflect fundamentals. Interest rates are one of the fundamental factors that ought to be reflected in asset prices. When rates are low, holding the expected future stream of profits constant, asset prices should be high. Bubbles are usually defined as a period when asset prices exceed their fundamental value. If asset prices accurately reflect the fact that rates are low, then that’s obviously not a bubble.

The response might be that “yes asset prices often fall when rates crash, like 2009, and yes asset prices should be higher, ceteris paribus, when rates are low, but the real problem is when interest rates are held at an artificially low level.”

It’s not clear what people mean when they talk of “artificially” low interest rates. The government doesn’t put a legal cap on rates in the private markets, in the way that the city of New York caps rents. The rates are market determined.

At this point people usually respond that governments are a big player in the markets, the Fed buys lots of bonds. OK, but how would we know if the rate is in some sense “too low?” As far as I know the most popular theories all derive from Wicksell’s notion of a natural interest rate and an actual interest rate. The natural rate was the rate that led to price stability (or 2% inflation in the modern context.) An excessively low interest rate was an interest rate that led to excessive inflation. In the US, inflation is currently running below 2%. Although it is above 2% in the UK, many bubble proponents believe the rate of NGDP growth (and by implication inflation) should be still higher, and hence that interest rates are still too high. So we don’t have artificially low rates in the Wicksellian sense in the US, and probably not in Britain.

The most recent iteration of this argument has less to do with bubbles than with the relative efficiency of a market system vs. a centrally planned economy. Thus one argument is that when interest rates are very low, perhaps for justifiable reasons related to a very weak economy, firms will take advantage of those low rates and wastefully misallocate resources. In that case it might be better to have central planners allocate capital. This is the argument that led Matt Yglesias to call Larry Summers a “socialist.” I’m not going to call anyone a “socialist” as it reminds me of when foolish young bloggers call conservatives “racists,” but I will say that some of the tweets in the twitter discussion remind me a bit of Summers’ comments.

I can’t really comment on the claim that the private sector will misallocate resources when rates are low but the public sector won’t (as often), because I don’t know the model that’s being relied upon for those claims. It just seems like a sort of free flowing assertion pulled out of the air. When the proponents of this argument come up with a model (not necessarily mathematical, a verbal model is fine) then I’ll have something to argue against. Until then I’ll favor a monetary policy that leads to stable growth in nominal spending, as the lesser of evils.

BTW, One implication of the “low rates causes undesirable bubbles” theory is that replacing easy money with massive fiscal stimulus would raise interest rates above zero. I wonder how the proponents account for the fact that large Japanese budget deficits failed to raise interest rates above zero, but did succeed in pushing the national debt up to more than 200% of GDP. And of course the Japanese government massively misallocated resources into a historically unprecedented set of infrastructure boondoggles, which dwarf anything going on in China. And despite all of that, NGDP in Japan is lower than 20 years, ago, which must be some sort of record.

Scott Sumner mentions asset prices as being a discounted value of future cash flows. Low nominal interest rates correspond with high bonds prices, by definition of yield-to-maturity. Current abnormally low real (after inflation) interest rates correspond to abnormally high stock and real estate prices. So, oddly, this implies that we should all be holding cash, maybe as a pile of green paper. No particular panic if inflation goes to 10% overnight-just spend a few months buying the newly cheap stocks and real estate. The situation seems to be rarely talked about in these terms. Why not?