Good piece in the FT online today by Gavyn Davies on what wil happen to markets when QE (quantitative easing) ends. As we have witnessed last week, comments on the potential end to QE can generate significant volatility in financial markets. But there is something in this debate that still confuses me and it has to do with the interpretation that some make of the end of QE.

QE will end one day, this must be the assumption of anyone who understands monetary policy. The day the recovery is strong enough, when central banks feel that the economy is close enough to full employment we will see a normalization of monetary policy conditions. From an expansionary stance we will move towards a more neutral stance. This has always been the case in the past although we used to think only in terms of interest rates and not QE. One way to see how this will happen is the chart below (which I am borrowing from a recent Brad DeLong blog post).

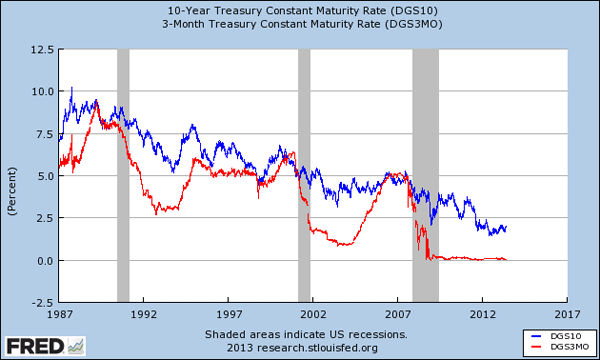

This is a plot of long-term (10 years) and short-term (3 months) interest rates for the US. The pattern that we see after each of the last recessions is that short-term rates deviate from long-term rates as a sign that monetary policy is hitting the accelerator (the yield curve becomes steep). A few years after the recession is over, short-term rates are raised and they reach a level similar to long-term rates. After that we see the two continuing at similar levels until the next recession comes. [Note: the chart above plots nominal interest rates so we need to be careful in our interpretation, differences in inflation over different horizons can be relevant to explain the shape; I am ignoring inflation in my analysis.]

We expect a similar patter this time, the red line will catch up with the blue line at some point in the future and before that happens we will see a statement from the US Federal Reserve that QE is about to end (or to slow down at first). What is clear from the chart is that it is taking longer than before for short-term rates to go back up to meet long-term rates, a sign that the current recovery is much weaker than previous recoveries.

What will we learn the day Ben Bernanke announces that we are starting that path towards normalization? It might be that we simply learn that he is becoming optimistic about growth in the US. This will be good news. It might not be a surprise to some who expected that type of growth going forward, but it could be a positive surprise to others that thought growth would never come back. In this scenario, it is difficult to think about such an announcement as bad news. We know that QE will end one day, we know that short-term rates will have to increase, so if the announcement was to be a surprise in the sense that it is coming too early, it would mean that there is a positive surprise in terms of growth happening early than expected — and this has to be good news.

There is a second and more pessimistic scenario: the day Ben Bernanke announces that QE is ending we learn that the economy is not doing much better but that the FOMC has simply changed their mind. That they do not care about low growth, that they want to be tough and that they are ready to stop QE to signal a change in policy. This would be bad news because it represents a change in policy and not a change in our expectations about growth.

Understanding what will happen to markets when QE ends requires to decide about which of the two scenarios above is more likely. I personally see the first scenario more likely than the second one. I do not see a policy reversal in the near future but I do see the end of QE as good news accumulate. But this is my view, what matters is how the stock market will read the communications of the central bank. The words chosen to communicate their actions at that point as well as their credibility will make a great difference.

One final point to notice in the chart above: while the pattern of deviations between the red and blue line are clear, there is also a clear downward trend in long-term rates (in nominal terms in the chart but we know that there is a similar downward trends in real rates). As Gavyn Davies points our in his article, there is some uncertainty about this trend. Is this trend real or is it the outcome of a bubble? This is a second potential source of uncertainty. When the red line starts climbing, what will happen to the blue line? Will it stay around where it is and the two will meet at a level that will be low by historical standards? Or will we see a significant increase in long-term rates as expectations of monetary policy are challenged? I have argued before that there are fundamental reasons why long-term interest rates are low that are independent of what monetary policy is doing. But others argue that long-term rates are distorted and ready to go up when QE ends. If this is the case, then stopping QE will suddenly increase all rates up and it will certainly be be bad news for financial markets.

Leave a Reply