Yesterday, Rep. Dennis Kucinich appeared on Fox News plugging his plan to encourage early retirement. I critiqued it in my Forbes column on Friday. Here is the relevant discussion:

Yesterday, Rep. Dennis Kucinich appeared on Fox News plugging his plan to encourage early retirement. I critiqued it in my Forbes column on Friday. Here is the relevant discussion:

Rep. Dennis Kucinich, D-Ohio, has proposed lowering the age to qualify for early Social Security benefits to 60 from age 62 for the first 1 million people who apply. He assumes that all the people who would take advantage of this opportunity are currently employed. Thus, according to him, the proposal would automatically lead to the opening up of 1 million job vacancies.

This is not a new idea. As historian William Graebner has documented, the Social Security program itself was partly conceived in order to encourage older workers to leave the labor force so as to create employment opportunities for younger workers.* That’s why those receiving Social Security benefits were long prohibited from earning more than a token amount of wage income. However, there is no evidence that encouraging retirement or penalizing work by the elderly ever had more than a trivial effect on creating job vacancies. (See this study by the Social Security Administration and this study by the International Monetary Fund.)

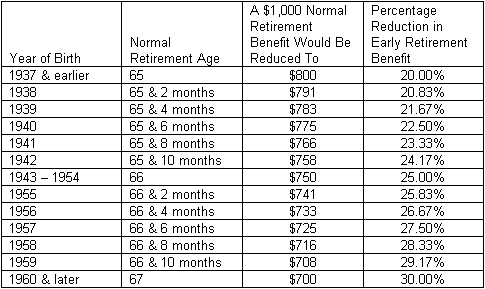

Indeed, the inadequacy of early retirement benefits has actually increased the labor force participation rate among older workers, according to an Urban Institute report. Those retiring at age 62 this year will receive monthly Social Security benefits 25 percent lower than those retiring at age 66. To be actuarially fair, the benefits for those retiring at age 60, as Congressman Kucinich proposes, would have to be even lower, thus making it very unlikely that his plan would induce much in the way of additional retirement among employed older workers. The only ones that would be attracted to it are those that are unemployed, which necessarily means that no vacancies would be created.

Let me elaborate a bit on my last point. It’s important for Social Security benefits to be actuarially fair. By this I mean that whenever one retires, whether at 62, 66 (the normal retirement age this year), or 70 (when one’s benefits max out) one should receive the same aggregate lifetime benefits. That’s why early retirees get less than those that wait until the normal retirement age and why there is a delayed retirement credit that boosts benefits for those that postpone retirement past the normal retirement age.

I have never seen poll data on this point, but my gut feeling is that a great many, perhaps most, people taking early retirement—which something like 70 percent of Social Security beneficiaries currently do—don’t fully understand that they are condemning themselves to a lifetime of lower Social Security benefits. I suspect that many mistakenly believe that their benefits will be boosted when they reach the normal retirement age. The following table from the Social Security Administration shows just how severe the penalty is for early retirement. Note that the penalty has increased substantially over time and will get worse in the future.

And I feel quite certain that only a tiny number of recipients know that there is a delayed retirement credit that gives them 8 percent more benefits for each year they delay taking benefits past the normal retirement. Thus someone who delayed taking Social Security benefits until age 70 would get 24 percent more per month than someone who retired at age 66 and 50 percent more per month than someone who retired at 62.

This suggests that if early retirement were further reduced to age 60, those benefits would have to be 16 percent lower that those now available at age 62. Since these benefits are already very substantially reduced, the attraction for anyone working is going to be very small indeed. That is why it is reasonable to assume that the only people who would find retirement at age 60 attractive are those that are unemployed, which means that no additional job vacancies will be created by the Kucinich plan.

If, on the other hand, Kucinich is proposing that those retiring at age 60 get the same benefits as those retiring at age 62 this would be grossly unfair; they would in effect be getting two years of benefits they are not entitled to and would, therefore, get more lifetime benefits than those in the same age cohort who waited until 62 or later. I fear that once this fact became known in future years Congress would have another mess on its hands similar to the infamous “notch” problem.

Finally, if it turns out that the Kucinich plan was implemented and turned out to be more popular that I think it would be, who is going to tell the one millionth and first person that he or she is out of luck? Moreover, I think it is a very bad idea to manipulate the Social Security system for temporarily expedient reasons, which is why I also oppose any reduction in the payroll tax rate to simulate employment. (I also don’t think it will work because the core economic problem isn’t high labor costs, but insufficient demand for business output.)

_____________

* A History of Retirement (Yale University Press, 1980).

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply