Thinking further about this from Friday’s Jon Hilsenrath Wall Street Journal article:

Stocks and bond markets have taken off since the Fed announced in September that it would ramp up the bond-buying program, and major indexes closed at another record Friday. An abrupt or surprising end to it could send stocks and bonds in the other direction, but a delayed end could allow markets to overheat. And some officials feel they’ve ended other programs too soon and don’t want to repeat the mistake.

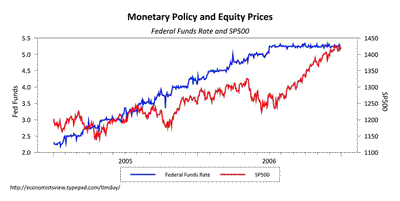

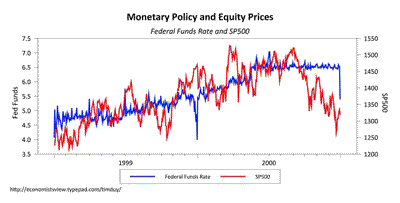

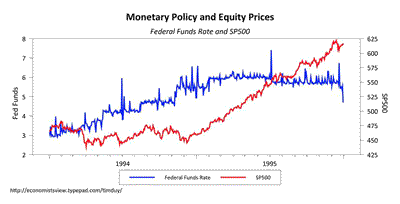

Although past performance is no guarantee of future performance, it strikes me that previous instances of tighter monetary policy did not trigger immediate widespread declines in equities:

(click to enlarge)

(click to enlarge)

(click to enlarge)

Just an eyeball look at past behavior suggests that equities are mostly flat in the initial stages of monetary tightening, and rise in later stages. Generally at least two years before the Fed inverts the yield curve and triggers recession. In addition, we are not expecting the Fed to begin raising rates until late 2014 or 2015. So policy is likely to remain supportive for what, at least three or four more years?

Fears of an imminent policy-driven collapse in equity prices are likely greatly over-exaggerated. See also Mark Dow here.

Leave a Reply