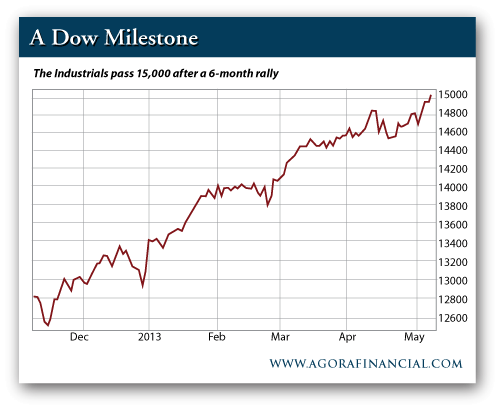

Dow 15,000!

It’s another day for the record books. That means new all-time highs for the most visible index in the land. The bull market everyone loves to hate roars higher…

Of course, a market milestone like this one will once again bring financial news to the front page and the top half of the evening news. For a few brief minutes, casual market watchers will think about stocks and why they’re moving higher.

Some will express anger over missing the market’s 4-year surge. Others will insist the gains could not possibly last much longer. But rest assured, no one will really know what to do about it.

The Dow has gained 20% since it bottomed in November. That’s a fact.

But you didn’t want to buy stocks six months ago. And you wanted nothing to do with the markets just before the Fiscal Cliff circus in late December.

Fast forward a bit. Now, you’re telling me the market’s too hot…

“To follow price action now when things are at all-time highs is just inviting trouble,” writes a cautious reader. “If you get in now at the highs and it heads the other way, your stop losses may limit your losses, but you nonetheless have losses.”

You’re right. If you put your money into the market, you will eventually suffer through some losses. That’s the price you pay to have some skin in the game. It is unavoidable.

Whether the market is at new highs or new lows, stocks could easily move lower. You can make your guesses as to when the market might top off. But you can only confirm a top or a bottom once it’s already played out.

Bottom line: you have to trust your risk management. You must go into every trade understanding all possible outcomes—good and bad.

Sure, it was easier going long last fall without the scrutiny that comes along with new highs. But was it a bad move jumping into stocks back in January when they first started to make multi-year highs? What about buying Dow components as the index broke 14,000 for the first time since 2007 just a few months ago?

Until the market proves otherwise, we remain in a buy-the-dips environment. The rally is showing signs of broadening. Energy and materials stocks are trying to join the party started by the popular consumer stocks I’ve yelled about for months. Check out these names before they’re out of reach…

Leave a Reply