Apple (NASDAQ:AAPL) has been dead weight for the market over the past six months, shedding nearly 40% of its value and finding it difficult to sustain any type of bounce. But over the last two weeks, AAPL has started to show signs of a potential bottom.

AAPL used to be the stock that could do not wrong. Even when the company would unveil an ostensibly “disappointing” product–say, the iPhone 4S when consumers were expecting a 5–sales were through the roof and the stock price continued to climb. In six months, that dynamic was completely flipped on its head. (Apple’s Halo Cracked – WSJ) Suddenly AAPL became the stock that everyone loved to hate. Margins are shrinking for AAPL and Google Android-powered phones are starting to wrest away market share.

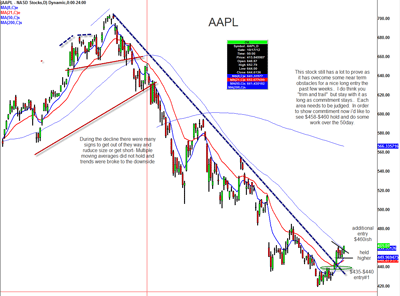

The launch of the Samsung Galaxy S IV, many thought, was going to be the knockout blow for battered AAPL. Taking into the account the extreme psychology shift we had seen in AAPL, we opined that the Samsung event might actually turn out to be an opportunity to “buy the news” in AAPL. Indeed, Samsung released the new phone in a hokey media event, and it wasn’t exactly the game changer many expected. AAPL gapped up the next day and hasn’t looked back, finally breaking the multi-month downtrend.

The problem with AAPL over the last few months is that each rally attempt has been met with selling and we haven’t been able to get any commitment to the upside. Over the last week, though, that has started to change. Given its weakness on a longer time-frame, I think if you are trading AAPL you still have to monitor its composure closely. At this stage, I would like to see the stock do work above the $460 area.

(click to enlarge)

Disclosure: Scott Redler is long AAPL and AAPL call spread

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply