First, let’s talk about Martin Armstrong’s call… He’s saying IF we get above 11,000 on the DOW with a MONTHLY close, then we may have already seen bottom, otherwise, we retest the lows, possibly break them and will likely bottom in the first half of next year (May). THEN, he poses the QUESTION, will we reach 30,000+ on the DOW by 2015, only six years away?

—

—

I like Armstrong and want to help him, but I have to call them like I see them. The only way that happens is in an all out collapse of the dollar, OR we go on some type of national debt forgiveness campaign which would result in the prior anyway.

With interest rates peaking in 1980 and declining to zero in 2008, he now sees capital flows reversing out of government debt (true) and into private equity (false). While I see the lack of confidence in government with this cycle, I also see a lack of confidence in corporate America that is at least equal. Capital does NOT have to flow from one to the other, it can also flow to gold or just out of the country.

Also, for the stock market to triple in the next three years, there would have to be earnings to support such growth… where does those earnings come from? You have a collapsed housing and credit bubble, you have very negative Baby Boomer demographics over that timeframe and you have a government who is flat out broke. Yes, they can print like Zimbabwe, and IF they do to the extent that we triple the stock market in the next six years, you better hold on because it will wipe out 99% of Americans who will no longer be able to afford to live. It may happen like that, but I just don’t think so – that’s my opinion and my call and it is very counter to what I just read from Armstrong. That’s not to say I don’t see a bottom and a turn in May of next year, I do, that’s what I’ve said all along. Credit collapses historically last 2.5 years and that will be the time. I just don’t think we go roaring into exponential growth again. The math of debt will prevent that.

Okay, on to today’s trumped up government releases.

GDP for Q2 came in unchanged from the initial read of -1.0% growth. The consensus was that it would be revised downward to -1.5%, it was not. Here is Bloomberg and the market pumpers:

Aug. 27 (Bloomberg) — The U.S. economy contracted less than anticipated in the second quarter as a jump in government spending and smaller cutbacks by consumers helped mitigate a record plunge in inventories.

Gross domestic product shrank at a 1 percent annual rate from April to June, the same as calculated last month, a Commerce Department report showed today in Washington. Analysts in a Bloomberg survey forecast a 1.5 percent drop. Corporate profits rose the most in four years, the department also said.

Companies from Wal-Mart Stores Inc. to Macy’s Inc. cut costs and stockpiles to bolster earnings as job losses caused consumers to curb spending. Leaner stocks and government programs to revive demand, including the “cash for clunkers” and first-time homebuyer incentives, are boosting manufacturing and housing, putting the economy on a path to recovery.

“The seeds of recovery are seen in this report,” Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York, said before the report. “Inventories are at rock-bottom levels and production is on the rise as store shelves are increasingly bare. ‘Cash for clunkers’ was the icing on the cake.”

The seeds have been sewn alright, the seeds of deception.

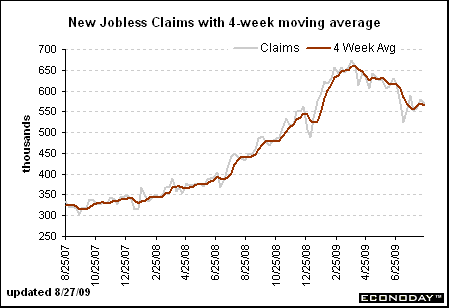

Weekly jobless claims fell a whopping 6,000, from a MASSIVE 576,000 loss reported last week, to 570,000 this week. I consider that to be no change and will spare you Econoday’s drivel, but will show you their chart:

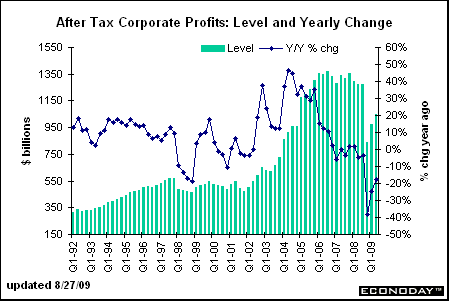

The headline regarding after tax corporate profits suggests we saw some huge rally in profits, the largest in the past four years! Of course those articles fail to talk about the year over year numbers again that show Q2 corporate profits are down “only” 17.7% year over year – a historic one year collapse by anyone’s measure. But I will grant you that it’s an improvement over the prior quarter’s -21.8% plunge. What you are seeing is volatility, a reaction to government stimulus and manipulation. Again, that cannot last forever and must be removed or otherwise America will not stay America.

Of course Econoday annualizes the quarterly gain to say that corporate profits “gained 33.8% on an annualized basis.” That is some kind of twisted logic! You have a collapse of historic proportions and a bounce higher for one period and that’s the line they feed the public. Here’s the chart, you decide if we’re going to go on to new record corporate profits anytime soon:

Hey, we get another look at the Fed’s balance sheet this afternoon, maybe we’ll find the source of that bounce there, eh? Let’s see, how many trillions did that indebt America?

By the way, don’t forget that the largest portion of the bounce in corporate profits came from the FINANCIALS who went back to marking their toxic waste to model. Remove that or mark their “assets” to reality and you will see NO corporate profits whatsoever. The false accounting continues, Enron was just a warmup.

We had another small change on the McClelland Oscillator yesterday and again am awaiting a large price move in the equity markets.

It seems to me that we are in a similar position to the giraffe. Perhaps he hit the bottom but how’s he going to dig his way out of all that sand? The Debt is the sand, we have a lot of digging to do!

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Nate,

As we discussed yesterday, the 30,000? title of Armstrong’s paper was an attempt at hyperbole

Hyperbole (pronounced /haɪˈpɜrbəliː/ hye-PER-bə-lee[1], from ancient Greek “ὑπερβολή”, meaning excess or exaggeration) is a figure of speech in which statements are exaggerated. It may be used to evoke strong feelings or to create a strong impression, but is rarely meant to be taken literally.

The emphasis should be on the question mark at the end of 30,000? While yes it is theoretically possible for this outcome to occur, it is of course not M.A.’s position that this would be the likely outcome. Marty’s intent in this paper was to shock folks out of their inertia long enough to talk about and explore the important issues at hand. Clearly this has worked, but as we both discussed yesterday, we share a mutual fear that his strategy may backfire against his credibility with those that have never been exposed to classical rhetoric. Thank you so much for consistently reminding readers that Armstrong is written this stuff in far less than optimum conditions, however its also important to understand the “context of Armstrong” to really get what he is saying. I, like you know some very smart people. Armstrong is easily the most intelligent person I have ever me. The man reads ancient Babylonian, Greek, Latin, and converses confidently on a broader range of subject than anyone I have ever know. He is the product of a true classical education. This has both its plus’s and minus’s For example, I been bugging him for years to get the “Oxford Idiom” out of his writing ex. “For the king did say”. The chief problem being that he sometimes expects his readers to follow “Swiftian” subtleties that can be lost in this centuries fast paced A.D.D. times.

Your point on a commodities bull is well taken. This was also explored in depth in some of M.A. previous papers. Clearly capital will go where it is first safest, preserved, and profitable, in that order.

Me Again Nate,

Apologies, I hit the wrong button and published the above before I got a chance to proof it. I didn’t what the spelling/punctuation obsessives who routinely complain about Armstrong typing verses his content to miss my message for the typos.

I am curious however…How much do “spell-checker / punctuation snipers” earn for the important and vital service that they provide to us all…FYI, that was Swiftian Hyperbole. See how that works folks.

Kindest

J