I grew up in no-tech. I watched the live tapes for price action, CRT screens came later. There were noisy screens that scrolled data on a wall. I would do work; phones, papers, talk to colleagues, etc, all the while the ‘thing’ would be clacking away. It only took a half sec to have a look. In “slow” markets, the tape went – click.. click…click. When markets got “fast,” the click went to a whir; that got the eyes. A change of cadence was a “Tell” that something had happened. In the background, over the other noises, you would hear the occasional, ‘whoa’, ‘jeepers‘, ‘huh’, ‘lookatdat’ – signs that something had printed of interest.

I still do it from time to time. I’ve been watching the following “name” of late. Like all stocks, this one has a story behind it, and its price is very much about expectations for the future.

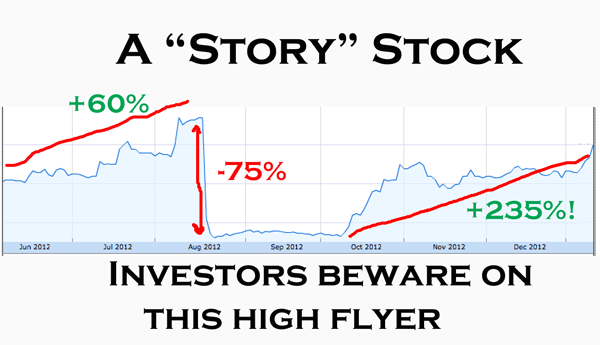

The stock had a very nice run up in the spring and early summer, +60% in just 4 months. What’s not to like about that action? But all hell broke loose on 8/16. The stock droped a mind numbing 75% in a single day – (the widows and orphans got taken to the cleaners)

After the blowout, the stock went no-place for a couple of months. It looked like dead money, but there was still life. In mid October it caught a bid. It made a major recovery coming into the end of the year – it doubled off of the low – looking good! The New Year has brought more cheer to shareholders. The stock has tacked on another 20% in just 8 trading days – momentum is rising. The volume is rising too, a block trade crossed today that was, by itself, 5Xs the daily average – News pending, perhaps?

So what is this thing? Is it an acquisition candidate that had a deal go bust in August, but is now coming back to life? Is this some company that had a terrible quarter, the market killed the stock, but now it is a “value” play? Or is this one of those big short names, like HLF, where short players are getting their balls squeezed and have to cover?

Actually, it’s none of those things. What’s driving this stock is politics. It makes for an interesting tale of the tape. This stock is Fannie Mae Preferred Series C (OTC:FNMAS). This puppy trades in the pinks, under the symbol FNMAS.

What would a Romney victory have meant for Fannie shareholders? The answer came from the guy in charge, Ed Demarco. On 8/16 he said that he favored running Fannie down in an orderly fashion, and then just shuttering what was left. On paper, Ed’s plan took the Fannie pref to zero. (my interpretation of events – the market read it my way). Ed D was backed by big ticket Republicans. So this was a window into what would happened if Mitt had won.

But Democrats hated DeMarco. The Blues want to use Fannie (and Freddie) as tools of social policy. The Dems want to keep Fannie alive forever, the Republicans have always wanted to bury it. In the fall, as it became clearer that Mitt would lose, the betting on Fannie rose.

After the election, Obama made it clear that DeMarco was out, and Fannie was here to stay. The prospect for an Obama victory is what got the stock going; the election result just fueled the speculation (and the silly rally).

The price performance has nothing to do with fundamentals. The chart is really a proxy for the market’s perception on the size of government in the future. This stock is telling me that that the street “bet” is for a return to a big government role in mortgage finance.

Funny how the markets always tell a story.

Note: Do not read this as an excuse to get involved with this swill – on either side. It’s a “stay away”. I thought that the correlation to the election, and the perception that Fannie might rise from the ashes with the support of the Democrats was interesting. Find another sand-box to play in, this one’s soiled.

Leave a Reply