Jefferies & Co star retail analyst Randal Konik is upgrading Francesca’s Holdings Corp (NASDAQ:FRAN) to Buy from Hold this morning with a $38 price tag (prev. $35).

Konik notes that a quarter ago he downgraded FRAN as valuation was high and he was surprised by the recent management change. However, since then valuation has become much more attractive, his confidence in the long term has not waned and he now feels comfortable with new leadership taking the baton.

Why Upgrade In Front Of The Quarter? Based on performance of the retail sector and their view that FRAN’s momentum continued into 3Q, Jefferies feels good about 3Q results and think guidance was likely conservative when given on 9/4. The set up is also favorable given very negative sentiment. While it is not their intention to make a direct call on the quarter, as rather they view this as a nice entry point on a LT growth name, they do expect a solid 3Q.

Confidence In New Management. Following the September ’12 announcement of CEO/co-founder John DeMeritt’s departure, they believe the company has transitioned smoothly to the new CEO, Neill Davis. Mr. Davis is currently President and director since 2007, and clearly is very familiar with the company’s operations. Additionally, Jefferies notes they know him from his previous CFO role at Men’s Wearhouse and believe he is a capable and experienced leader. Meanwhile, they also like that Theresa Backes (COO and recently appointed President), a key member of the management team, has been a constant throughout this transition.

Solid Fundamentals. FRAN continues to have some of the strongest fundamentals in retail. The company’s unique real estate strategy and high 4-wall margins yield strong new store economics, with over 150% ROI within the first year. Operating margins are also significantly above industry average, with firm\s model forecasting ~25% operating margins this year. Also, the company’s older stores continue to perform very well with SSS up 15-20% in the 1H of calendar 2012.

Valuation Is Again Compelling. FRAN currently trades at 21x EPS and 11x EBITDA, roughly in line with peer growth companies. However, Jefferies believes FRAN warrants a premium valuation given: 1) its early stage of growth vs. peers; 2) superior operating margins; 3) highly visible earnings trajectory of 25-30% annual growth; and 4) strong ROI.

******

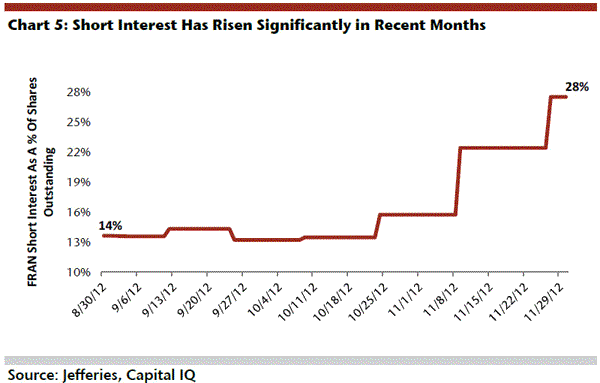

And now for the most important chart:

Sentiment Now Too Negative. FRAN’s short interest has risen sharply within recent months, from 14% before 2Q results to 28% at present. Additionally, FRAN has the third highest short interest rate within Jefferies’ coverage universe of 25 companies. They believe sentiment is now overly negative at these levels especially given the strong fundamentals and growth story at FRAN.

Notablecalls: Several reasons to like this call:

– FRAN took a 8 pt (-25%) hit last quarter not because of weak results but because of the resignation of CEO/co-founder DeMeritt. Now there’s a new CEO in place and has Jeffco’s blessing.

– The co is scheduled to report tomorrow. Short interest has been on the raise into the quarter, rivaling only Deckers (NASDAQ:DECK). Jeffco is confident enough to make a positive call on the quarter. That’s not something one sees very often. Will create buy interest.

– Konik has the hottest hand in retail right now. He called the bottom in Deckers (NASDAQ:DECK) and Abercrombie (NASDAQ:ANF).

Francesca’s (NASDAQ:FRAN) could be next. Has all the characteristics.

I’m thinking +7-10% today, putting $27.50+ level in play.

PS: Posting this around open. Scale into position if possible. Avoid overpaying at around open.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply