In October, the International Monetary Fund painted a gloomier picture for global investors, as it projected slower growth due to slumping world trade and uncertainty in the West. Despite the forecast, big gains can still be unlocked in the faster-growing emerging markets. We believe the smaller stocks are holding the key.

Why Emerging Markets?

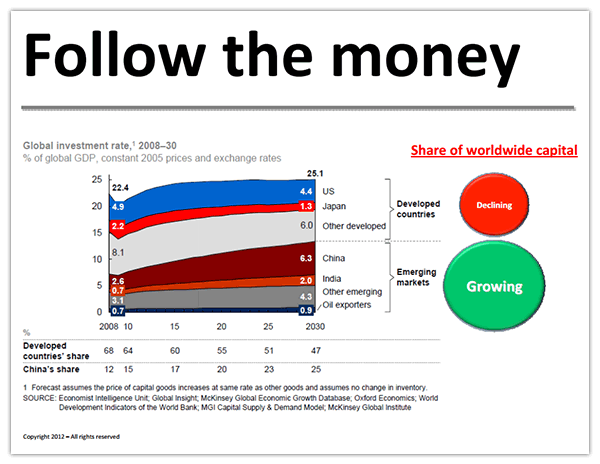

In our recent post-election webcast, Keith Fitz-Gerald, investment strategist of Money Map Press, offers simple advice for investors looking for growth: “Follow the money.” Similar to the massive investment projects during the Industrial Revolution and the postwar construction in Europe and Japan, today, the world is “at the beginning of another investment boom, this time fueled by rapid growth in emerging markets,” says McKinsey Global Institute.

You can see the up-and-coming investment boom in the chart below. Looking at worldwide capital from 2008 to 2030, you can see that emerging markets’ rate of investment is growing while developed markets’ investment rate is shrinking in relation to world GDP. In 2008, the investment rate in developed countries was 15 percent of total GDP; by 2030, this percentage is estimated to fall to 11.7 percent.

By comparison, in emerging markets, the global investment rate as a percent of global GDP is projected to nearly double, from 7 percent in 2008 to 13.5 percent in 2030.

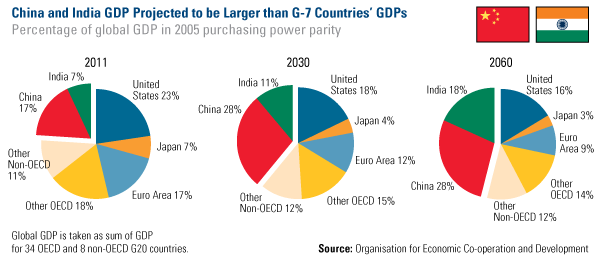

Two trends are driving this investment: rising urbanization, which should increase domestic consumption, combined with growing wealth due to employment growth. Income on a per capita basis in China and India is expected to increase seven-fold over the next 50 years, and in the poorest countries, income per capita will more than quadruple by 2060, says the Organisation for Economic Co-operation and Development (OECD). To accommodate residents’ needs, emerging market countries need to construct homes, transportation, water systems, skyscrapers, factories, hospitals and shopping centers.

If government policies can successfully steer growth, this should propel the two most populous countries in the world, China and India, to become the largest economies in future decades. According to the OECD, on a 2005 purchasing power parity basis, the combined GDP of China and India will soon surpass that of the G-7 countries. By 2060, China and India’s GDP will exceed the total GDPs of the entire current OECD membership.

China and India are not the only emerging markets experiencing significant growth; countries in Emerging Europe also have better GDP growth potential than developed countries. Russia and Turkey are projected to have a GDP of about 4 percent this year, while Poland’s GDP growth is expected to be 2 to 3 percent.

Turkey has especially benefited from strong domestic growth and sound policies that have helped increase the domestic production of goods as well as make its exports more competitive to attract capital. For example, Turkish mining law is investment-friendly, as there is little bureaucratic control, an easy permitting process, and lower fees, and allows broader activities for companies involved in mining gold, copper and boron. These policies encourage mining companies to dig up the natural resources under Turkey rather than head to another country.

These measures have received positive recognition lately, as the country was recently upgraded to investment grade by rating agency Fitch. This not only allows Turkey to borrow at a lower interest rate, but should also boost investor sentiment.

What’s the best way to gain access to the strong domestic growth potential in these countries? We believe the key is held by small stocks located in emerging markets. These smaller companies are more affected by the strong domestic growth happening within the country and less impacted by slower Western demand.

However, as the Wall Street Journal points out, “investing in emerging markets isn’t as straightforward as it might seem.” That’s because exchange-traded funds (ETFs) that invest in emerging markets mimic an index that is weighted by market capitalization. This means that the majority of holdings tend to be larger multinational companies much more dependent on the global economy.

What’s even more confusing for investors is that when you dig deeper into the holdings of mutual funds labeled as “small-cap emerging market” investments, many funds hold larger companies in their top 10. That’s likely due to liquidity constraints as well as the manager’s reluctance to stray from the benchmark index and peers.

To find the most attractive small-caps in developing markets, we believe in analyzing stock fundamentals rather than focusing on specific countries. At U.S. Global, we routinely rank companies by dividend yield, revenue growth and price-to-earnings ratios, selecting those dividend-payers that are growing faster than the emerging country’s GDP and offering the lowest price-to-earnings among their emerging market peers. Research has shown that stocks with these criteria have historically outperformed the overall MSCI Emerging Markets Index.

A few of the stocks that have been hitting our screens are City Union Bank (CUBK:IN) in India, Turkish steel manufacturer Kardemir Karabuk Demir Celik Sanayi ve Ticaret A.S. (KRDMD:TI), and Turkish tractor manufacturer Turk Traktor ve Ziraat Makineleri (TTRAK:TI). While these markets may give investors pause because of the volatility, we believe in the trend of mean reversion. In emerging markets, it’s the hard-hit small companies that can pack a big punch and stage a strong comeback.

Leave a Reply